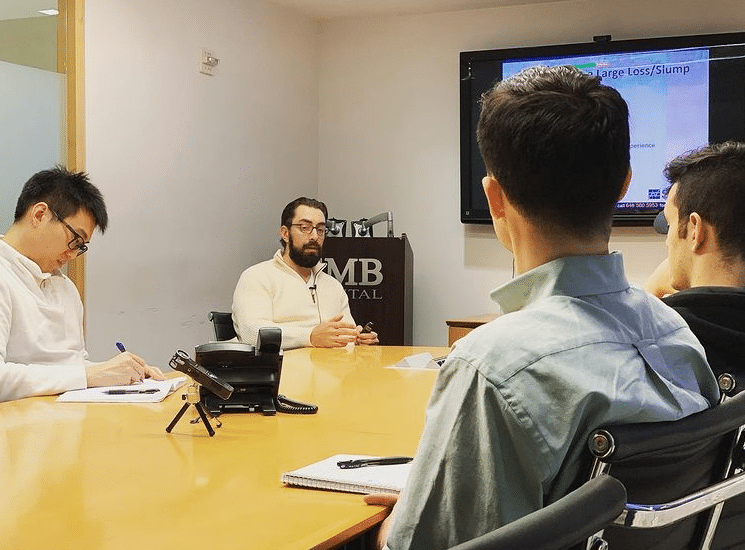

Yesterday Shark, one of the top traders at our proprietary trading firm in NYC, shared his new dynamic hedging strategy with other firm traders. Specifically, he reviewed how he attacked his recent hugely profitable short trade in GME, using this dynamic hedging strategy. This was a trade that netted sizeable trading profits, but the role-modeling that Shark did was so … Read More

Thinking in R(s) may be what you need to improve your trading

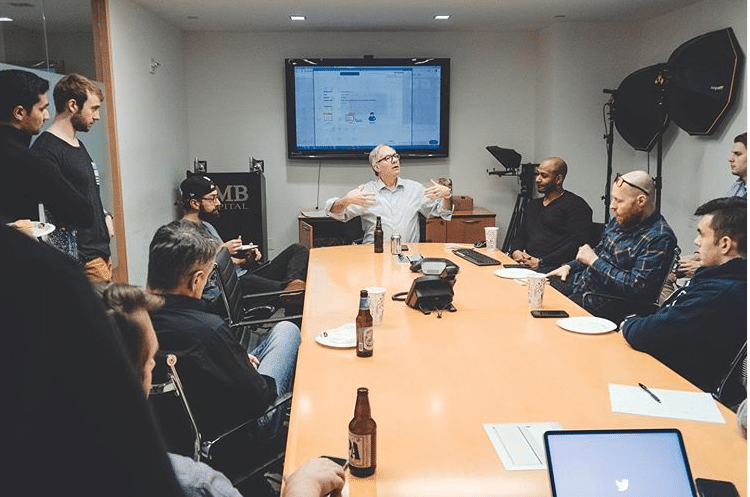

One day each month, we block off time for each trader to present their monthly review. Today is that day. Themes often develop during these reviews as to what is working for many traders on the desk. Today a theme emerged for many of the developing traders. And that theme can help your trading. Junior traders or developing traders often … Read More

How market profiles are constructed

In this video Merritt Black discusses what market profiles are and how they are constructed.

Do Options Income Traders Make Money Every Month?

The term “Options Income Trading” misleads new traders into thinking that they can realistically make money every month through this style of options trading. New traders may not realize that there will undoubtedly be losing months when adopting any of these strategies. In this video, we explain the realities of this style of trading, so that a new trader can plan his trading activities and cash flow realistically.

Making money in a low options volatility market

Most options traders have a defeatist attitude about earning profits in low volatility environments. The truth is that in many cases, low volatility environments are the best for making money in market neutral options trading. In this video, we cover the reasons behind this phenomenon.

[Recording] Mentoring with Bella (Webinar August 18)

Mike Bellafiore helped an improving trader from our community decide where to focus to get to the next level in his trading.

The Myth of “Financing” a Long Option

Options Traders are often lured into believing that the less cash they pay for an options structure, the better. You must look at the full structure of an options trade to understand its risk and reward characteristics. In this video, we discuss an example of a “free option” that contains a huge risk, not obvious from the amount of cash that the position initially costs.

Are you on the right path with your trading?

Are you on the right path with your trading? Watch this webinar replay with a trader from the SMB community looking to get serious about his trading.

- Page 1 of 2

- 1

- 2