Wouldn’t it be great if we had a tool that gave us a heads up when market was making a short term top? What if that same tool could be used to time the bottom in market pull backs as well? If we had something like this surely we would make many millions of dollars if not billions in the market each year?

Market participants spend a lot of time analyzing various data points to help time market turning points. Sentiment, money flows, momentum are a few that come to mind. Every morning we hold an “AM Meeting” where I give an overview of the broader market indices before we discuss the In Play names of the day. In large part my analysis is based on recent price action: 1)has volatility been constant 2)have certain price areas shown a propensity to reverse trend 3)has price moved significantly away from a “trend channel” 4)has price broken out of a well established range. Outside of these factors I will overlay second hand knowledge I have gained from reading others’ analysis on recent money flows in ETFs and Mutual funds.

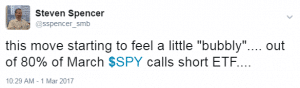

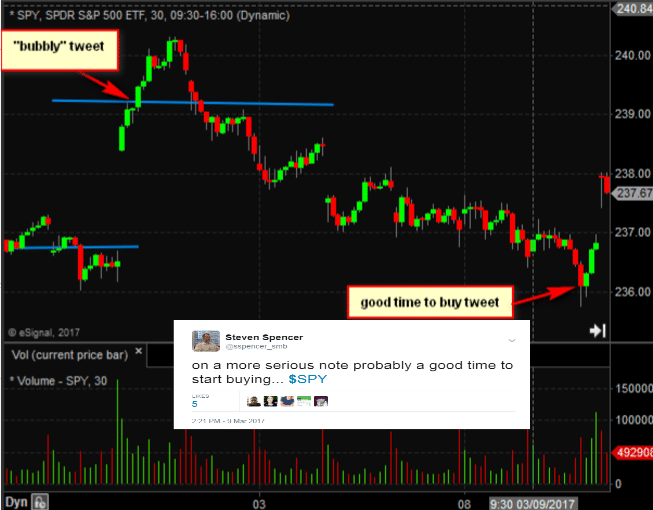

On March 1st the market gapped higher following Trump’s SOTU address to Congress. It became extended above its recent uptrend channel and I tweeted the following.  The market continued higher for a few hours before topping out. The same day Trump tweeted about large stock market gains almost “top ticking” the market to the penny.

The market continued higher for a few hours before topping out. The same day Trump tweeted about large stock market gains almost “top ticking” the market to the penny.

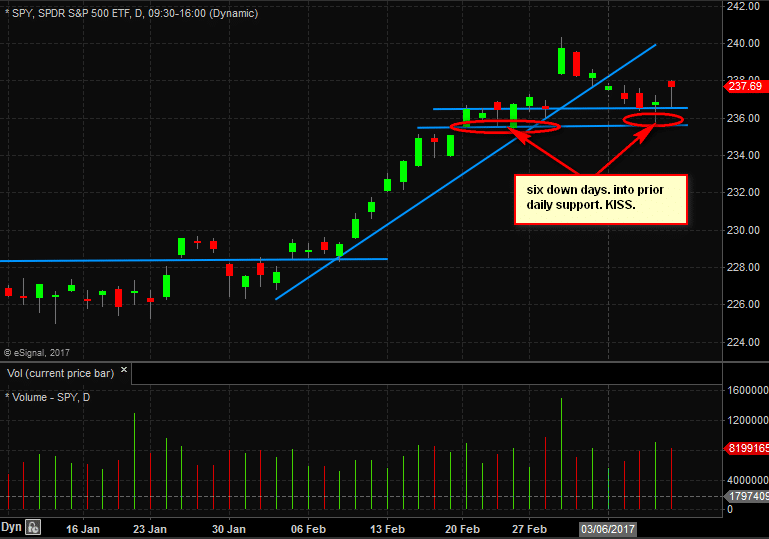

The next six days we slowly trended lower. On March 9th I tweeted “probably a good time to start buying”. Why buy then? 1)gap had filled from SOTU 2)hardest down move since we topped 3)unusual volume for time of day 4)most SPY pull backs are $4-$6 5)daily support. For those reasons opening a long position was a good risk/reward. The SPY closed $1 above the low and gapped higher another $1 the next morning. As per the plan discussed in our AM Meeting that day I began to short the SPY against my options position around 238.25 in the pre-market.

Steven Spencer is the co-founder of SMB Capital and SMB University which provides trading education in stocks, options, forex and futures. He has traded professionally for 20 years. His email address is: [email protected].

Steven Spencer is currently long SPY through a combination of SPY ETF and SPY options