One of the amazing benefits of being part of a prop desk is that we all make more money individually by sharing ideas. Important levels are shared via call outs on the desk, via our intraday alerts software, during video review sessions (VRS), and during our Stocks In Play call before the Open.

It’s a constant battle to get those on our desk to make the “best” trades that are highlighted. I’ve heard that there are “so many” alerts being shared that it is difficult to hone in on the best trades. There may be some truth to this point so I want to discuss how to identify the “best” shared information whether it is on a trading desk or via a larger community such as StockTwits.

Criteria to consider:

1) Does the idea comport with your trading style? In other words, is the trading setup in a stock and time frame that is suitable to YOU. This isn’t that much of an issue on our desk as we are all focused on an intraday time frame and trading liquid stocks that are In Play. But if you are looking to pull ideas from StockTwits then you need to spend some time figuring out which contributors mesh with your style. There is a ton of trading talent on ST but if you attempt to make trades in stocks or time frames that you aren’t comfortable with you will be stressed out and make trading errors.

2) What is the level of experience of the person who has identified the trade setup? This is pretty simple on our desk. There are only a handful of traders with more than three years of trading experience. If they identify a trade and share it with the desk it should be made by all those on the desk. Even if it is only with 100 shares. Also, the proof is in the pudding as they like to say. If I notice a less experienced trader’s ideas are very solid then I will allocate more capital to their trades than others.

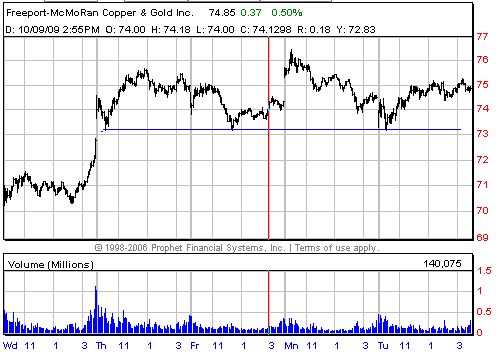

3) How many times has the level been tested? If a stock has a significant move off of a certain price level it catches my attention. If it has three significant moves from that same price level it REALLY catches my attention. A recent example of this idea is illustrated by FCX in the past four trading days. I opined to our traders in a VRS last week that if FCX pulled back from 75 to around 73.20 that I would establish a long position. My reasoning was based on a powerful up move FCX had the prior day when it finally held a bid above that level. For the past three days FCX has printed no lower than 73.16 and on average has popped two points from this level. If FCX decides to trade down to 73.20 for a fourth straight day I will get long with confidence. And by the way, if it holds an offer below 73.15 I will initiate a short position. 73.20 has established itself as a level from which FCX will make multi-point moves.

4) How large a move has the stock previously made from the identified price? If a stock has made a huge move off a specific price then it offers a great risk/reward opportunity. See FCX above to understand the importance of this criteria.

Trading Setups To Consider:

5) Stocks that were strong the prior day and gap higher should be bought at key levels on pullbacks. The two best prices to enter trades are the prior day’s high OR a key level above which the stock had its most powerful up move. I think one of the reasons these trades work out so well is that many market players decide that once a strong stock goes negative that it is in full reversal mode. I don’t find this to be the case in uptrending stocks in an uptrending market.

6) Stocks that were weak the prior day and gap lower should be shorted into pops. The two key levels to get short are the prior day’s low or an afternoon resistance level that led to a powerful down move. The funny thing is that intraday short setups also work really well in a strong market. This is most likely the case because when the market has a solid foundation market players are behaving rationally (as compared to 2008) and ALL trading setups will work better. Not just longs.

7) Stocks that were strong the prior day and gap down should be bought at key levels. Levels to consider buying in this scenario are the top of the opening range from the prior day or in a consolidation area that led to a powerful up move.

8 ) Stocks that were weak the prior day and gap up should be shorted at key levels. Levels to consider shorting are the bottom of the opening range from the prior day or a level where the stock had a large down move from.

Use the above information to make more money. In the words of Jerry Maguire, “Help me help you.”

Don’t forget to follow us on Twitter!