This is a guest post from one of our traders, SW, about his trading day from Tuesday:

A senior trader CB came to me after the close in regards of my recent performance. I expressed my frustration and disgust in missing an “A trade”. At SMB, we are taught to grade our trading setups A, B, and C, for purposes of proper risk management — betting the most on your best trades.

After going over my recent trades, CB explained to me that being stopped out frequently in C-B trades has been clouding my judgments in A trades. I started to trade fearfully in A trades, and took profits pre-maturely when a trade was working for me. And it would move another 50c to $1 without me. Why? Because I was too afraid that that they will run my stops. I broke my plan when my emotions got in my way.

CB advised that my trades were fine, and my plans were fine, but I have to stick to my plans and trade more selectively. CB also noticed I was involved in the harder-to-trade stocks.

In the long run, trading is a game of probability. I should not let C and B trades cloud my judgment in A trades. Stick to the plan and keep execute.

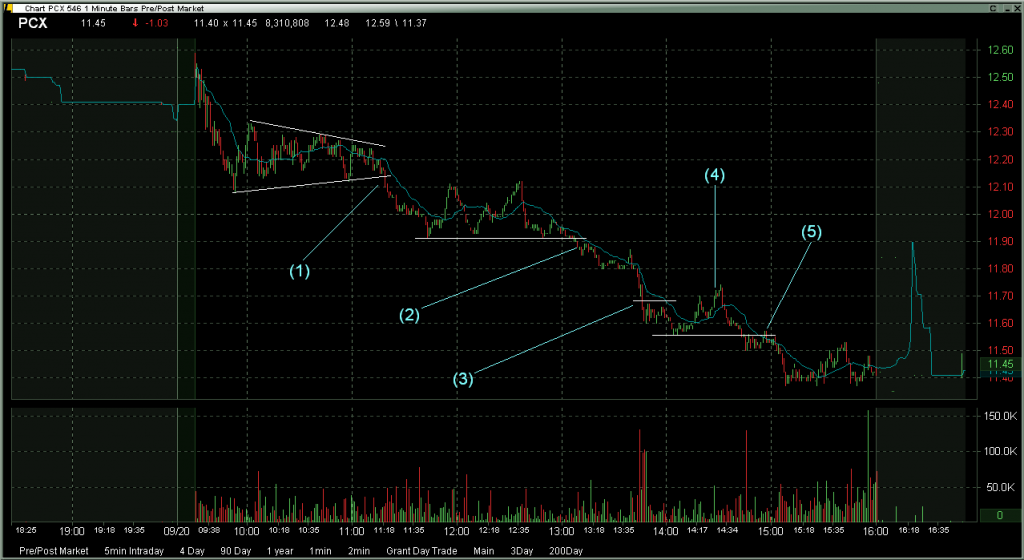

Below is my analysis that PCX is not a flat, if short from 12.

1) Get short (break down & below yesterday’s low)

2) Get shorter (break down at the low)

3) Get even shorter (below 200day low)

4) Lighten up

5) Get back in

2 Comments on “Don’t let C-B trades cloud your judgments in A trades (PCX)”

where was your initial stop at the 1st short opportunity and how do you adjust your stops with each additional short?

(1) shorted 12.09, stop 12.16

(2) shorted 11.89, stop 11.93

(3) shorted 11.67, stopped out 2 lots above 11.70, hence (4)

(5) got back in