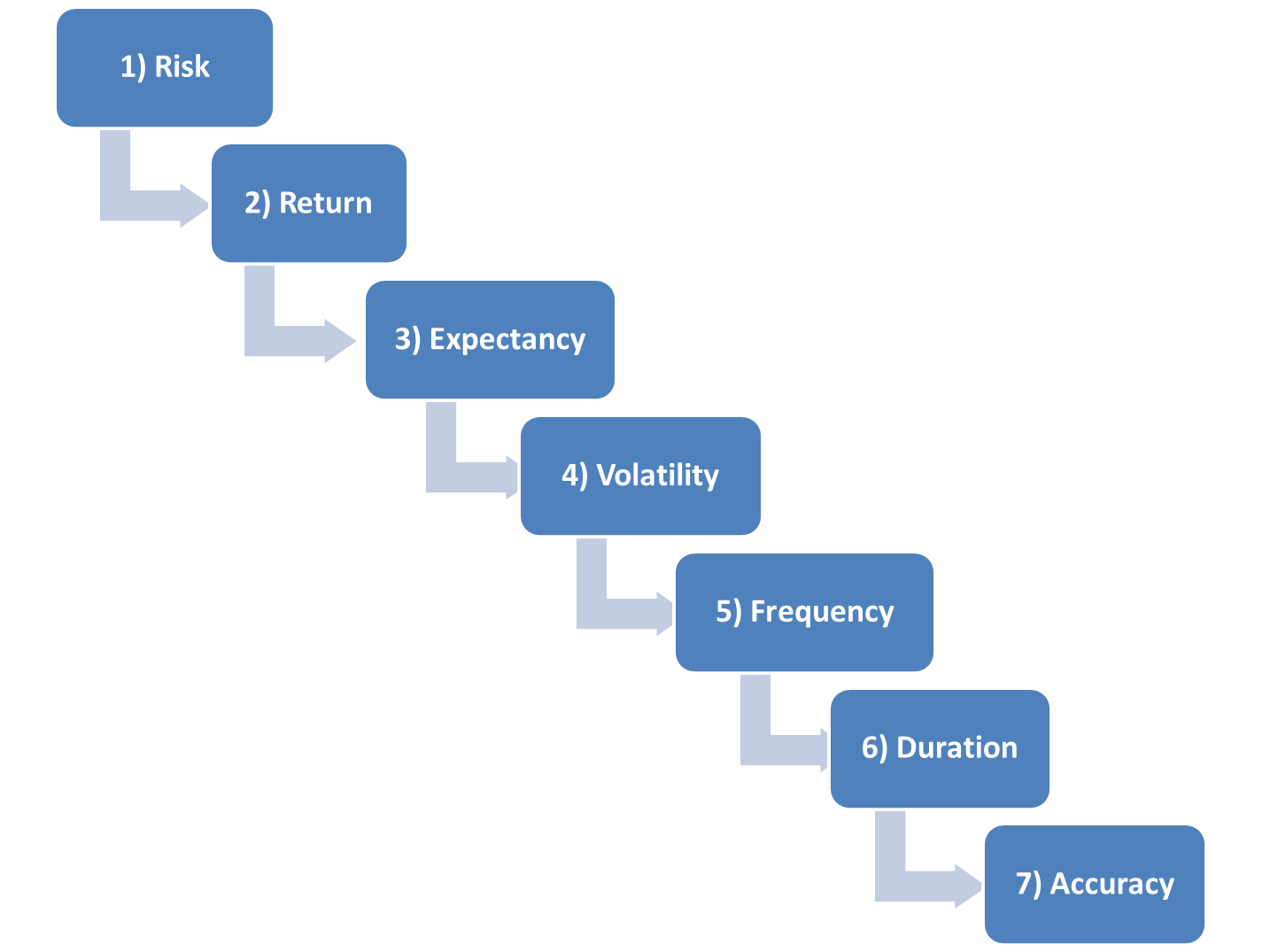

Previously, we covered Risk and Return as the first two things we look at when building a system. The third thing we want to review is called Expectancy. The idea behind expectancy is to focus on the big picture and long-term results of your system — and not just the next trade. Insurance companies and casinos base their entire enterprise around this … Read More

The Second Step to Systems Success

Last time we talked about Risk, which is the first and most important aspect of a trading system. We discussed how limiting risk can create higher absolute returns because of reinvestment, raising capital, and using leverage. Now we can talk about our second focus: Returns. There are three types of returns that we need to understand. First is the back tested returns. … Read More

Six Lessons on Systems Trading

In my recent post, Confessions from a Discretionary Trader, I wrote how I was spending more time each day learning about quantitative trading. Today I attended the live taping of our new course, SMB Systems Foundation, with market veterans Rick Martin and Andrew Falde at our NYC headquarters. Here are the six most interesting ideas I found shared in this course from … Read More