Now is a good time to look back at the #NewNormal and discuss possible trading patterns for US equities for the remainder of 2013. The #NewNormal was a description I came up with in late 2012 to describe the slow steady grind higher in US equities that was rarely interrupted by periods of higher volatility. This state of the market … Read More

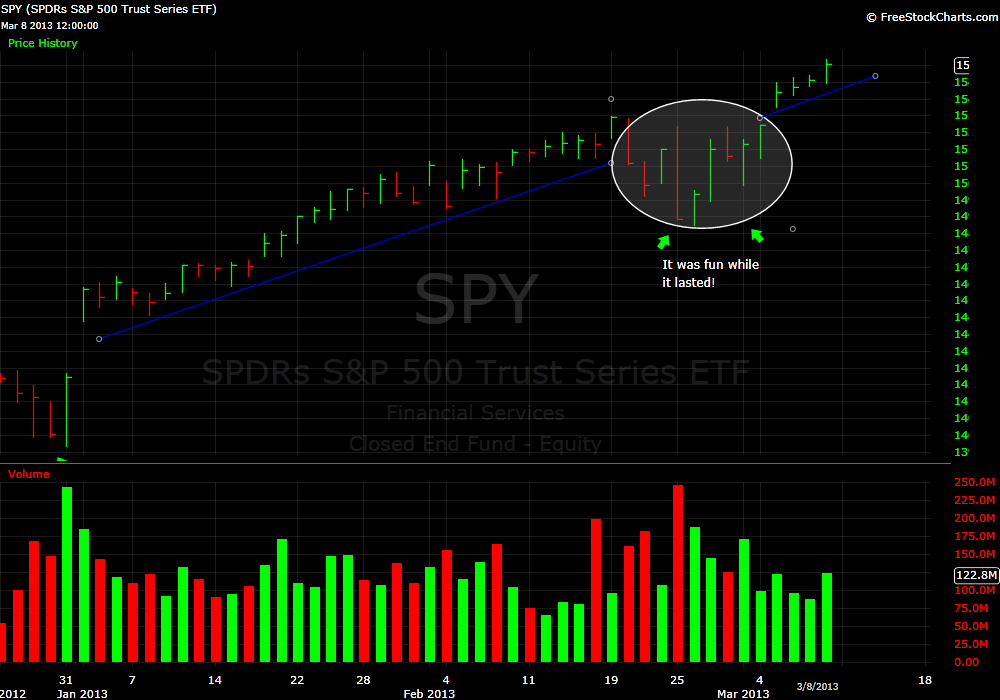

It Was Fun While It Lasted

Two weeks ago while on vacation I wrote this market-related post, wondering if the most recent down move would lead to a higher level of market volatility or simply retrace and be back to business as usual. Well, it appears that we have our answer as it is back to the #NewNormal. In the past four trading days the SPY … Read More

The Market Sells Off. Now What?

I was off the desk today travelling and visiting with family, but checked in several times to see how our traders were doing. It was an exciting day in the market. It is the type of day you typically see only a handful of times each year and as a short term trader you dream about being able to “crush it” … Read More

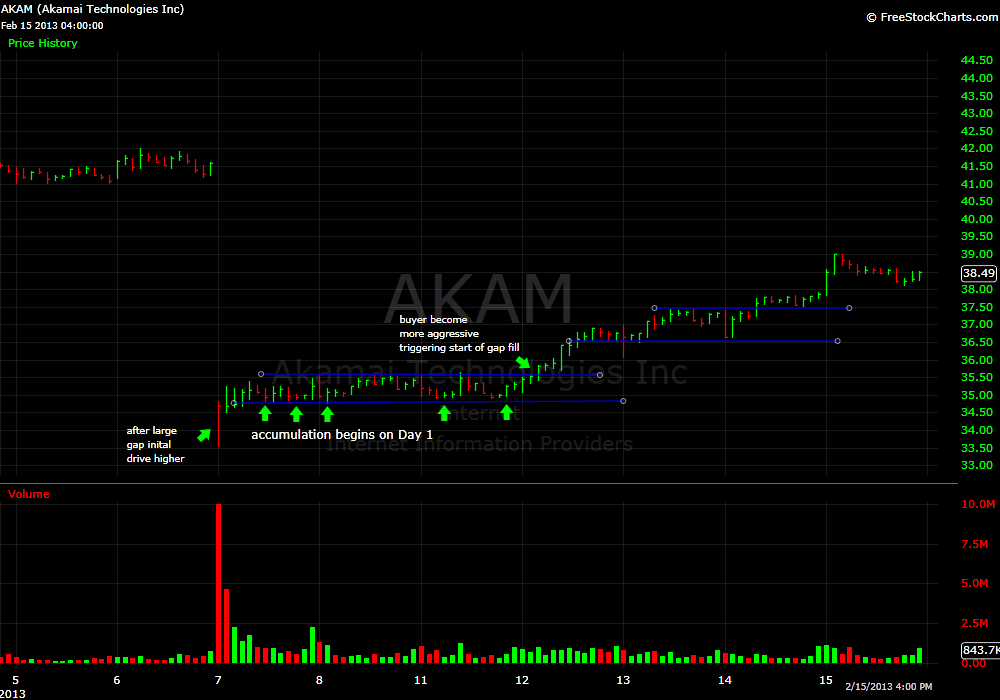

Not So Fast

One of the more common patterns seen in a strong market are longer term players buying stocks that have gapped lower after earnings. Sometimes this plays out on Day 1 with momentum buyers aggressively buying the stock leading to a gap fill. But many times a gap fill will play out in the days following the earnings release once the … Read More

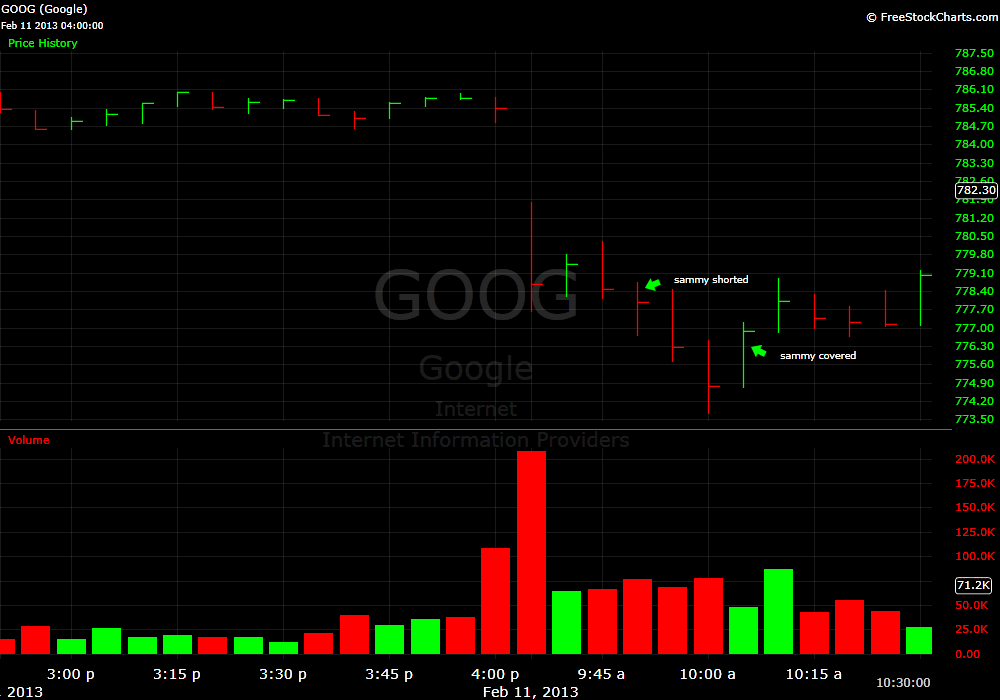

Should Short Term Traders Consider Fundamentals–Part II

In Part I of this series I discussed whether understanding the news could help short term traders limit their risk on overnight positions. Today’s post discusses whether understanding the news gives a short term trader a possible edge in determining profit targets and when to exit an intraday position. As examples I will use two trades that Sammy, an SMB … Read More

Danger Will Robinson

One of the final lectures in The SMB Foundation is on risk. Risk as it relates to intra-day trading is not simply evaluating the order book for possible exits if a stock moves against you. It involves understanding the current market environment, the type of catalyst that is the primary driver for a stock on a given day, the price … Read More

The #NewNormal and $SPX 1680

I was on BBC a few days ago to talk about the market’s reaction to the “fiscal cliff” legislation. I had hoped to use the opportunity to spend some time clearly outlining a concept I discussed in my final webinar of 2012. The BBC economics reporter prattled on longer than expected so I only had about 60 seconds to outline … Read More

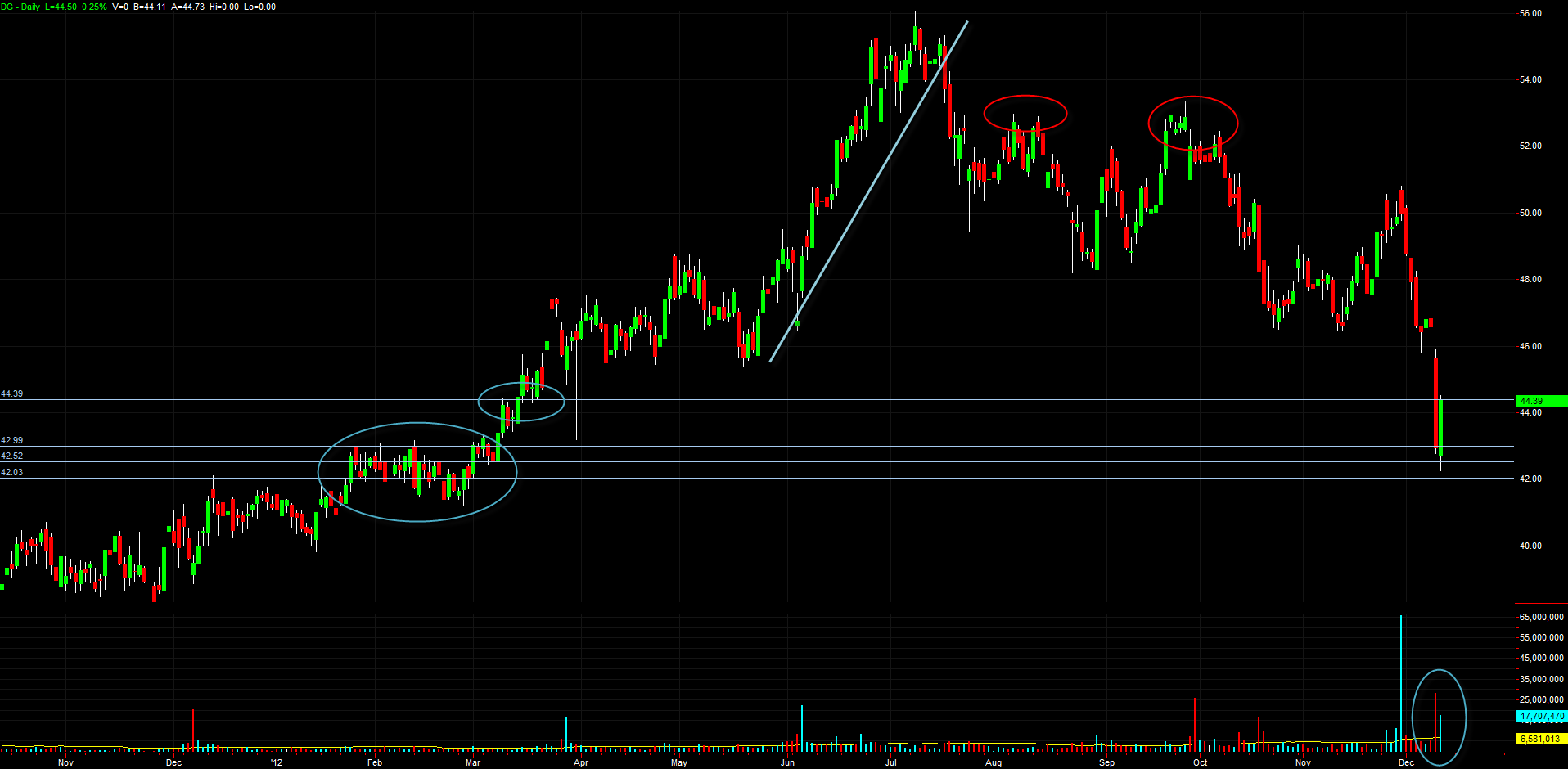

Guest Post: “Reversal Rehearsal” $DG

This guest post from experienced futures trader Bruss Bowman provides an excellent example of how to incorporate higher time frame price action into a possible lower time frame trade. It is clear from the post that Bruss in a methodical thinker who is also flexible in his thesis if price behavior fails to confirm. Reversal Rehearsal: Stock Study in DG … Read More