I work with a lot of traders trying to “make the turn” – that is the turn to consistently profitable. Among the plethora of issues preventing the average trader from being consistent, one has come up rather often recently. The gap. The gap between what you see as great opportunity at the end of … Read More

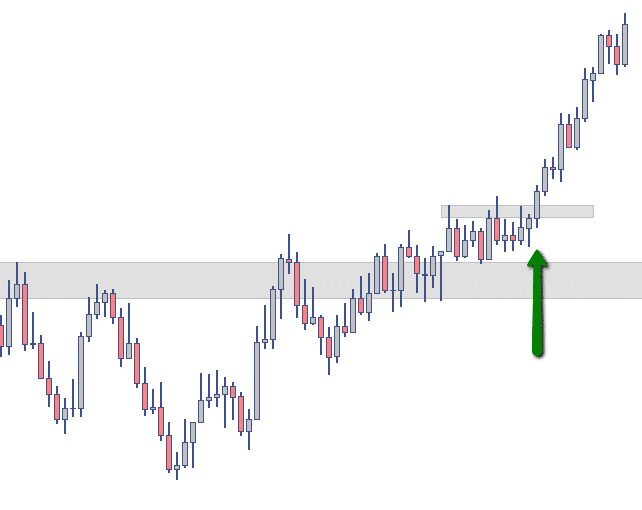

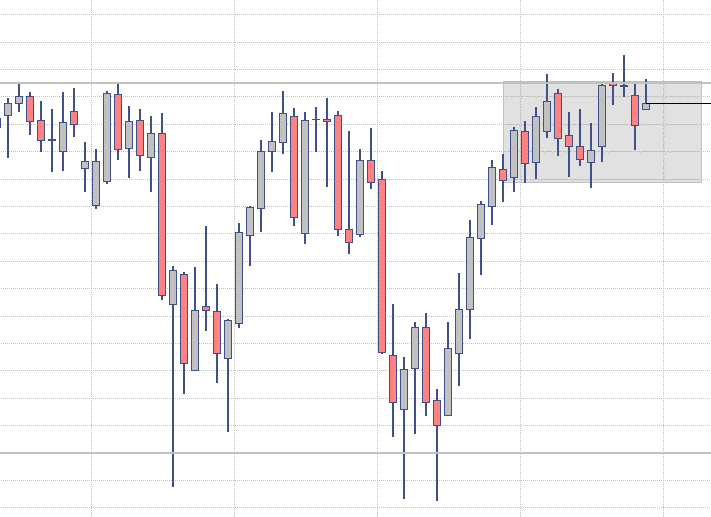

Not All Setups Are Created Equal

In working with retail traders I get to see where people have holes in their trading plans, and where they need the most help. One of the most common areas I see a major need for improvement is in using the higher timeframe. Why do we use the higher timeframe? Let’s say, for example, we’re in intraday trader that likes to … Read More

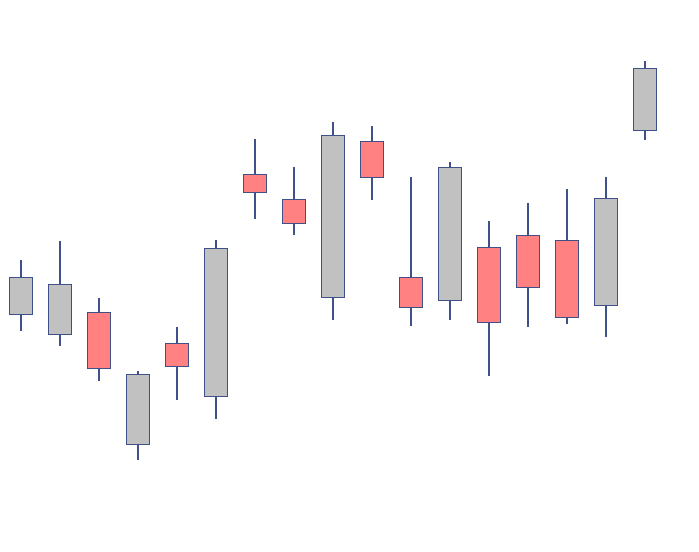

Entry Types For Momentum vs Rangebound Plays

Last Friday we had a great talk, with Brexit fresh off the press, during our weekly Trading Conversations webinar last Friday. As usual, we covered a wide range of things such as using context, how to adjust your trading to handle volatility, and more! Not a bad way to wrap up your trading week with some open trading conversation. One … Read More

Underperformance and Your Beliefs

We covered several interesting topics during our weekly Trading Conversations webinar last Friday. As usual, we covered a wide range of things such as using context, randomness, risk/reward, knowing your market with statistics, and more! Not a bad way to wrap up your trading week with some open trading conversation. One topic we covered in particular stood out to me, … Read More

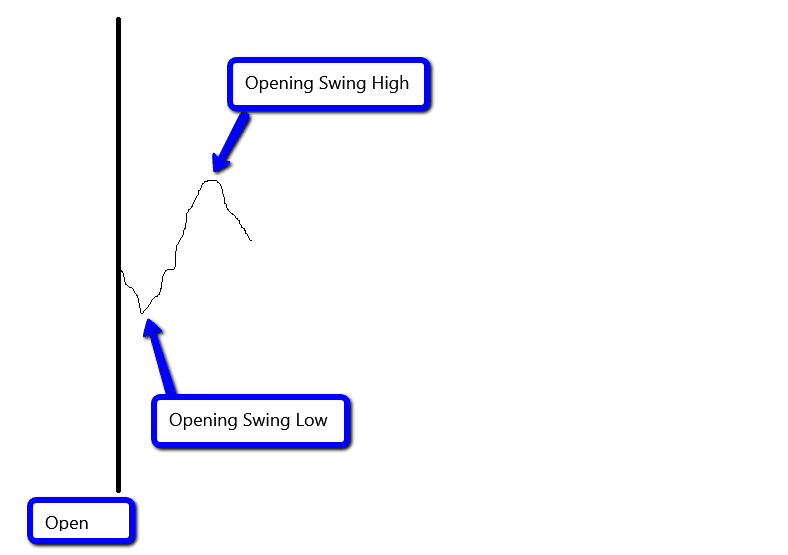

Using the Opening Swing to Improve Your Trading

Last Friday, during our weekly Trading Conversations webinar, we had a lot of great questions from our community – like we do most weeks! One question was about analyzing stocks right around the open, from the first minute to the first hour or so of trade. Keeping with the live and interactive spirit of Trading Conversations, I asked users to … Read More