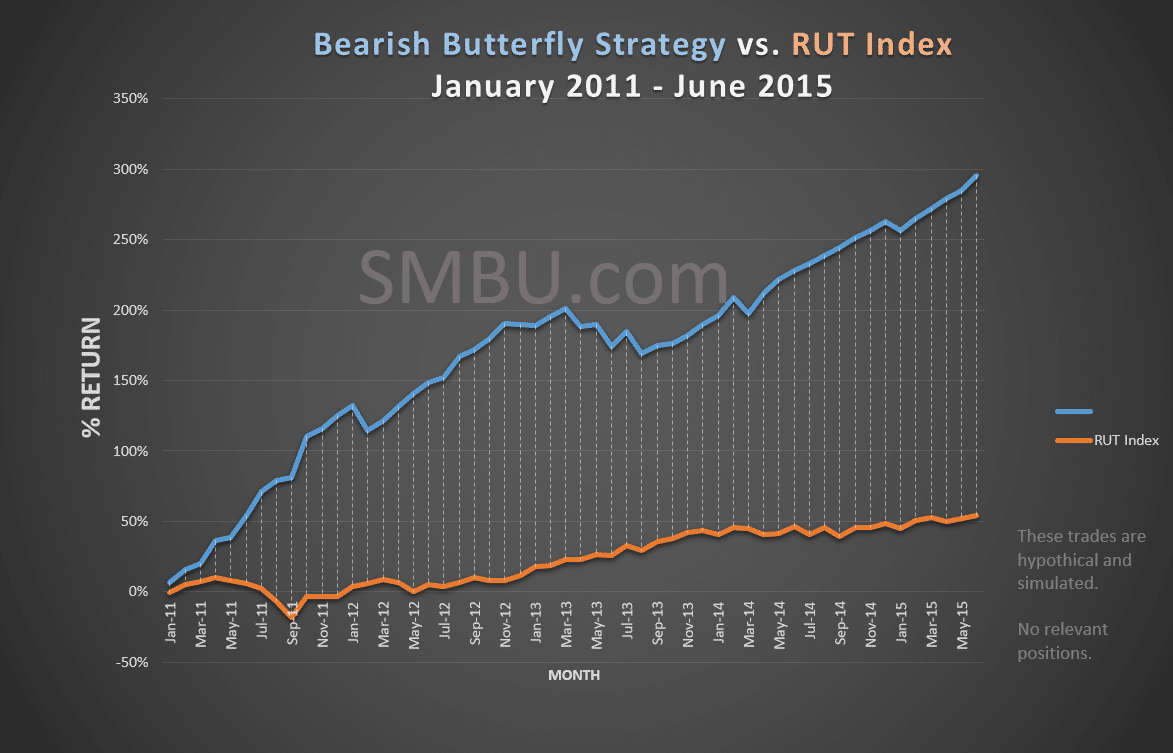

Please note: Trades discussed below are hypothetical and simulated for educational purposes only. Review the options risk disclosure. The graph below compares the Bearish Butterfly vs. the S&P 500 index. If you had traded the rule-based Bearish Butterfly Strategy for the past 5 years, you could have outperformed the index by 288% — even though the market was bullish during … Read More

One Mistake Your Broker is Glad You’re Making

A common mistake that new and developing traders make in the options market is to trade strategies that involve high commissions relative to the earning potential. We often see newer options traders applying great options strategies to the wrong instruments. Option trading strategies that involve frequent management to control risk can be commission intensive. This is especially true if you’re … Read More

Decoding the Secrets: What Do Options Traders Know That Others Don’t?

Options traders like you have been telling us for years what they want to achieve in their trading. Strangely enough, they don’t ask us to show them trades that make bigger profits. Nor do they ask for risk-free trades. The word we hear most from options traders is consistency. Who wouldn’t want to be more consistent, right? However, we believe … Read More

$NDX Iron Condor Trading

This week, Seth Freudberg, SMB’s Options Training Director, speaks with our summer college program participants, drilling down deeper into the trade management of an $NDX iron condor trade. Enjoy the video! Seth Freudberg Director, SMB Options Training Program The SMB Options Training Program is an eight-month program designed for novice and intermediate level options traders who are seeking an intensive … Read More

Members Only Options Webinar: Exploring the Hindenburg Strategy with Doc Severson

Your Option for a better trading life……together (SMBU Options Tribe) SMBU’s Options Tribe is an online community of options traders dedicated to sharing successful options trading ideas with all of our members worldwide. Each Tuesday, SMBU hosts an options webinar—the Options Tribe—during which veteran options traders and experts in the world of options trading share live presentations. Next week, Doc … Read More

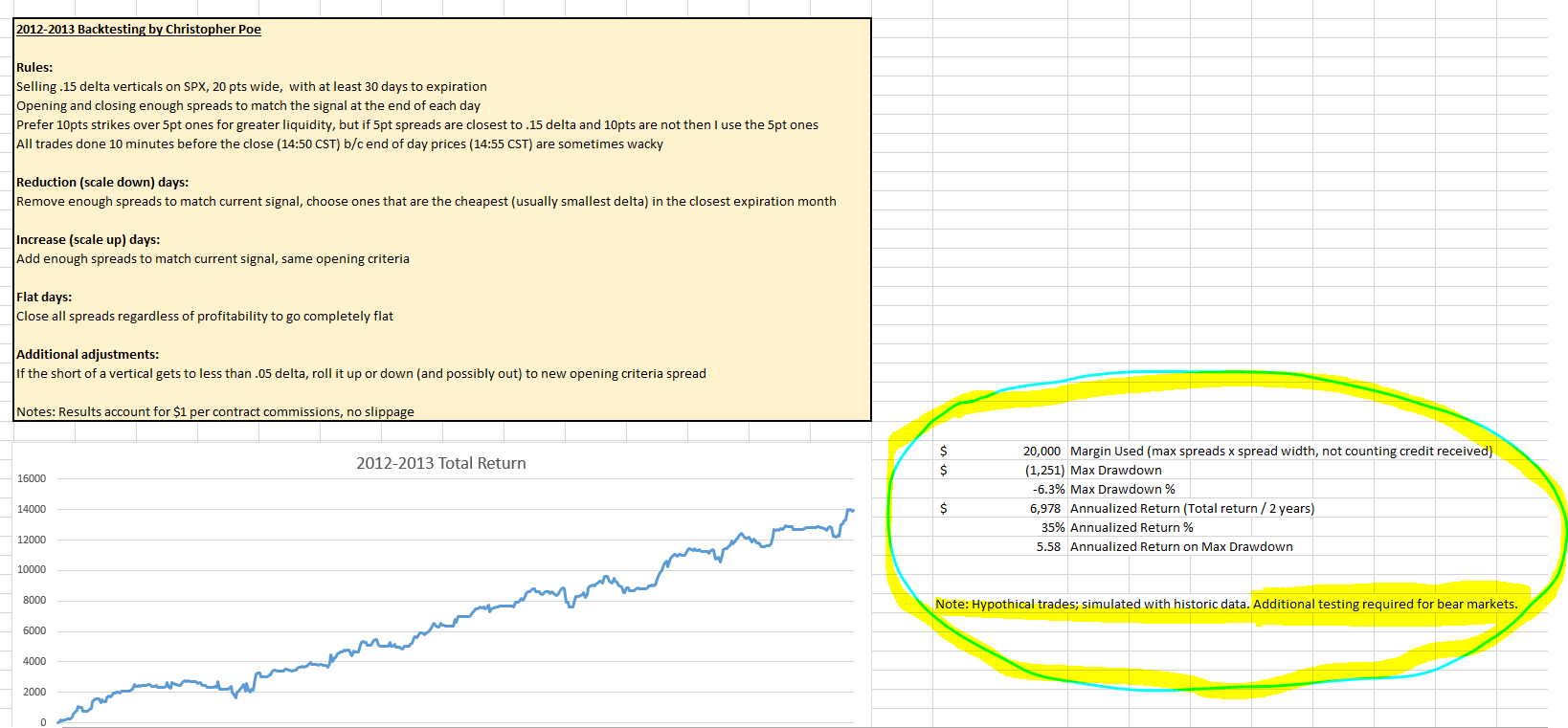

Back Testing an Options Strategy

Note: The following contains hypothetical results; simulated using historic data. As mentioned at a recent SMB Options Tribe meeting; a group of options traders are now working to back test a proprietary momentum signal using a variety of options trades. Several tests have come back with varying results… but we are seeing a common thread for options trades that show low … Read More

Your Head is Fine But Your Strategy Stinks

One of our very bright new traders asked to chat about trade psychology. He feared his needed help and wanted to seek my advice on a trading psychology coach. Many of our traders work with psychology coaches. The results are often very positive. I asked the trader to stop by my office for a chat to see if his issues … Read More

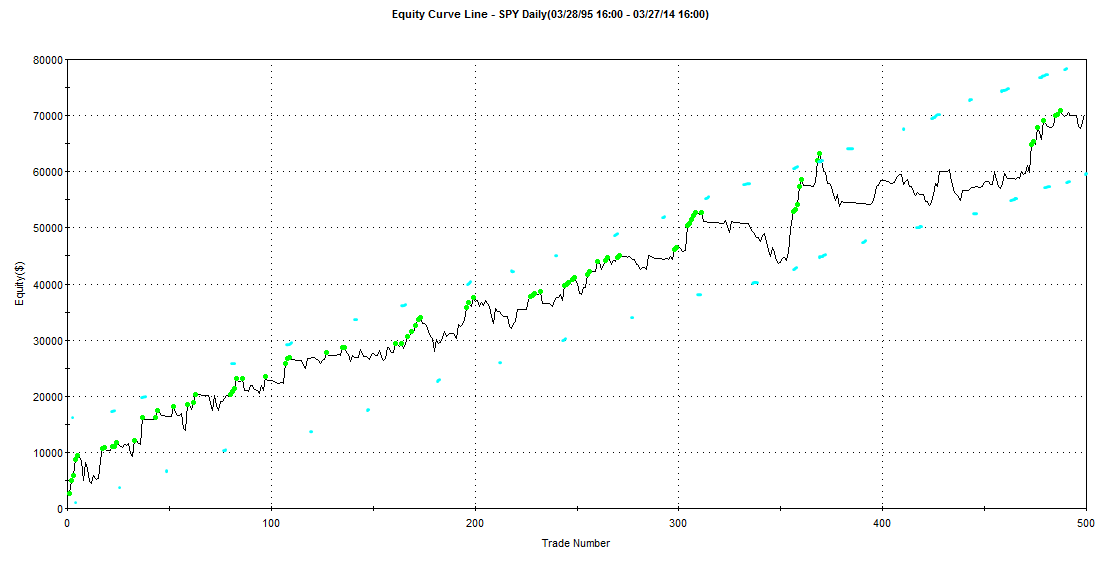

Volatility-Based Sizing

In running back tests, it’s important to understand the impact of volatility and position size. A consistent position size in number of shares or dollar amount can greatly skew historic results. If optimizing, this may lead to curve-fitting the system to periods of high volatility. Here are some examples of the impact of fixed-position sizing vs volatility-based sizing: The first … Read More