Hi Mike,

I am hoping for your insight on a trade I’m making today. My uncertainty in this trade it typical of what I find in a lot of my trades.

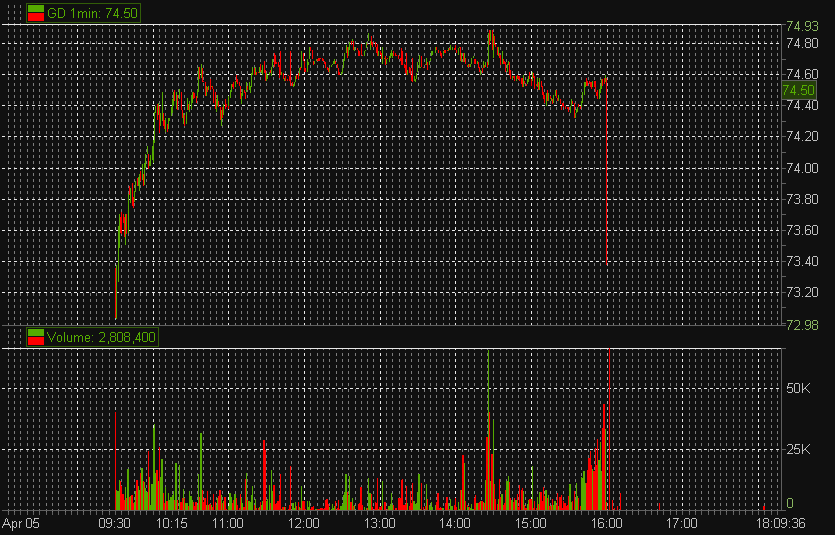

I am trading GD as a second day play. My thinking is that the sell-off yesterday was overdone and that it ultimately held important support at 73. I was looking for the stock to break yesterday’s resistance of 73.84, however I waited for 74 to be taken out as i felt this was more likely the key number. My thinking was twofold. 1. The stock could trend higher from 74 to 74.70 (yesterday’s high) and with a .15 stop below my 74 entry this would be roughly a 1:5 risk/reward. 2. If GD trades through 74.70 it could trade quite a bit higher as it fills yesterday’s gap down.

But here is the question, do I need to adhere to just one of these trading plans? If I don’t take my 5x profit at 74.70 the stock could easy reverse at this resistance and trade back down. I don’t like establishing a potential reward and then getting greedy and not realizing it. On the other hand, I don’t want to sell myself short here on what could be a strong move. Do I take off half the position? Do I take off the whole position, realize the profit, and trade the 74.70 level as a new trade? Do I just raise my stop and let the stock trade at this level for awhile? (This option is appealing because if it consolidates below this level it might be a good sign the stock will move higher. However giving it the proper space may mean risking a large share of my unrealized profit.) Do I get bigger position size if the 74.70 breaks? The root problem I’m having is whether or not to book profits when my predetermined reward is achieved, or to let a trade that is working keep working. I’m curious for you insight, I find this one of the hardest parts of trading.

Thanks as always for your generosity with your time.

Bella

I will answer the question from the facts you stated and from your thinking above. You wanted to make a trade from 74 to 74.70. This was your trade. Thus, when GD approaches 74.70 it is time to exit. And then yes there would have to be a hold above 74.70 and a new trade that you develop above this important level. We would call this a new Support/Resistance trade.

You could have started this position and noted the 74.70 as a place to be cautious but not necessarily get flat. But again this was not your thinking when you entered the trade. Thus the exit at 74.70 was essential.

Great question. Keep working on your trading game!

Mike Bellafiore

Author, One Good Trade

thanks so much for the review Aynul

One Comment on “Traders Ask- GD Trading”

Some questions for the trader:

Why do you think the sell-off was overdone?

I’ve also made a trade in it yesterday, but it wasn’t a stock I payed much attention to so I was thinking of a scalp and shorted 200shares from .67 with a SL @ .76 and took profits on the 1st hundred @ .20. I tried to short some more @.40 after it rebounded and couldn’t hold .50. Eventually it turned back and made my SL @.53 and that was it. But my impression was that this stock was set to trade sideways rather than having a clear trend. And this is why I’m interested in why did you approach it with a strong long bias?