Last Friday most experienced guys in our desk traded RIMM on the open. The moves where fairly violent and most of us got ripped up at first. It seemed the stock was crowded with big traders and most levels didn’t hold that cleanly. The risk in most plays ended up being about 2-3 times larger than one would have thought. All this slippage was adding up…and quickly! I want to discuss the role of active trading (not scalping) and how this helps us catch the big move with more size than usual when the setup is presented.

As active traders we try to make the spread a few times while we clearly identify the direction of the stock and a level from which we can fully load the boat. Most times we can make enough money to grind a full day like this even if a big set up play is not presented. Other days making the spread / catching the 20-30 cent quick moves in a violent stock is just not as profitable. Last Friday, RIMM just offered very few clean opportunities to easily make the spread, and offered plenty of other ones to give up the spread. But then it gave us a huge opportunity and we took huge advantage of it.

Whether we make money or give some back to the stock we call this paying for information. The whole purpose of actively trading a stock is to develop a feel for how weak or strong the stock may be. As a trader you are “paying” or “getting paid” for valuable information that should enable you to have more confidence about a trade setup when the opportunity is presented.

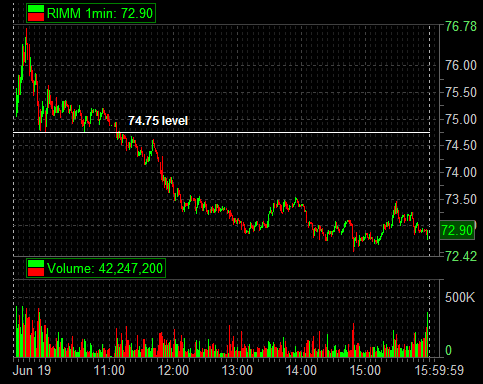

This was exactly the case in RIMM last Friday. Most of us struggled trying to figure out whether the stock was most likely to close at its high or low for the day. There was some frustration amongst some of us who got ripped up in a few plays on the open. But then the trade setup came in. The stock was getting bought at 75.1 when the market was trying to find some support. Then the market started to rally but no buyer was willing to step higher and those who tried got smacked by some very aggressive sellers. RIMM had trouble holding above 75.30, then it had trouble holding above 20 cents. The buyer was not there at 10 cents. It was just a matter of time before the intraday support level of 74.75 was taken out, we just needed a catalyst.

So after struggling for the first 45 minutes we finally had observed enough to conclude that RIMM was acting weak. Further, we spotted a level where we could risk 5 cents with the potential to make a buck plus IF we ever saw a catalyst. All we needed was the stock to trade and hold below 74.75, the market to start trading below its opening range or spot a significant seller close to the intraday support level. In the event of seeing any or all of them then we wanted to add to our position, sit back and enjoy the ride to the downside.

Yes maybe by looking at the chart one could see exactly the same setup. But we had more than just a setup, we had a huge advantage: we traded the stock actively on the long side near support we could tell just how much accumulated volume was being done. We had a feel for how much downside the stock could have if it started to trade lower. We had paid for some information and it was time to get the money back plus a lot more.

You can see from the chart the stock got massively weak after taking out its intraday support level. It traded down a bit more than 2 bucks from that setup. I made about 3 times more money than what I had originally lost on all my small trading gathering information. That was a chop! Happy trading this week.

Don’t forget to follow us on Twitter!