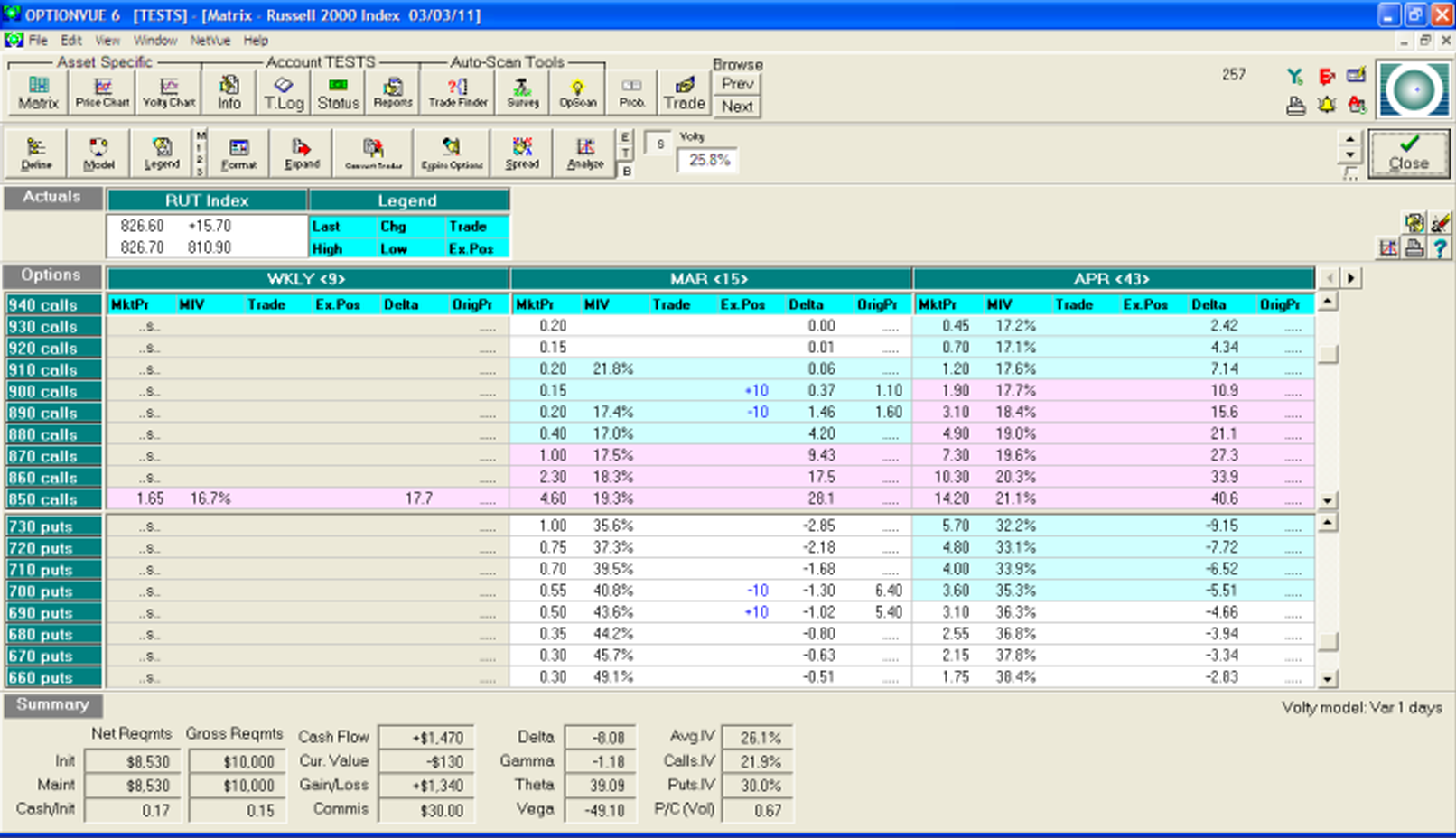

One of the most popular income options strategy is known as the high probability iron condor, which consists of a call side credit spread and a put side credit spread “facing each other” very far out of the money. For example, on January 19, 2011, at about 10:30 in the morning, the RUT Index was trading at 798. An options trader … Read More

The Right Way to Adopt a New Options Strategy for Your Playbook

In our last blog post we discussed the reasons that options traders should take it slowly when adopting a new income strategy. Here are some simple steps you can take to assure that your adoption of a new options strategy is sound: Communicate with the developer of the strategy and see if he or she is still actively trading the … Read More

Beware of the Fad: Five Reasons to Take it Easy with a New Options Strategy

In the options universe, there are plenty of traders who are happy to share a new strategy that has either worked well for them in the recent past, or has backtested splendidly over an extended period of time. Regardless of whether these strategies have been developed by competent veteran traders or newer traders who have not experienced every type of … Read More

Options Trade Initiation: Why Patience Pays Off

When developing traders enter into income options strategies, there is a tendency to become impatient when executing the opening trade. The trader will typically put an order in at or around the mid-price but often finds that the market is not biting on that price immediately. This can create anxiety and a feeling of impatience in the trader, arising from the belief that, since almost … Read More

Are you REALLY willing to get back on the horse?

In Friday’s options post, we talked about the tendency of options traders to become enamored of a particular strategy simply because the trader is on a brief winning streak with that specific strategy. This propensity is particularly dangerous because market neutral income options strategies typically are entered monthly. So even a mere four month winning streak—only four successful trades in a row–allows … Read More

Avoiding Pitfalls: Safeguard Your Options Trading Journey

In a speech delivered to the American Enterprise Institute in late 1996—in the middle of the formation of the dotcom bubble of the 1990s—then Federal Reserve Board Chairman Alan Greenspan coined the term “irrational exuberance” to describe an illogical optimism about the economy that was pumping up stock prices well beyond any reasonable level. History shows that he was correct, … Read More

“Going to School” on Experienced Options Traders

This blog entry is the introduction to a series of posts about common mistakes made by options traders and how to avoid them.