We make trading decisions based upon three factors: intraday fundamentals, Reading the Tape, Technical Analysis. I traded MDT today using all three to start two shorts. These are trades that if I made 1000 times I would profit.

Intraday Fundamentals

We trade stocks with fresh news. Today we had new news with MDT:

Co issues downside guidance for FY11, sees EPS of $3.40-3.48, excluding non-recurring items, vs. $3.48 Thomson Reuters consensus. For FY11, based on estimated market growth of 3 to 4 percent, the co expects revenue growth in the range of 2 to 5 percent on a constant currency basis, down from 5-8% previously.

Missing on revenues is more important than the bottom line generally. When a company offers fresh news that its revenues for the full year will be worse than expected this is a candidate to finish at the low. This fact alone can cause the stock to trend cleanly and negatively for the entire day.

Technical Analysis

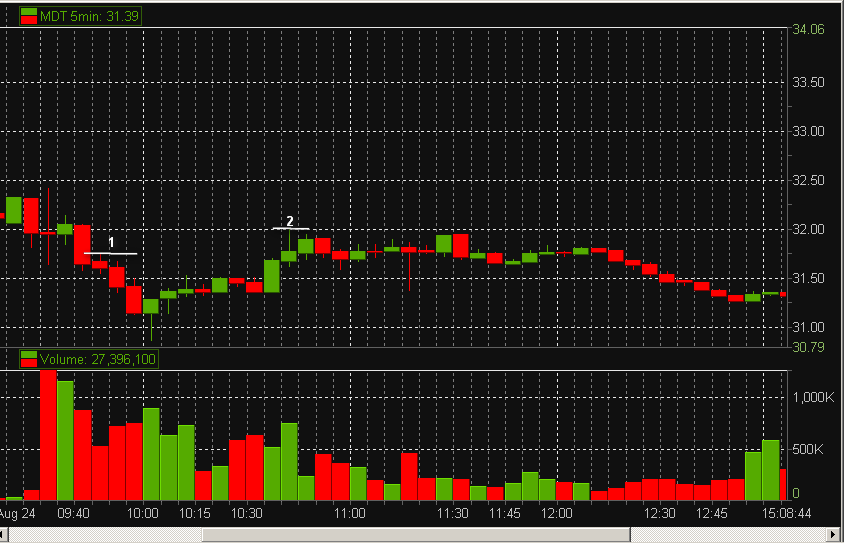

MDT gapped down to near 32. To find the next support level you must use a 2 year chart to find 30. On the one year MDT was below all support.

On the Tape

On the Open 32.20 held the offer showing an aggressive seller. And then there was a huge battle near 32.

The First Trade

MDT moved away from 32 finally after a huge battle. It found 31.60, created a deep red candle on our intraday charts, and got us excited about to our short. 32.75 held the offer. This is a short. There is no support on the long term charts until 30 (maybe). Intraday the sellers have won the first two battles. The fresh news offers a potential pattern for MDT to close near the low. The trade is short 32.74 and hold until the intraday downtrend is broken.

The Second Trade

MDT traded weakly down to 30.85 after failing from 32. The market held the 1050 and 1040 futures level and bounced. MDT approached 32. Reshort is the play. When a stock has failed from a level, makes a sharp downmove and then later re-approaches this level we almost always re-short.

Those were two excellent risk/reward shorts in MDT today. If you have any questions or comments, please post on comment on our blog.

Mike Bellafiore

Author, One Good Trade: Inside the Highly Competitive World of Proprietary Trading (Wiley Trading)