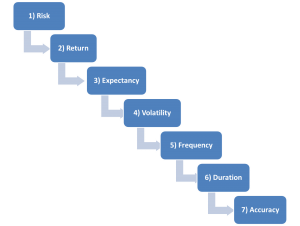

Last time we talked about Risk, which is the first and most important aspect of a trading system. We discussed how limiting risk can create higher absolute returns because of reinvestment, raising capital, and using leverage.

Last time we talked about Risk, which is the first and most important aspect of a trading system. We discussed how limiting risk can create higher absolute returns because of reinvestment, raising capital, and using leverage.

Now we can talk about our second focus: Returns. There are three types of returns that we need to understand. First is the back tested returns. An automated system should generate back tested returns. These returns should cover different market conditions and include enough data points to be relevant.

The second type of returns to track in automated systems is simulated returns. These are accumulated in real time over the course of weeks or months to compare and contrast the back tested returns. If the simulation is significantly different (better or worse), then we may need to head back to the drawing board.

The third (and most important) type of returns are actual returns. These can be different than simulated returns because of liquidity assumptions and changing market conditions. There must always be a plan to turn the system off when a certain draw down level is reached that exceeds historic norms in back tested and simulated trading.

There is one important pit fall that systems developers should consider. Back tested returns should not be dependent on a certain market condition (a sustained multi-year bull market, for example) or only work because one trade out of 200 generated most of the returns. These type of conditions do not lead to a statistically relevant system moving forward. Testing your strategy on different historic market conditions is important to know if you can expect your Risk & Return assumptions to carry forward into the future.

Andrew Falde

No relevant positions.