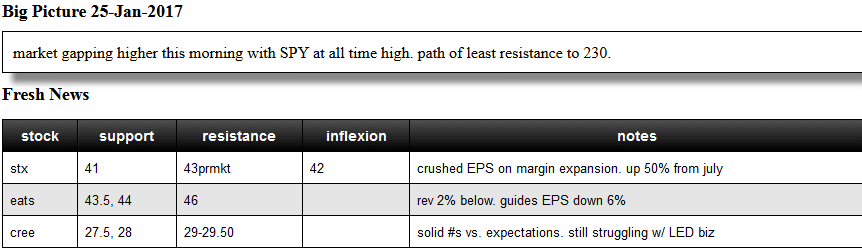

(1/25/17) Things didn’t work out so well today. Technically, EAT trade idea worked perfectly but I forgot to enter my “trading script” pre-market so I missed the short at 46, which worked perfectly trading down $2 to our first support area. It’s actually my second favorite setup for a stock reporting earnings: poor EPS & guidance that pops to well defined resistance right on Open and fails.

No excuses for missing this one. Nailed the levels perfectly. Finished our AM Meeting at 9:10AM so had 20 minute to enter all my scripts prior to market Open.

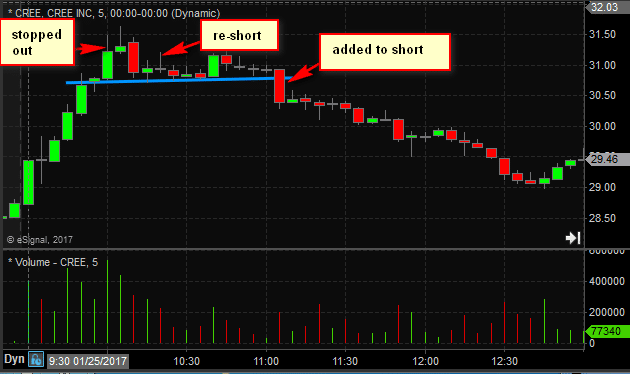

The next two stocks: STX & CREE are a different story. Got stopped out of shorts in the first 30 minutes on both. Was only able to “re-short” CREE for the reversal that pushed it back below 30.

I shorted STX right on the Open for a quick failure at pre-market high. The thought process was it had run up 50% since the July earnings report and there would be profit taking before it could move higher. I got stopped out multiple times including around 10AM when it got above 46.50. I was on the desk when it dropped to 45.50 and could have re-shorted at 46 but took a pass. The reversal turned out to be very clean pushing it all the day down to 43 by the Close.

CREE is a stock that I have owned over the years in my long term account so very familiar with how it trades and long term prices that make sense. I felt very comfortable being short it above 30 but was stopped out as well as it made new highs in first thirty minutes. Was able to re-short against 31.50 when it began to tick lower. And added to position below 30.85 when it began to reverse.

But overall, the failure to have my script in EAT caused severe under performance. Tomorrow is another day 😉

Steven Spencer is the co-founder of SMB Capital and SMB University which provides trading education in stocks, options, forex and futures. He has traded professionally for 20 years. His email address is: [email protected].

No relevant positions