Last week I wrote a column talking about how I had moved towards using 15 minute charts more often intraday to keep me focused on a stock’s most relevant trend. I still use lower time frames and the tape to identify the best entries but the higher time frame view will inform whether I am short or long. I thought the price action from SNDK on January 26th illustrated this point rather well.

Take a look at this chart that includes the price action from the after hours on January 25th when SNDK released their earnings and the pre-market action from the 26th. This price action can only be described as bearish. The initial reaction to the earnings release was a two point down move. This was followed by a second wave of selling.

The next morning in the pre-market SNDK continued to consolidate near the prior day’s after hours low. When the market opened the initial drive was to the downside. This is one of my favorite short setups. A stock with a fresh news catalyst has been aggressively sold when the news is released. The next morning it trades lower in the pre-market. And finally it creates a new low after the market Opens. At this point the burden of proof is on the stock to get me to shift my bias to the long side.

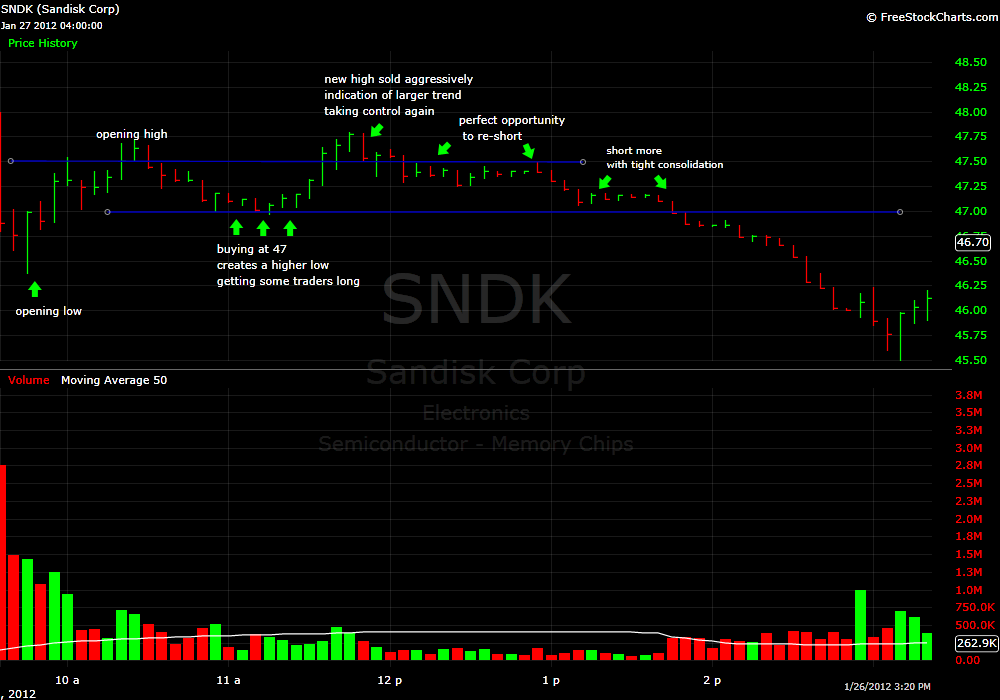

There was a lot of chatter on the desk about this one. Mike even tweeted that he would consider getting long if it got above the 47.50 level. If you look at the 5 minute chart you can get some insight to his thinking. Around 11:00AM SNDK was clearly being bought at the 47 level, which was about 70 cents above the opening low. If it were to then start to hold above 47.50 he viewed the short term trend as having changed.

SNDK did eventually trade above 47.50 and made a new high. But what immediately followed its new intraday high was telling for me. It quickly sold off and then began to consolidate below the 47.50 level. This was the first evidence that the higher time frame trend was beginning to reassert its influence. If you were only watching the 5 minute trend you might argue that it simply was having a pullback and consolidating higher than 47. Therefore you might be thinking long.

Those focusing on the higher time frame trend who were interested in being short this stock were presented with a well defined consolidation where they could start building a position. See the annotations above for additional spots where you might have added to a short position. (note this was a circuit breaker stock so you would have had to offer shares to establish short positions)

After the downtrend resumed SNDK found its November 25th low of 45.50 before being bought into the Close.

Steven Spencer is the co-founder of SMB Capital and SMB Training and has traded professionally for over 15 years. His email is [email protected].

No relevant positions

One Comment on “The Lens Matters (2)”

nice website, glad i stopped by. Mr. baytrader