We have been doing an exercise with our traders that I thought I would share. We ask our traders to create a playbook. Plays and patterns that make sense to them that they want to trade more of. At the end of the day the trader considers a best trade they made, details this trade in our SMB PlayBook template form and then sends it to me. I review the trade and then add some notes (Bella note). We then share this trade with the desk and include this in The SMB PlayBook (available to all SMB Trading traders). All traders can review this playbook and get some practice on specific trades or co-opt one of these trades for themselves.

Below is one example of a trade we just added to The SMB PlayBook.

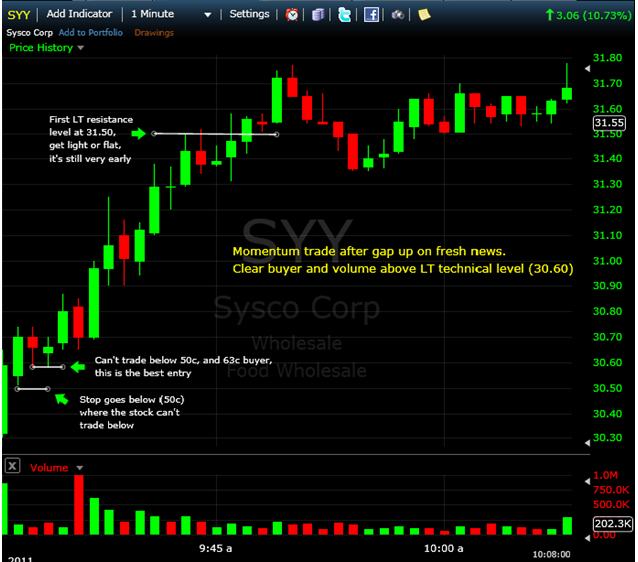

Name of The Play: Gap and Go Above LT Level w/ Buyer

(Bella note: SYY had gapped up from 28.50)

Intraday Fundamentals: Sysco beats by $0.03, beats on revs (28.51 )

Reports Q3 (Mar) earnings of $0.44 per share, including items, $0.03 better than the Thomson Reuters consensus of $0.41; revenues rose 9.1% year/year to $9.76 bln vs the $9.46 bln consensus, due primarily to higher prices and case volume growth. Food cost inflation, as measured by the estimated change in Sysco’s product costs, was 5.1% driven mainly by high levels of inflation in the meat, seafood and canned/dry categories. This compares to deflation of 0.8% in the prior year period. In addition, sales from acquisitions (within the last 12 months) increased sales by 0.6%, and the impact of changes in foreign exchange rates for the third quarter increased sales by 0.6%

Technical Analysis: 30.50, 31.50, and 32 were longer term technical levels. The most important intraday levels were 30.50, where the stock couldn’t trade below. There was a buyer at 30.63. 32 was a level where a lot of volume was done intraday.

Reading the Tape: There was a clear buyer at 30.63 (Bella note: significant volume done at this price as well). He dropped for a second but the stock barely dropped, going down to 30.58 and began the up move (Bella note: We are seeing this pattern more lately. There is a buyer, he holds a bid, then drops but the stock does not really go down. Then they rebid to the same held bid price or higher and the stock trades higher. When you are watching a held bid and our long or thinking of getting long you must prepare for this possibility. When the bid drops watch to see if it does not really go down and then rebids at the same price. If so then consider getting back in.) There were large offers that were taken out aggressively w/ clear momentum.

Trade Management:

Mike Bellafiore

Author, One Good Trade