Traders, I look forward to sharing my top ideas for the upcoming week, including my precise entry and exit targets and explaining the exact setups and scenarios I am looking for.

So, without further ado, let’s jump straight into it!

Beginning with the latest theme, Chinese stocks.

Now, I won’t go over the background surrounding the move, be it macro or technical, as I already did so in detail in my latest Inside Access meeting. Instead, I will outline where I see the opportunity going forward and lay out my plans.

Mean Reversion A+ Opportunity

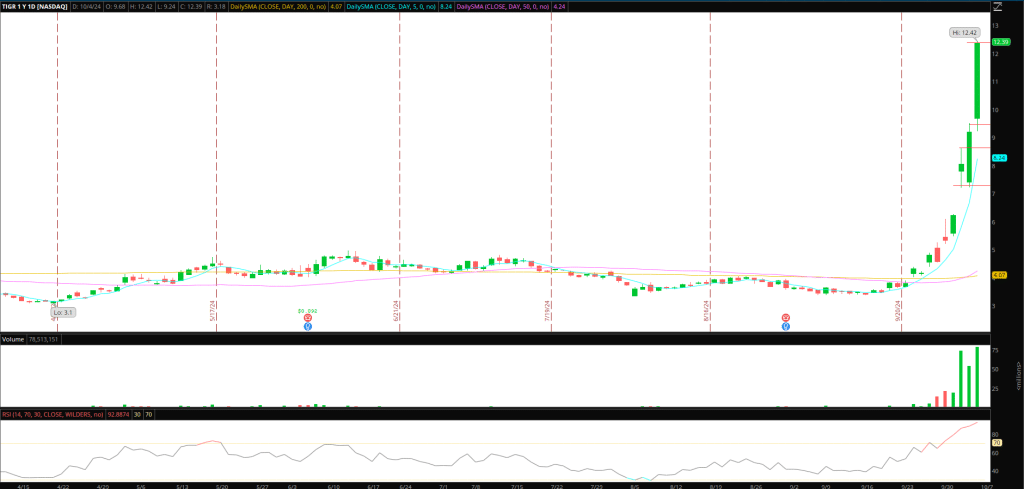

The Idea: Firstly, I am looking at the most overbought Chinese stock, judging by its range expansion and RSI. It’s important to remember that these Chinese stocks are breaking out of multi-year bases, are real companies, and have immense tailwinds coming from Beijing’s measures. So, I’m not looking for a “crash” type move—just a mean reversion opportunity.

The Stock in Focus: Due to range, liquidity, and RSI, TIGR is the best stock for a mean reversion opportunity. Again, it is a real company here with immense inflows and benefits from rotation into Chinese stocks. However, with its RSI now in the mid-90s, it’s set up almost perfectly for a mean reversion trade.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

The Plan: There are various scenarios and ways in which this can play out. Each scenario has different gradings, i.e., A+, A-, or even A++. As I discussed at great length in Inside Access, it’s important to game plan each scenario and outline IF/THEN statements.

For example, IF TIGR gaps up on Monday, further stretching its RSI, has one last push off the open and immediate rejection, THEN that is A++, and I will look to be short versus the HOD, explicitly targeting a lower high entry and consolidation breakdown / VWAP breakdown for an add.

Or, if TIGR gaps up on Monday and gives the gap back in the pre-market, I would downgrade the move to A—and look to short a lower high / failed pre-market high attempt. Ifthe stock holds weak under VWAP, I might upgrade its rating to A+ and size accordingly. These are just two possible scenarios. There are many more, with different gradings and EV, which will impact my risk.

Other stocks I will be watching closely, with a similar plan, are FUTU and YINN.

Now, this theme will take up most, if not all, my attention as a mean reversion opportunity sets up, followed by plenty of open-minded trading opportunities after that.

So, with that being said, here are just two additional stocks I have set alerts in.

Additional Mentions:

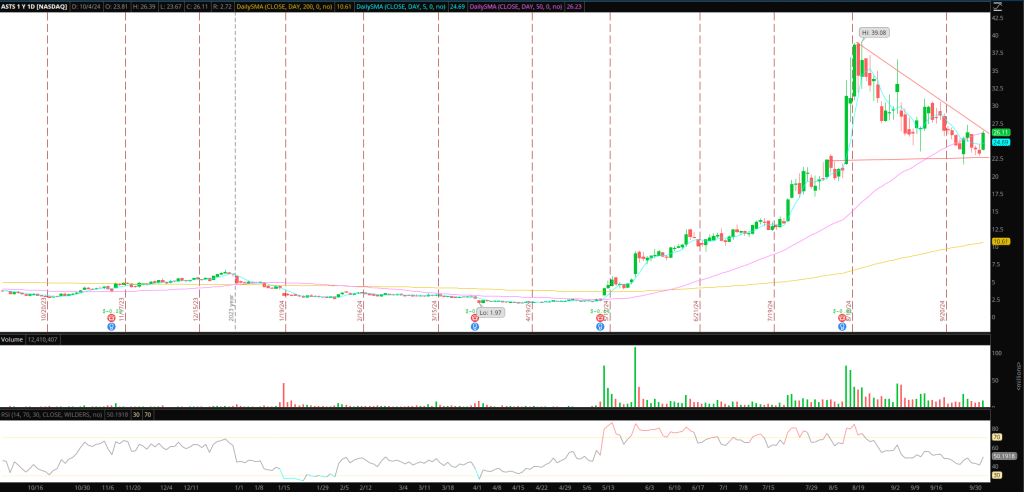

ASTS Consolidation Breakout

The Idea and Plan: Similar to my previous plan in the name, the stock has digested its upmove and stabilized well above its rising 5-day SMA. After Friday’s action, it appears ready for a momentum move higher.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

I will be looking for further confirmation before entering long for a swing. I want to see the stock hold above Friday’s high and its rising 50-day. If ASTS can spend time with RVOL, holding above that zone, I will look to enter with a LOD stop, targeting a move toward $30 as target 1.

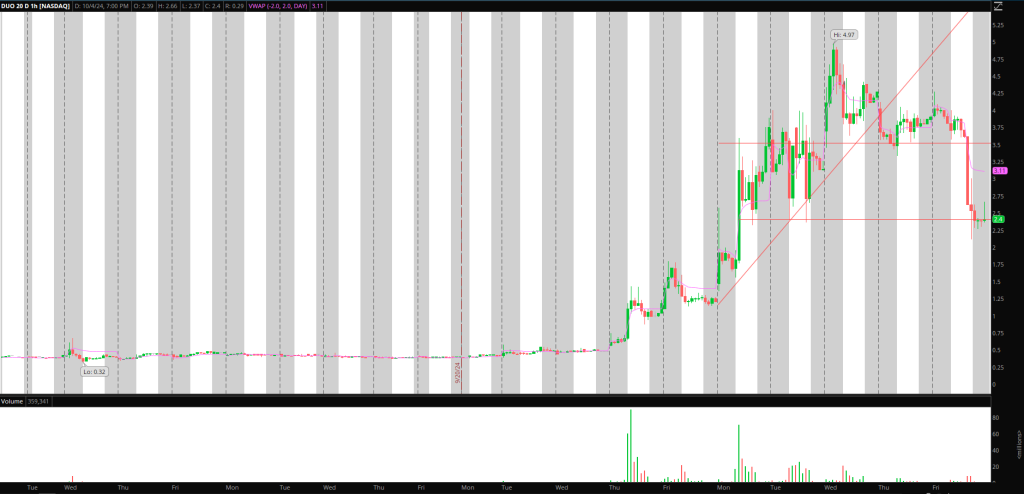

DUO Backside Short

The Idea and Plan: Multiple offerings were announced last week, and finally, a character change on Friday afternoon. I am certainly not looking to chase weakness in the name. If it can push back toward the $3.5 area of potential resistance, then I would look for a short, trailed against lower highs, targeting a move toward $2.5 and $2.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

BENF Failed Follow-Through Short

The Idea and Plan: I’m keeping it simple after Friday’s failure. If the stock pushes back toward $1.9 and fails, I’ll look for a short scalp that targets $1.6 – $1.5. I won’t watch the stock. I’ll have alerts set, and if they go off, I’ll pay closer attention to price action to react or disregard it.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.