A former SMB DNA student reached out to me for feedback on his trader psychology. He posed an important question. That question is: what is the optimal mindset for elite trading.

This trader’s specific query was:

Curious how my mindset during my best trading days compares to elite traders at your firm during their best trading days?

My best trading days are when:

- Mindset = super level of consciousness and awareness combine with a high degree of confidence while valuing humbleness to avoid overconfidence. I am positive and believe today is going to be a good day in the market.

My worst trading days are when

- Mindset = Consciousness and awareness are limited due to heightened emotions. Likely had a poor night of sleep and morning routine was not up to par. Confidence is lower.

Solution = Build a mindset checklist into my big picture narrative. The market needs to be contextualized each day, but so does (MM). (end)

SMB is thinking about trader psychology, just like you

When we reviewed our YouTube channel at the end of 21, we learned that videos on trader psychology were some of the most popular. Further, we recently remade our interview scorecard for firm hiring and much of our evaluation determines on how a candidate thinks. Also, at our firm, traders have access to the best trading psychology coach in the world- Dr. Brett Steenbarger. Moreover, during recent chats with traders setting their yearly goals many were about trading bigger, which is related to trader psychology. Finally, one important best practice we utilize at the firm is to study, study, study, the heck out of what leads to your best days. Said better, what did you do prior and during your best PnL days that led to you trading at your best.

Tips for Successful Trading (Trading Psychology Every Trader Needs)

The optimal mindset for elite trading

My take on the optimal mindset for elite trading?

1. Sustained focus

You should see the sustained focus of the best younger trader at our firm. He made north of 3.2m in his second year of trading. I shared yesterday with Dr. Steenbarger how remarkable his focus was during the trading day. And that is stands out, even compared to other serious traders at the firm. He is locked into the information running up and down his trading screens. He takes a short break midday to lift. And then he is back locked into the markets. He is not willing himself to concentrate for extended periods. He just loves it. This is what he is meant to do.

2. Openminded

The best active trades let the price action speak to them. They may develop a trading thesis, but then they search for confirmation based on the price action. The best trades come to you, if you just observe what the price action is foreboding.

3. Align your trading with your strengths

If you think quickly, you probably want to scalp. If you are a deep thinker and diligent, you probably want to trade on a longer time frame. Trade a style fitted for your strengths is necessary for the optimal mindset. We are often happiest when we pursue what we are best at.

Trading Psychology: Growing Your Trading Business (Dr. Steenbarger and Bella)

4. Collaborative

The traders making the most at our trading firm are collaborating. They are NOT trading in a silo. Effective collaboration is worth as much as 5x-10x in PnL.

Seeking other points of view helps you to make better trade decisions. You may have missed something. You may underestimated how good your trade idea is. Two and three and four and more trading brains teamed correctly are much more powerful than one.

5. Controlled aggression

This might be the most important ingredient for active traders.

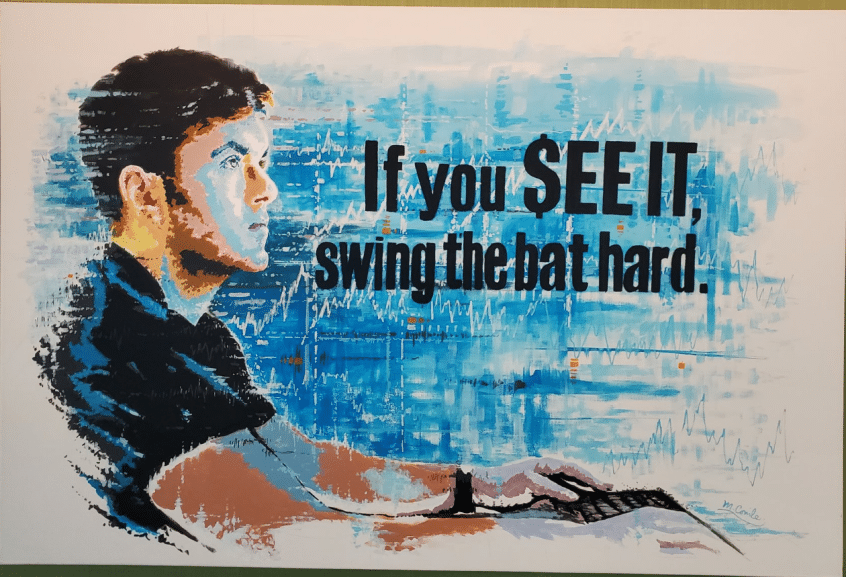

If you see an A+ trade setup for you, then swing the bat hard. If the trade is not acting as you anticipate, then get the heck out. Yesterday, a savvy experienced trader shared during a firm monthly review, his plan to trade bigger. It included both putting on max risk when he saw his trade, but then also cutting the trades that were not working much better.

This hangs on the walls of SMB Capital in NYC…

6. Acceptance

If you make a good trade, no matter the result, you can accept it. Your job is to make one good trade. You cannot control the results.

7. Learn

Each trade is an opportunity to learn. Compound this principle trade upon trade towards becoming your best trader. Play the long game. How good can you be in ten years if you learn from every trade?

8. Equanimity

Hint we screen for this during our hiring process. How do you respond to a difficult trading situation? Each difficult trading opportunity is your opportunity to practice reacting at your best in a tough environment.

Please contribute to this conversation for the trading community, with your thoughts on the optimal mindset for elite trading here.

Mike Bellafiore is the Co-Founder of SMB Capital, a proprietary trading desk, and SMB Training, which provides trading education in stocks, options, and futures. Bella is the author of One Good Trade and The PlayBook. He welcomes your trading questions at [email protected].