Sorry for the delay on this post. A few had asked about the message I shared on StockTwits Tuesday morning regarding ESRX putting in a bottom.

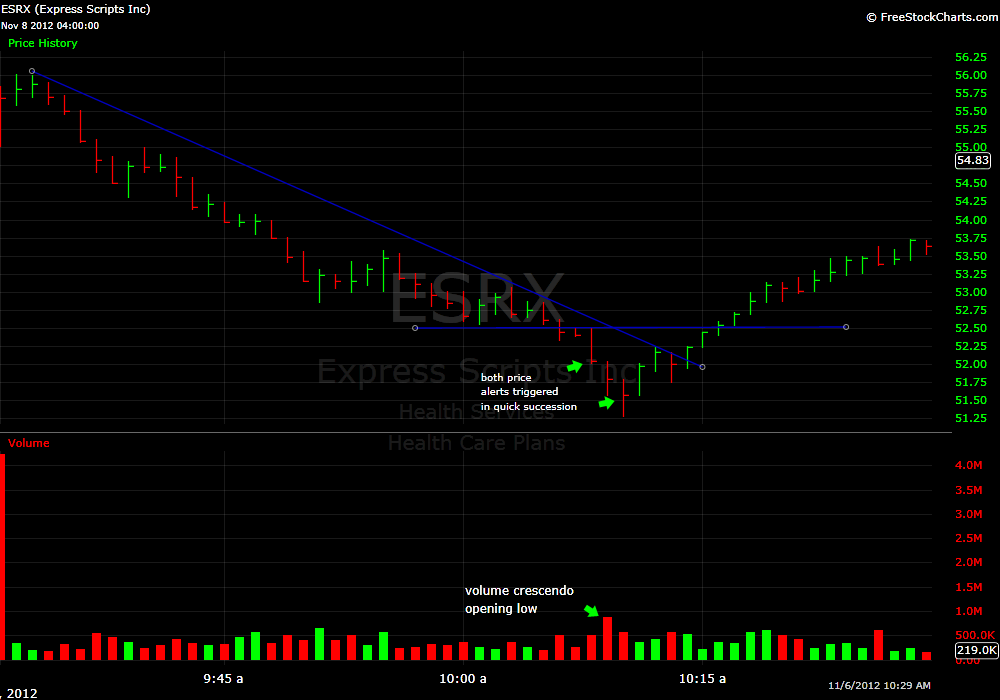

Tuesday morning ESRX was on the top of our list of In Play stocks. Was gapping down and set up for a nice short right on the Open. Our “best case” scenario for downside was 51.50-52 based on longer term support. For this entire earnings season we are seeing stocks that gap down on earnings bouncing strongly from longer term support areas. We saw that again today in MNST that bounced from its recent low of 40.

I had alerts set for ESRX at 52 and 51.50 to remind me that those were important levels to cover shorts and to look for early signs of a reversal. Both alerts triggered in quick succession around 10:08AM meaning there was strong downside momentum at the time. I looked at the volume bars and saw that volume had just made a new high as well so we had the elements of a potential panic low. There then appeared to be a buyer on the tape around 51.80 so I shared my thought on StockTwits that it may have bottomed.

That was my thought. In terms of how to play it for a reversal you can do a search on the blog for “reversal” and you will find a few posts I have written regarding this setup. The main thing to remember is it is a very low probability to try to enter a trade right off of a crescendo low but it should make you start to pay attention for more clues of a reversal.

Steven Spencer is the co-founder of SMB Capital and SMB University and has traded professionally for 16 years. His email is [email protected].

No relevant positions