We had a meeting with a Year2 trader after the close and he did something you ought to be able to do. Let’s call this prop trader Frequent Flyer. Frequent Flyer has fallen in love with a strategy, that between us, I don’t love. As a directional discretionary trader this strategy doesn’t feel like real trading to me. It’s … Read More

Risk Management for New Traders

In our daily video Seth Freudberg discusses risk management advice for new traders. Some key points made by Seth: Get into mindset that you will be in your job for a few more years at least. Trading options can stay in your current job as long as you have internet access 3-5 times per day. Find options strategy that works … Read More

Ask Anything: A System to Increase Your Trading Risk

I have been trading on my own since March and after a few weeks of consistent results, I decided to increase my sizing and expand my Playbook with newer and different intraday plays. Despite the fact that I have the impression that my trading skills is improving, my results in terms of P&L have deteriorated. Should I go back to … Read More

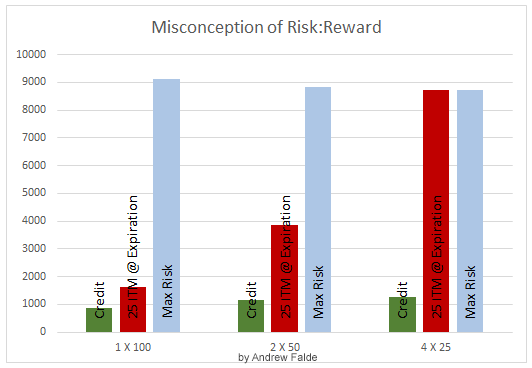

The Case for Wider Option Spreads

When analyzing a vertical based credit spread, including iron condors and butterflies, the first question that usually comes up is where to place the short strike. In a distant second usually comes the question of where to place the long strike, that is how wide the spread will be. This leaves some analysis to be done on using more contracts … Read More

Risk Tolerance VS Risk Capacity

To be successful at trading, long term, it’s extremely important that our risk tolerance is in line with our risk capacity. Risk “tolerance” has to do with the amount of draw down we can withstand prior to the loss psychologically effecting our trading. Risk “capacity” has to do with the amount of draw down we can withstand prior to the … Read More

What is Risk?

What is risk? Imagine a word that everyone threw around constantly, but that no one could define. A word that was critically important, but never used properly. In trading, that word is “risk”. Of course, we have to use the word constantly. We are taking risk in order to generate a return. We put on positions and make sound … Read More

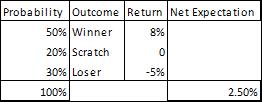

Before Placing a Trade: Embracing Risk Management for Success

Today’s lesson is going to be a little about trading psychology and a little about money management. At the end of this post we have provided additional training videos to further enhance your skills. We are going discuss what risk is and how most traders view it from the wrong perspective. First, let’s cover a couple of definitions: Money management is how … Read More

Trades Getting Out of Hand?

Ever start out simple, with just one or two trades, and then end up with an entire mess of options? Congratulations! You’re now trading a “position”. Perhaps you’ve heard the term but aren’t sure what it means. You’re trading a “position” when you’ve gone beyond using just one strategy. Trading a position is typically going to be much different than … Read More