In yesterday’s post, I made a case for a bounce play in the Japanese stock market. Last night’s extreme move makes this call look kind of silly in retrospect, but I want to highlight some important points and lessons here.

First of all, this really highlights the difference between “armchair quarterbacking” or “time machine trading” (as we like to call it on the trading desk!) and actually executing in real time. Anyone can pull up the chart after the trade is over and say you “coulda, woulda, shoulda done XYZ”, but the best we can do in real time is identify good risk/reward opportunities, execute the trade, and then manage the risk. When we trade, we make our decisions based on what is “normal” or what usually happens (not exactly, sometimes we may play for a low probability play that has a high potential payoff, but the concept is sound). This move in the Nikkei is literally unprecedented in the entire history of major equity markets, so there is no shame in taking a loss on a trade like this.

There are two places, in my opinion, a serious problem can emerge. One is position sizing. Yesterday, I wrote: “Lastly, I would suggest you spend a lot of time thinking about how a trade like this might play out. Perhaps the disaster is worse than expected and the market drops much faster and further than expected. In this case, you take a loss on the trade, but it was a “normal” size loss and well-calculated. Fine, we lose on about half our trades anyway, so this is no problem. ” When I wrote that, I honestly thought there was less than a 10% chance of a much larger drop, but the possibility was there. If you are a trader who scales into positions, this is a possibility for position management that we don’t discuss very often. If you hold a partial position, you can elect not to add the remainder, give the trade a larger stop, and still take a no-larger-than-anticipated loss on the trade. This technique should be reserved for those rare situations (less than 1 out of 100 trades I would say) where a market is more volatile than you had anticipated and you decide it needs more room, and the key is that you must be able to limit the loss to your initially planned loss.

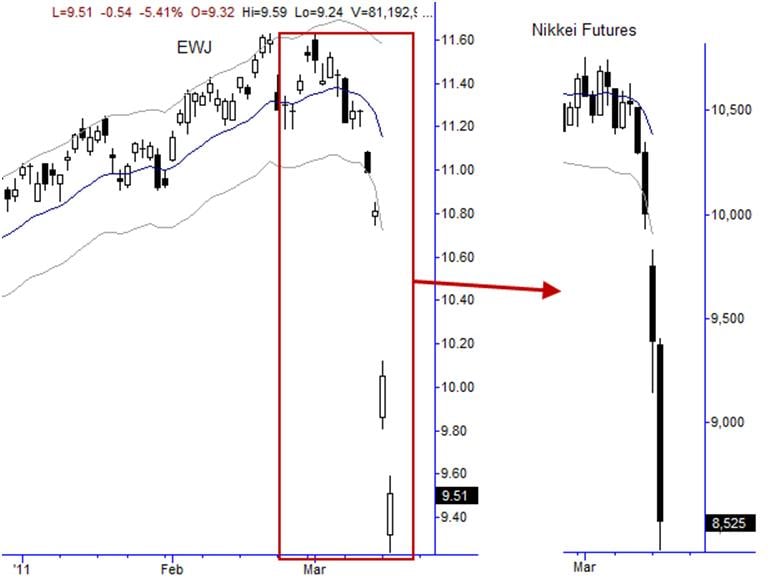

The second problem emerges if you don’t execute at your stop price. Why might this happen? Newer traders will often see a stock get to your stop price and then decide to “give it a little more room” or “just wait a minute and see what happens” or “decide to get out when it comes back above my stop”. I can tell you where this road leads – to a blown out account! (Think about the difference between this scenario and the one I outlined in the previous paragraph. The key is the actual size of the dollar loss on the trade.) It is also possible, in futures, to be locked into a limit move against you. Nikkei futures did lock limit down last night, and I made sure beforehand that my stop level was in front of that lock limit price. If you are moving to futures from stocks you will probably make this mistake at some point in your career. I know I did once and I can tell you it was painful enough that you’ll make this mistake exactly once. Another thing to consider is that many people like to trade ETFs. If you’re holding GLD, SLV, USO, UNG, EWZ, UUP or whatever overnight, think about the consequences of having 8 hour access to what are, essentially, 24 hour markets. Look at the chart below. The ETF trader had to deal with nasty overnight gaps which where mostly filled in (with the exception of the weekend) for the futures trader. Over the course of a career, these things can add up to a big difference in the bottom line.

So, yes, this was a losing trade, but proper position sizing and risk management is key. Not to downplay the enormity of the tragedy unfolding in Japan, but, even in this most extraordinary situation, if you manage your risk correctly a losing trade is simply business as usual. Extraordinary situation. Ordinary trade. That’s not a bad goal, actually…

6 Comments on “Extraordinary Situation; Ordinary Trade.”

a day early on that call. japan bounced 7% the next day trough to peak. and SPYs bounced 2% today. we still see resilience in the face of some awfully bad news and very choppy market action.

Thanks. Yeah, that’s the danger of calling out real trades in real time — some of them will be losers especially in a time of such great volatility and uncertainty. Now that the immediate crisis is over we can listen to everyone tell us how we should have traded it, but it sure wasn’t that easy in real time.

Win or lose, I thought it was important to call attention to a move of historic proportions in a developed equity market.

This is a good point about stops in futures and one I hadn’t considered. Additionally, you refer to an important consideration but do not bring full attention too it. There are 2 concepts probability of loss and size of loss. Given any consideration, it is obvious that there is no meaning to risk to reward as expectancy will be zero for any random risk to reward except for a slight skew in favor of the trend (tail events). In fact, everything is fixed with the expectancy assumed equal to zero.

It is very important to consider both the probability of the loss with the magnitude of the loss. The relevance becomes important when we realize that the “max adverse excursion” for any trade will almost always be worse then a random point to point closed loss.

On a trade like this, one could choose to use a very wide stop. However, if one wants to use such a wide stop and if one calculates that the probability of that stop being hit being extremely low then one may likewise deduce that the stop, even if the position is managed, will not be a trivial loss.

Where am I going with this? Given that on a trade like this, one is looking for a large winner then perhaps trading this with options spread or call options might present a better way to manage risk, although the pricing may not be there given the volatility.

By using the stop, you are making an implicit consideration toward as Dr. Steenbarger would say path dependency which also suggest that one is looking to take out a short term, perhaps not very persistent, directional move. The statement is about volatility and not persistence.. If this was your opinion then that is understandable but it is relevant that one may have a different but similar opinion.

The other consideration was whether your initial hypothesis was the best hypothesis for dealing with an abnormal situation. I would imagine that Bella might have had a different approach to this trade, that is one based on the open.

>On a trade like this, one could choose to use a very wide stop. However, if one wants to use

> such a wide stop and if one calculates that the probability of that stop being hit being

> extremely low then one may likewise deduce that the stop, even if the position is managed,

> will not be a trivial loss.

not sure what you’re driving at here. a key is to standardize the risk on all positions so that no one loss is either extremely significant or trivial. that’s an important key.

>Where am I going with this? Given that on a trade like this, one is looking for a large

>winner then perhaps trading this with options spread or call options might present a

>better way to manage risk, although the pricing may not be there given the volatility.

obviously the pricing was not there. implieds were absolutely nuts. there was also a good chance the position would have needed adjusting (whether adding to or subtracting from) in the “overnight” hours when options markets are closed. futures were the only real possibility here. again, everything is standardized. this was not an attempt to swing for the fences, but just a “normal” sized trade, win or lose.

>By using the stop, you are making an implicit consideration toward as Dr. Steenbarger

>would say path dependency which also suggest that one is looking to take out a short

>term, perhaps not very persistent, directional move. The statement is about volatility and

>not persistence.. If this was your opinion then that is understandable but it is relevant that

>one may have a different but similar opinion.

we bought it because we thought it had potential to bounce… meaning it would go up… don’t overthink. 🙂

a 7% bounce on a 2% position assuming a 100k capital is only $140. No loss there.

Strange comment. We risk a standard percentage of equity on each trade for each system. This is a non-discretionary element of the system… you don’t size up on trades you really like to take shots, and you also don’t do any trades on silly small size. For a position where the volatility is high, the stop on the trade is very far away… this will naturally require a smaller-than-normal position size to get the same dollar risk from the entry to the stop.

It’s a very simple and elegant system that automatically adjusts your position sizes for volatility provided you understand where to set your stops.

Make sense?