One of our traders was getting shot for “A Day in the Life” video today. Another of our traders is up on Friday for a similar shoot. We will share these videos with you upon completion. But what was most interesting today was a discussion that was captured on this video. This discussion was about flipping.

One of the advantages for a day trader is how easy it is to exit a position. Unlike a Big Bank we can change our position from short to long easily. A Big Bank might take days to unravel a huge long position. By the time they do a good shorting opportunity may have dissipated. But not for a day trader. We can go from long to flat to short in a millisecond.

But one of our advantages can also become a weakness. If you flip too much then this will harm your trading results. You will increase your transaction costs. And most importantly you may lose sight of the big picture. You may lose the opportunity to catch a big directional move. Let’s discuss with a specific trading set up.

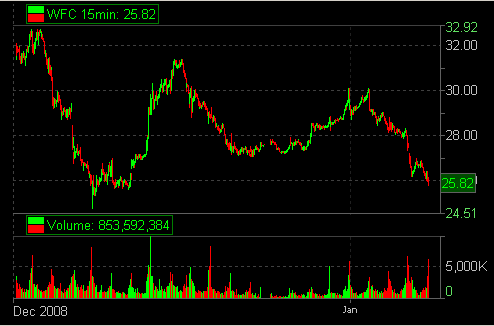

During our AM Meeting Steve and G discussed the 27 WFC level. This was an important level. One of our traders decided to trade WFC on the Open. WFC traded below 27 and he got short. At 26.87 a significant seller appeared. This trader added to his short position. But then the 26.87 level lifted. This trader flipped his position. This was wrong.

1) WFC was still below the important level. 2) A significant technical level is more meaningful than an intraday resistance level. 3) You should only flip during special occasions. 4) This trader missed the re-short.

You should develop a flipping strategy. But it should be restrictive. Personally I would not flip WFC below this significant level unless there was a huge intraday level defended. And in our trading example above this was not the case. For almost all of your trades you should get long above the support level and not below it. It is much easier to trade buying WFC above 27, above the support level. This is less stressful and offers a higher win rate. Also, I do not want to miss the potential significant move downward below 27.

At our firm I am reluctant to offer specific rules for how to trade certain trading scenarios. We are all different. What works for me might not work for you. But there are fundamental principles that we all must follow. And flipping too much is fundamentally wrong. And trying to buy stocks below support only works on very select occasions. Every trader must develop a detailed flipping strategy and be disciplined with this strategy.

Anyway I have to go wipe off all this make up they put on me for the interview I gave about said trader above. Best of luck with your trading!