I received this email over the weekend from Reader David, a developing trader, improving daily: Hey Bella! How bout’ this market! Just so much opportunity, and great setups that I am seeing everyday. Today that trade was ABIO over 5. I got long 2 lots on the break and added above 5.50, sold out near the highs and waited for … Read More

It’s the Price Action Stupid!

Borrowing phraseology from the Ragin Cajun and former advisor to President Clinton, James Carville: it’s the price action stupid! Why is the market going up with unemployment so high, consumer debt outrageous, an environment where taxes must go higher, energy 5xs the norm, housing still depressed, access to credit stunted, expensive war expenditures, the Greece failure, a weak dollar, and … Read More

Traders Ask: The Benefit of Being an Idiot

I received this email from Reader Bob titled “Someone has to tell me to stop being an idiot like I was today”: Might as well be you :-). So overtraded, didn’t focus on my edges, missed my #1 set-up on LEN (top of my trade plan). The easiest $1 anyone will see when it walked through the top of the … Read More

Priorities

I was psyched for an opportunistic Monday after Friday’s action in GS and the market. On our Sunday night SMB University show on StockTwits TV I went through all the levels in GS, JPM, MS, BAC, DB and the market momentum leaders. I read every blog and article on the GS/SEC civil suit. I mapped out a plan for new breaking … Read More

The Power of Trading Skillz (RIMM 72)

The modern science of elite performance has taught us that reading and watching videos is not going to make us a great trader. Anyone interested in the markets can read a chart in RIMM and recognize the 71.80 and 72 levels. I call this acquiring domain knowledge. And that is important. And certainly RIMM is a Trade2Hold above 72. Oh … Read More

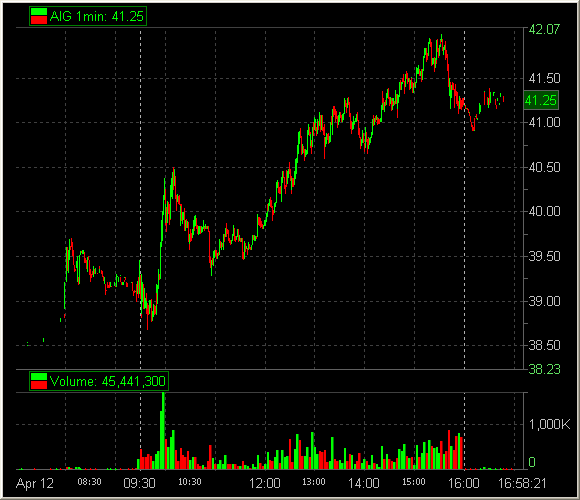

PLAYING AIG FOR A BIGGER MOVE

Wednesday AIG broke about an important resistance level of 36. If for some reason you have been trapped under a rock for the past two months you might have missed that most things breaking out head for higher ground. Boss Lindzon has labeled the recent market upmove as the “inconceivable rally.” One of the original trading bloggers, Rev Shark, on … Read More

The Superstar Effect

High Frequency Trading (HFT) is supposed to be the new superstar on the Street. I wonder if this will be the case in ten years. More importantly, are we ignoring excellent trading opportunities because we perceive HFTs as the superstar? The NASDAQ Day Trader used to be king. Tech and then Internet stocks rained money on then this new breed … Read More

I AM A TRADER

We watched tape of MEE from yesterday after the Close. It was a very difficult stock. But I heard a comment from a very bright trader that I bet is heard on other trading desks:” I don’t like scalping MEE because I can’t tell when it is going to spike 20c against me.” I know too many traders passed on … Read More