Traders,

It’s a unique and exciting trading environment, and as always, I look forward to sharing my thoughts and trading plans with you.

Critical Adjustments and General Market Thoughts

Last week was a week for the books regarding the market’s volatility, sheer range, and price action, especially several leading mega-cap stocks and ETFs. Regarding mindset and adjustments, it remains a trading environment versus swing, in my opinion.

Sure, the bounce off the panic lows on Monday worked well, but the several 1 – 2% declines along the way up make swing positions increasingly tricky in the environment compared to intraday momentum trading.

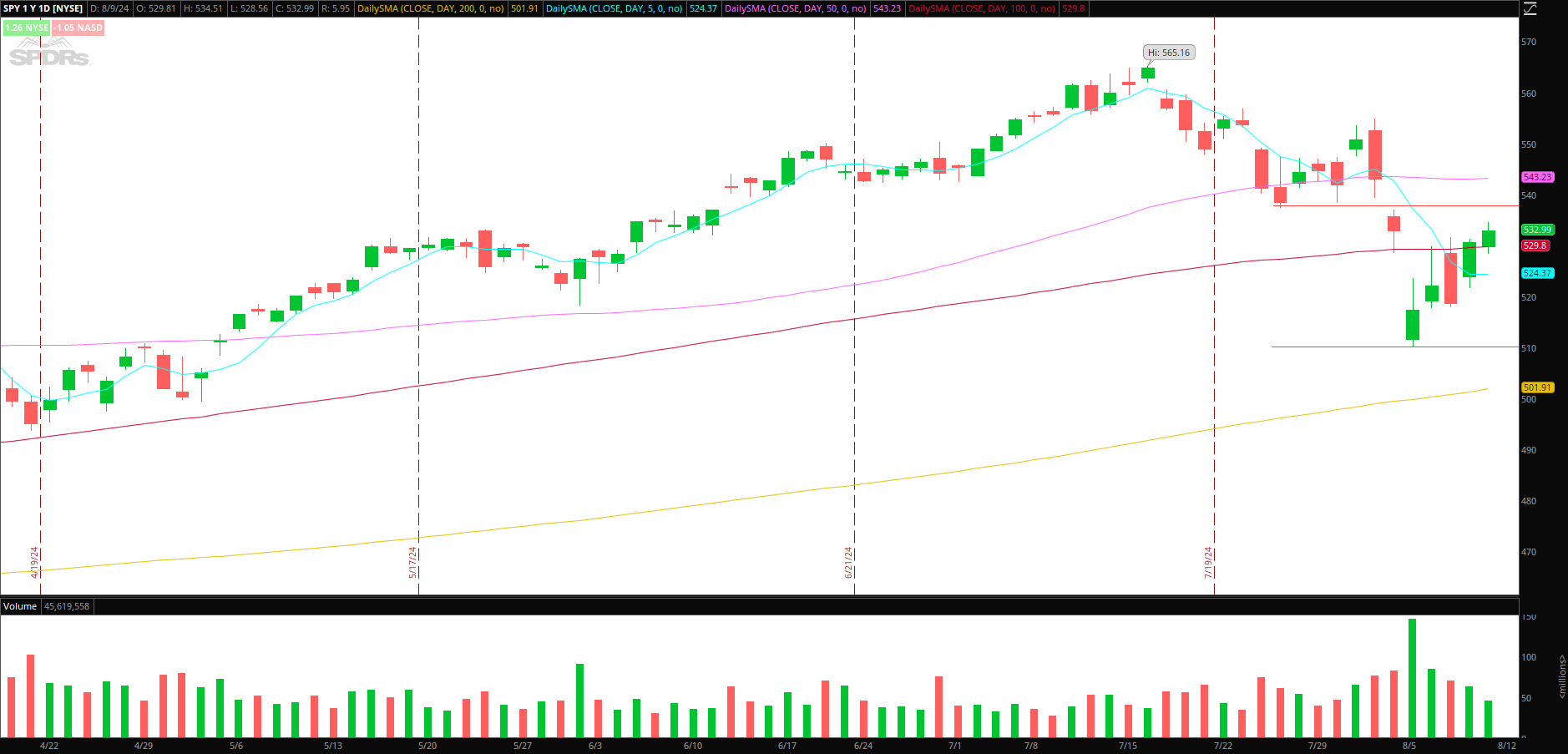

I’ll closely monitor the overall market, SPY, and QQQs this week as we come into a potential resistance band. For SPY, that area of possible resistance that could market a lower high and downtrend continuation is $537 – $540.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

For tech and innovation (QQQ), which has led the way on the way down, and now, with this bounce, on the way up, that band matches up to its 100-day, near $456. As the price edges closer to this potential zone of resistance in the market, I will pay close attention to market internals and price action for signs of a possible turning point and skewed R: R opportunity for momentum shorts.

If that scenario begins to form, several avenues exist to express it. For example, not only could I be involved in leading market ETFs, but I might consider identifying relatively weak names for momentum trades on the short side.

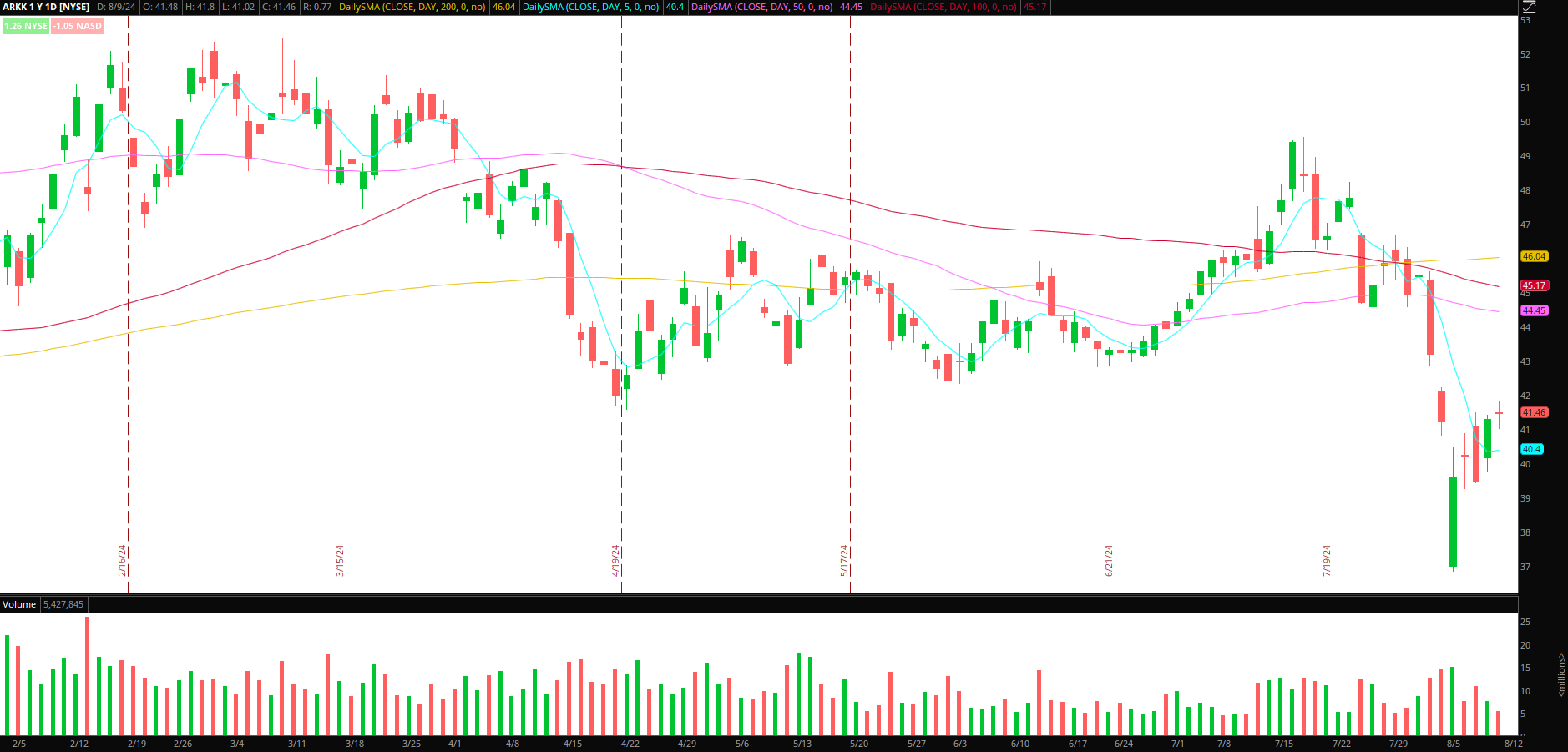

For example, apart from the obvious go-to names and ETFs, ARKK is another interesting option right now for the above idea, given the bounce into a significant zone of potential resistance from its daily chart. If the market stalls and then turns lower, ARKK, which has traded back into a hefty level of potential resistance near $42, could offer skewed R: R.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

The opposite might happen as well. That is to say, the market might digest the recent week’s action, with volatility subsiding, have a slight pullback, and correct overtime by going sideways. If that occurs, I would look for beaten-down names trading at crucial inflection points, offering the potential for quick directional moves if internals begin to improve.

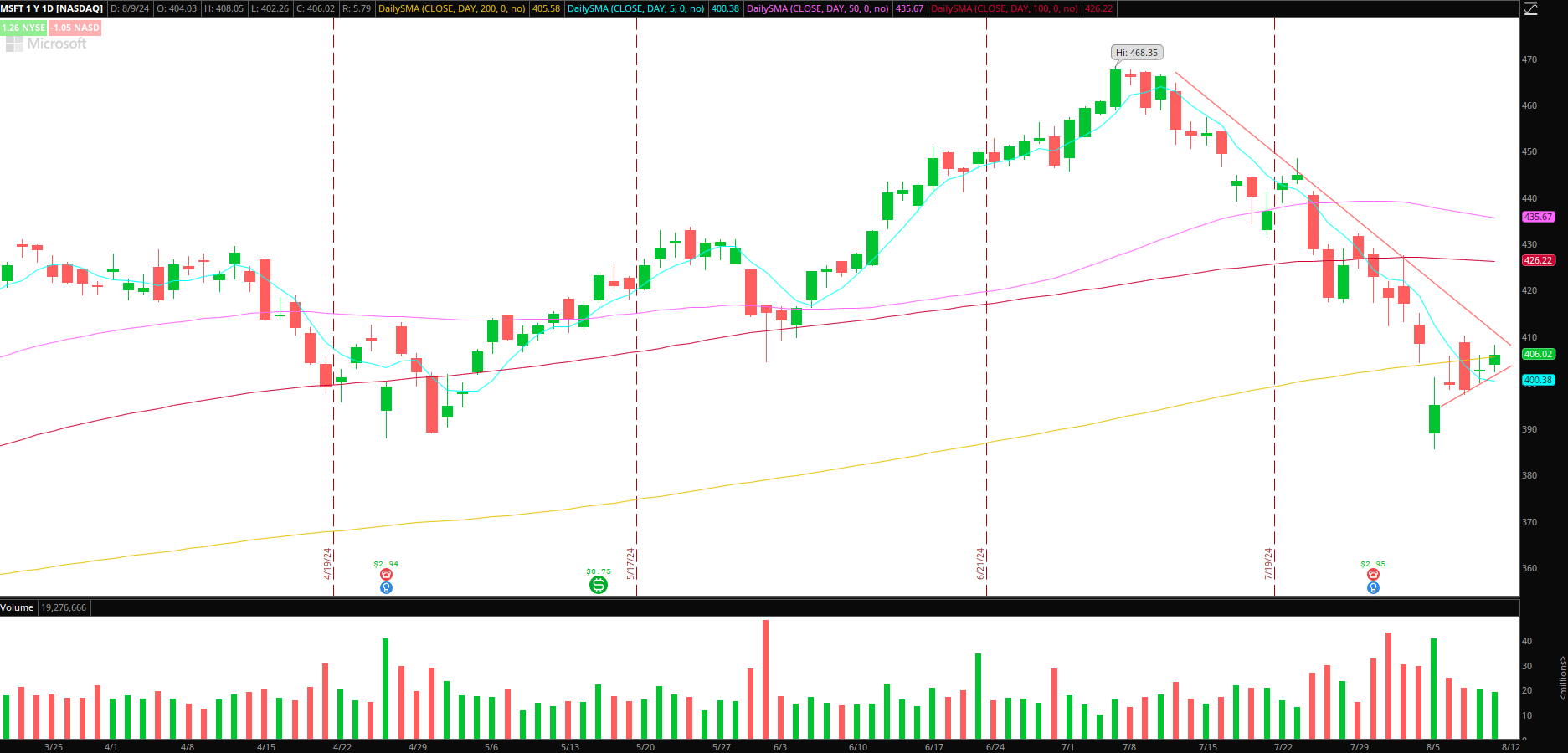

For example, a momentum breakout in MSFT: Contracting flag near the resistance of its steep downtrend, offering the potential for momentum longs or shorts depending on the market’s overall direction. If the market stabilizes and finds higher footing, MSFT’s bounce could grow legs, offering a clean momentum entry above $410.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

In such a case, I would be long on the breakout of $410, with a stop at the LOD, scaling out of the position on extended higher highs on the 5-minute timeframe while trailing my stop using higher lows. A similar setup exists in TSLA, consolidating between a flattening 200-day and 100-day SMA, making it a candidate for a momentum breakout trade in either direction.

Additional Ideas Uncorrelated to the Overall Market:

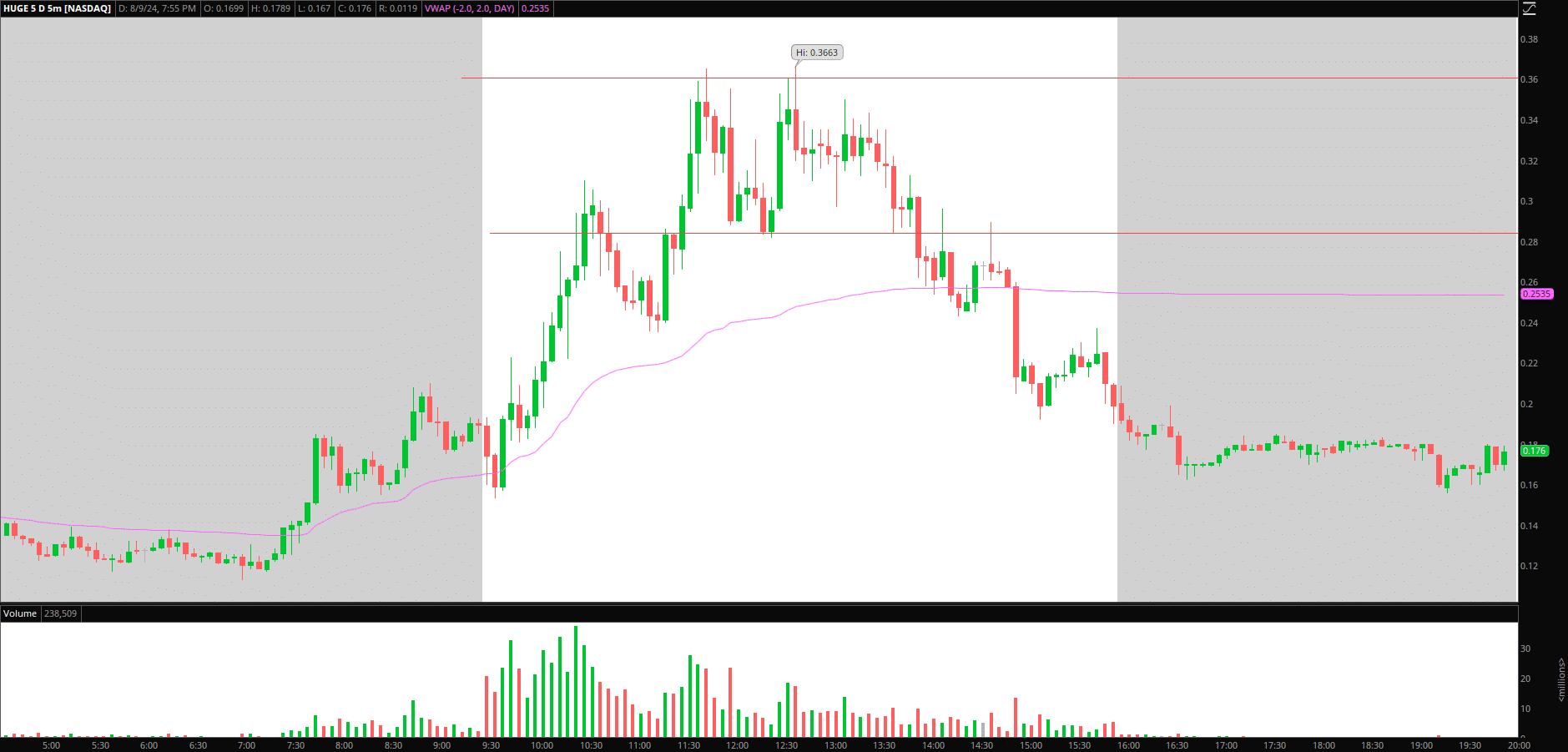

HUGE Pop into Resistance to Short: Awesome volume and mover on Friday, considering its % move. I’ll just have some alerts set in the name in case volume comes back in and drives it back toward $0.30 + for a potential failed follow-through setup and short vs. the high for a move back toward $0.20—teens.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

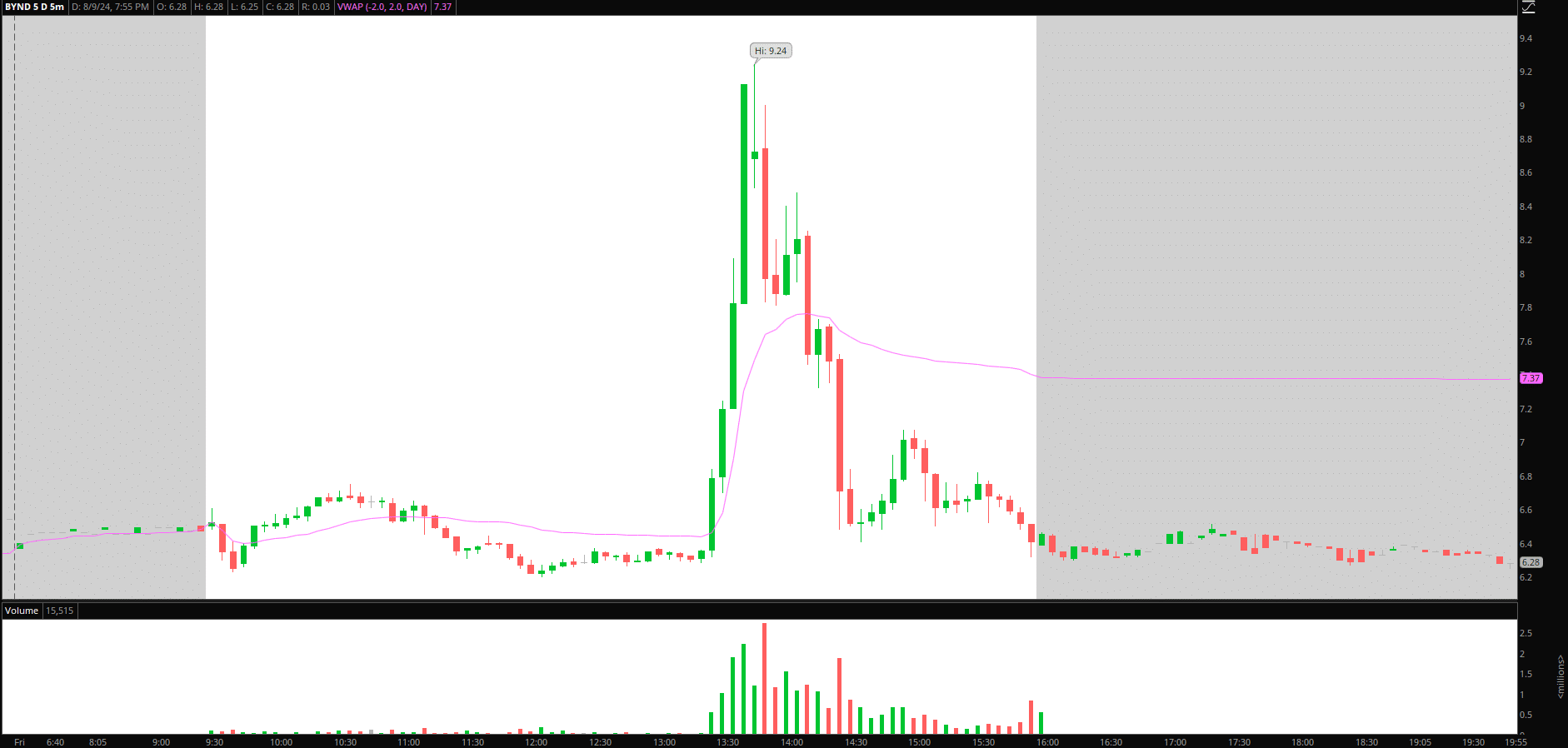

BYND Pops to Short: On Friday, once the price turned at $9 for a roundtrip short, similar to CHWY, It provided a brilliant short opportunity. It’s great to see several people on the desk do well here. It’s a long shot, but I’ll have alerts set $7+ for any secondary move off options activity for a re-do.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.