Traders,

Last week, the top trade idea that I shared in IWM played out extremely well and was my best swing trade of the week. In my latest Inside Access meeting, I reviewed it in detail, going over my executions and thought process.

So stick around as I share my top ideas for the upcoming trading week. I’ll go over my trade plans, thought process, and entry and exit plans.

Starting with small caps, yet again, for a third straight week.

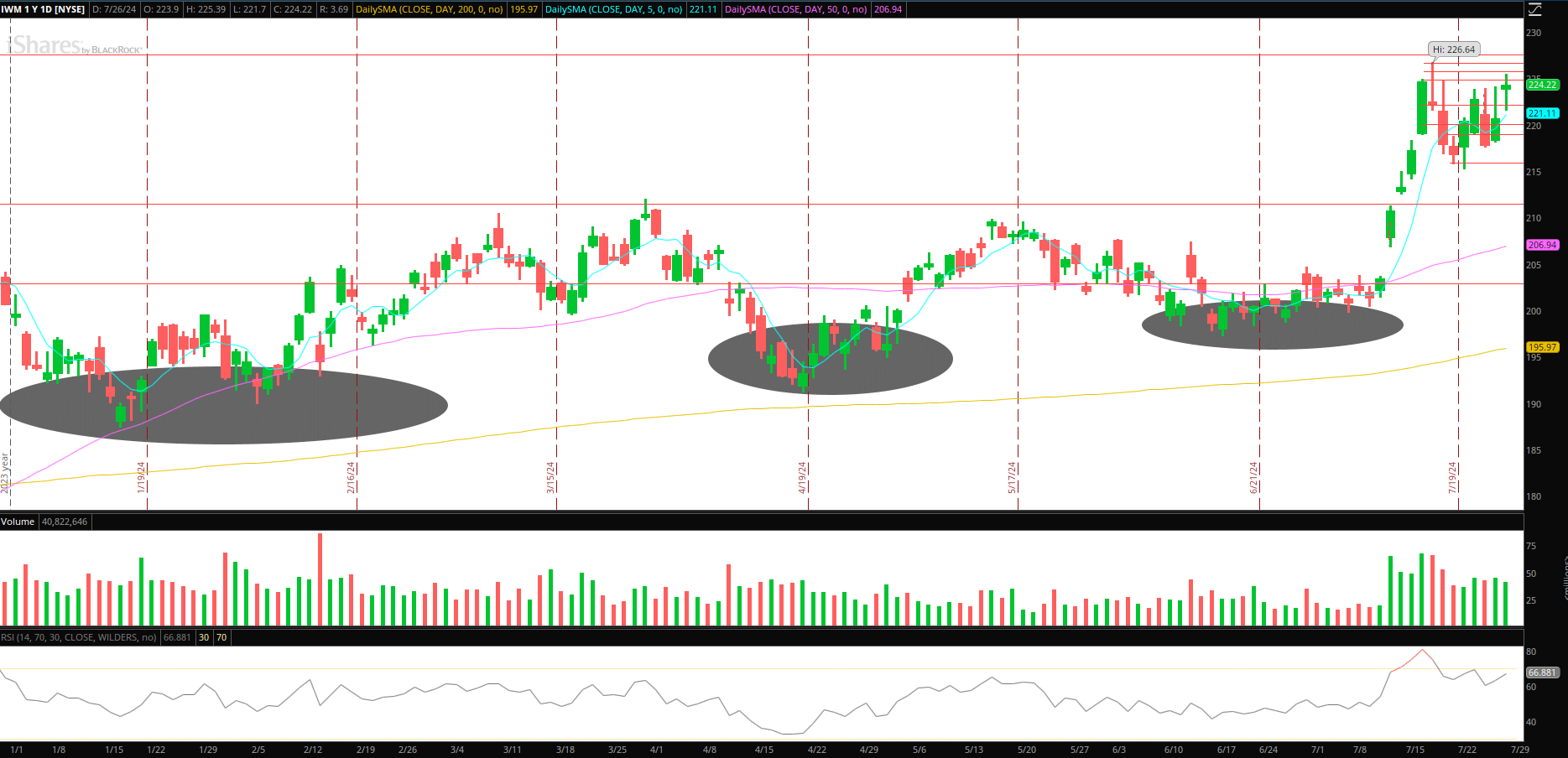

Continuation in Small-Caps (IWM)

Last week’s bounce-long swing played out exceptionally well per the watchlist plan. However, a new setup presents itself going forward: a consolidation breakout for a second leg higher. After the bounce earlier in the week, the IWM has spent some time displaying relative strength and consolidating near highs, setting up a consolidation breakout opportunity.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

Here’s my plan:

For entry, I am looking for either a quick wash-out lower and reclaim, thereby confirming a higher low versus Friday’s low. Alternatively, as the IWM closed above the week’s resistance on Friday, I am looking for a lengthy hold above and would target an intraday breakout for entry versus the day’s low.

After that, I would target similar measured targets as I did with the previous swing in IWM, using ATR targets and higher-high extensions. My first target would be a new 52-week high and extension above the previous high of $226.64. After that, I would look to trail using the same approach as outlined last week: 5-minute higher highs to scale out and higher lows to trail, targeting a multi-day leg higher.

Of course, it will be imperative to gauge overall market sentiment, internals, and relative strength.

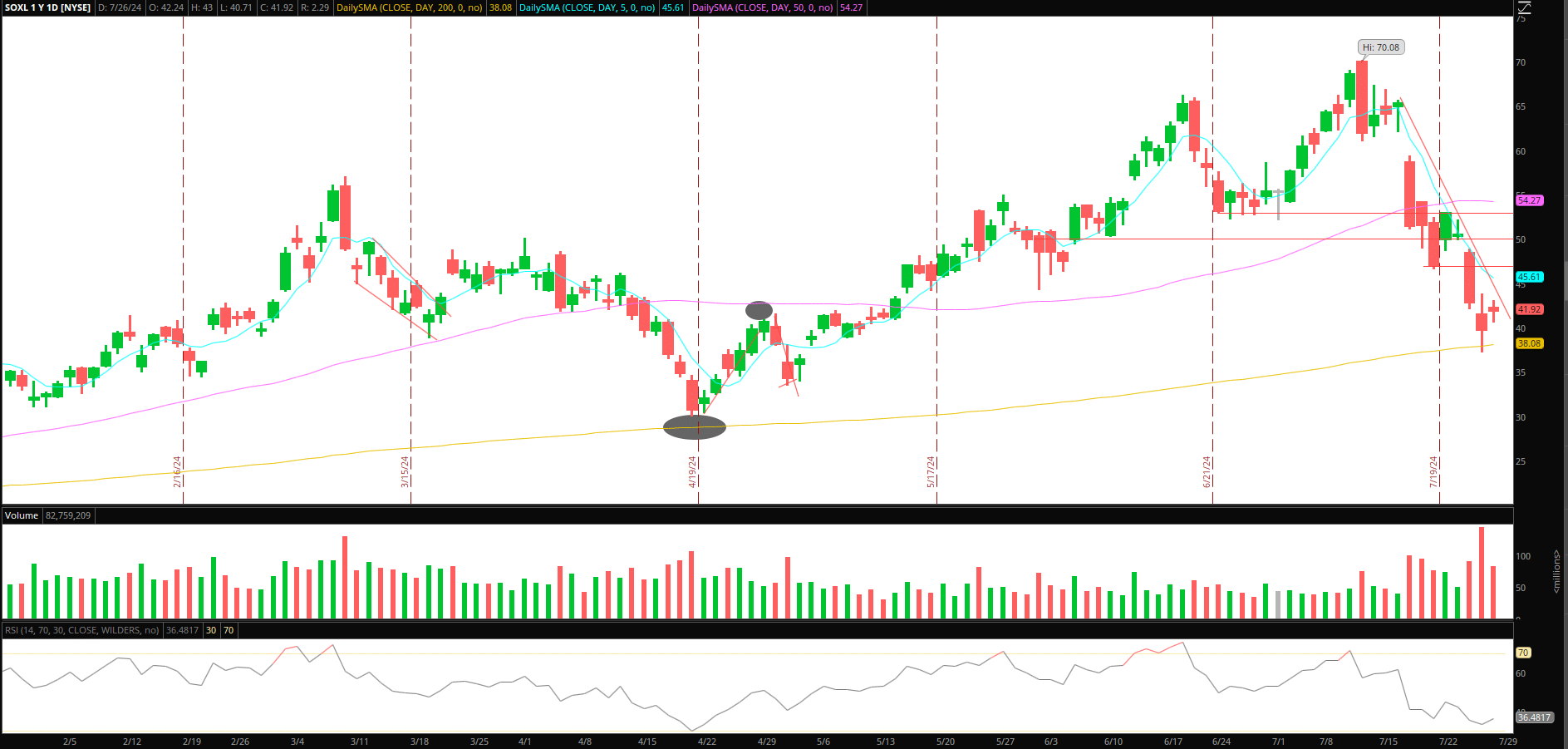

Relief Rally in Semis

The last time we saw a selloff toward the 200-day mark in SOXL, we bounced sharply once we broke the steep selloff’s downtrend over multiple days. I’m not saying the same thing will happen; however, if SOXL / the sector can firm up over its multi-day VWAP and begin to base above short-term / the prior week’s key resistance levels, I will look to initiate a long on the right side of the downtrend.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

Here’s my plan:

SOXL has now fallen over 40% from its 52-week highs and tapped its 200-day on Thursday. For the upcoming week, If SOXL can break its steep downtrend and base above key multiday resistance, around $43, followed by a push higher to break its downtrend, I will look to position long with a stop at the LOD.

I would look to hold this position for two to three days, trailing using higher lows on the 5-minute timeframe or the prior day’s low, depending on the price action and RVOL of the bounce/move. My first target to lock in gains and begin trailing my stop would be a measured move toward prior resistance and a 1 ATR up move between $47 and $50, with an ultimate target being a fast move toward $52.

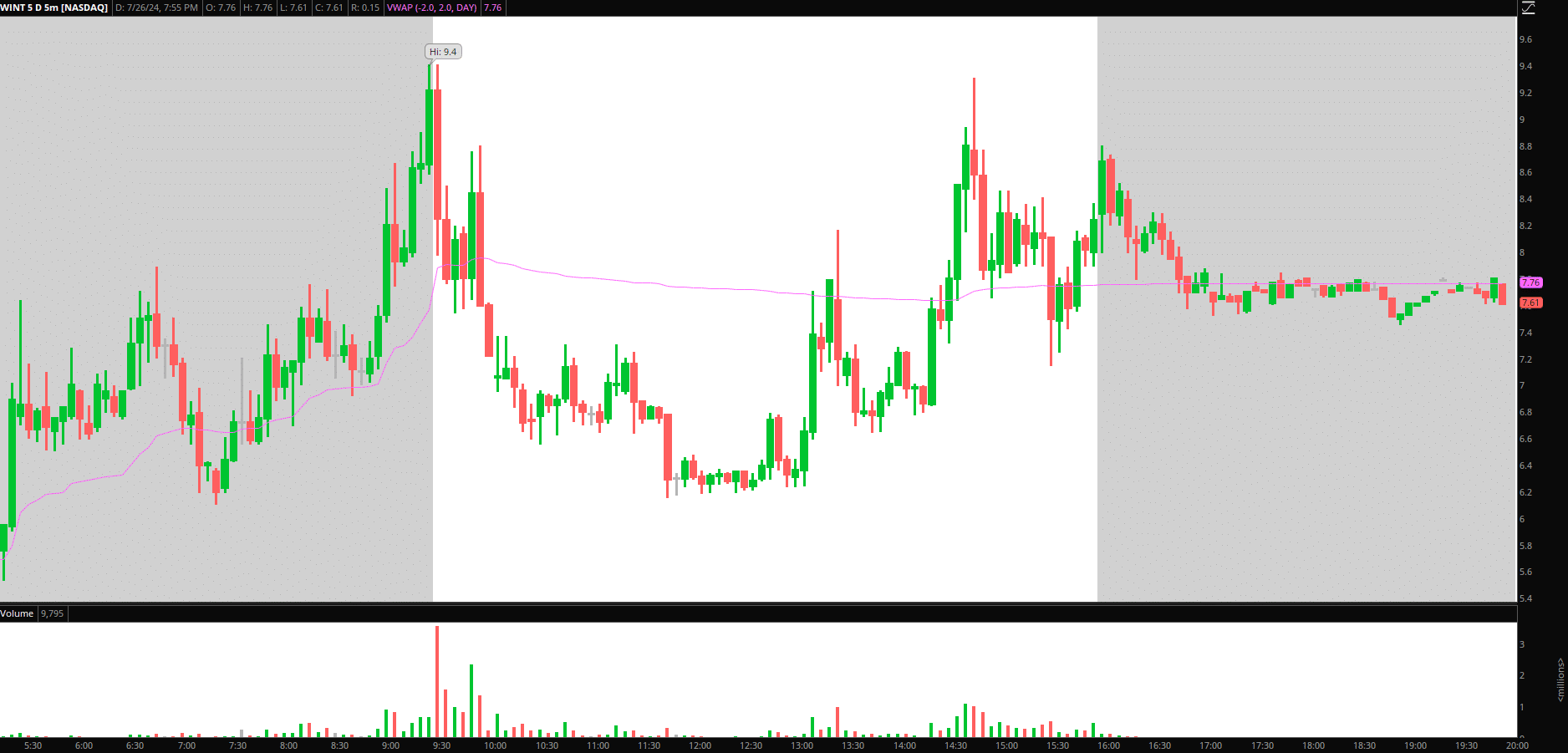

Additional Small-Cap Ideas:

WINT: Small-cap liquidity traps have been playing out extremely well with T+1. WINT had a strong close on Friday. Therefore, I will be monitoring this going forward for a trap and reclaim over $8 and potential squeeze out over last week’s highs. Once it exhausts, I will shift my attention to the short side. This one is a day trader, not a swing candidate, similar to my thoughts on SERV the prior week.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

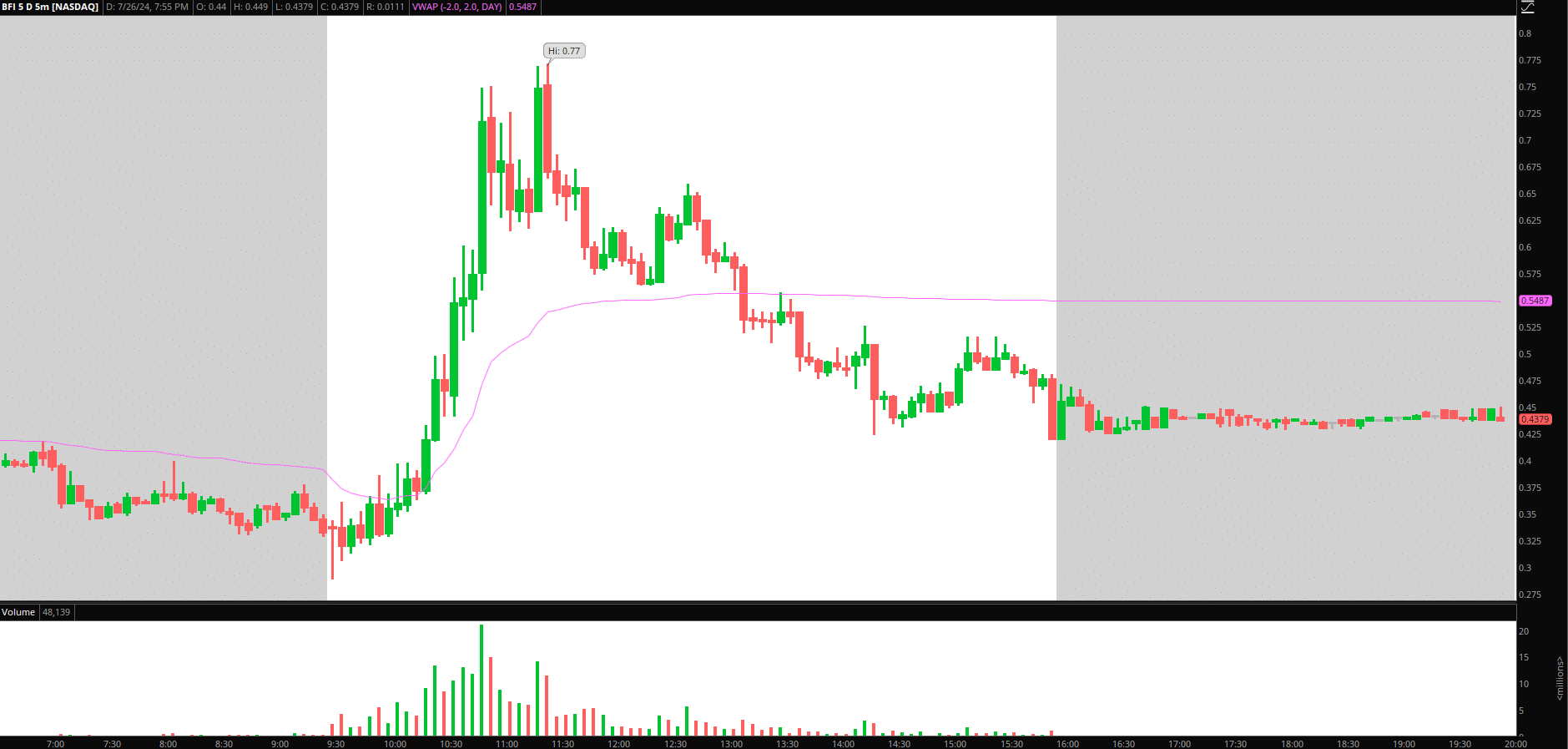

BFI: Friday saw a beautiful push and squeeze out, followed by a great short opportunity once the backside was confirmed with the lower high near $0.65. I will set alerts in the name in case it pops back toward $0.60 – $0.65 for a failed move higher and bull-trap, looking for a short versus that failed high and a move back toward $0.40.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

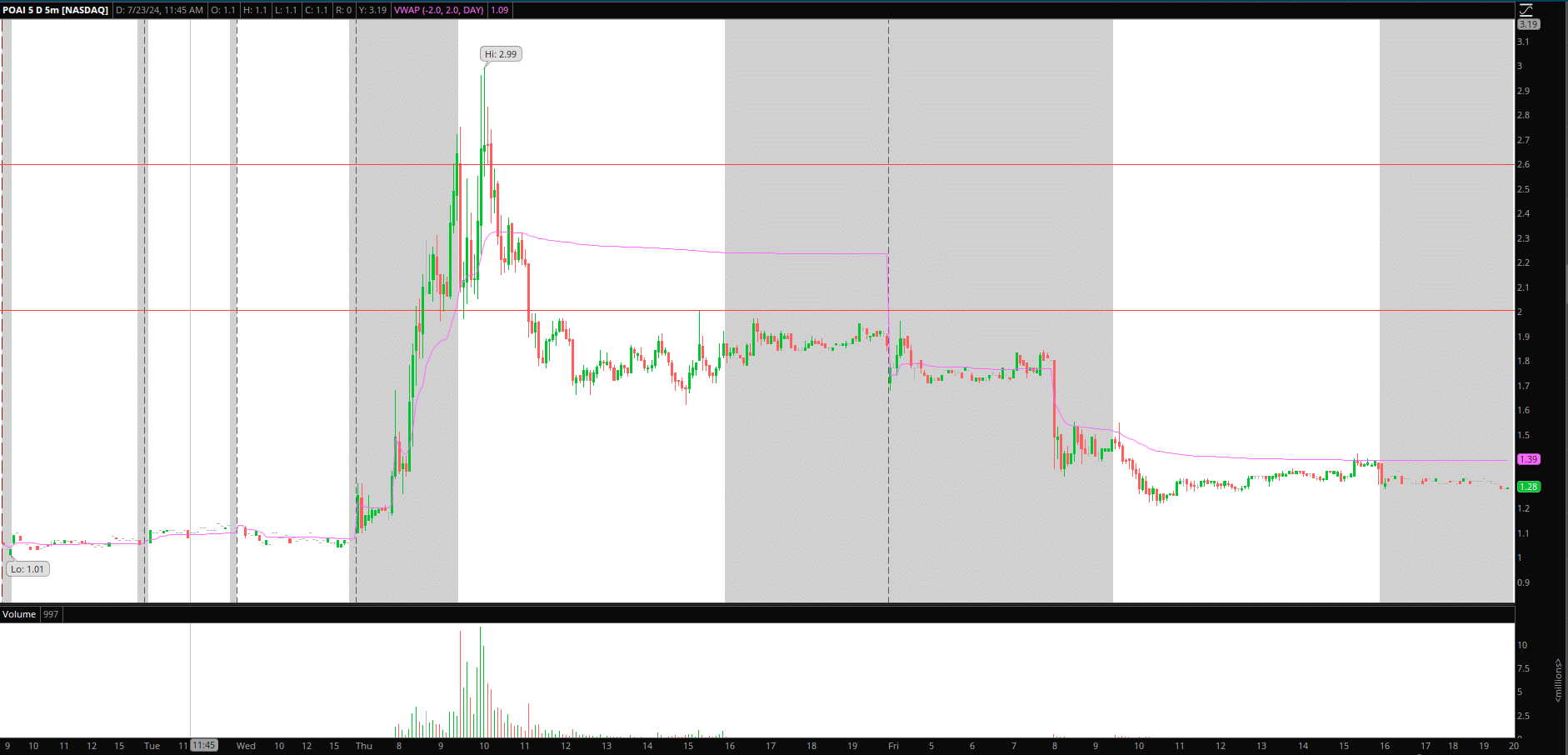

POAI: This was one of the top intraday short-opps from last week regarding small caps. Alerts are set in the name in case it has a quick liquidity move back toward $2+ and fails for a short back toward the low $1s.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.