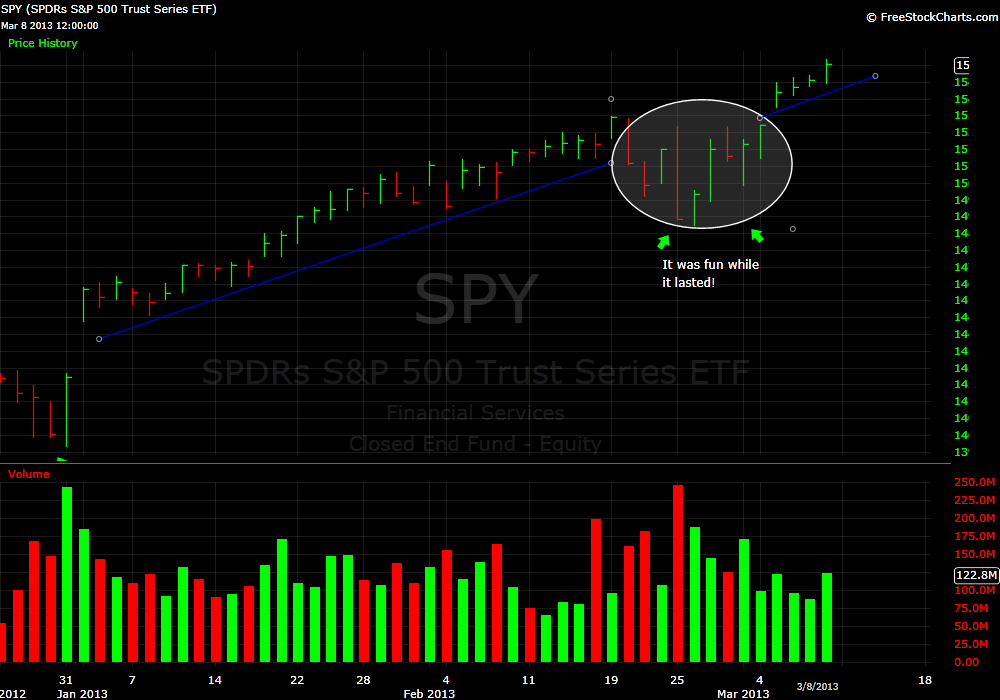

Two weeks ago while on vacation I wrote this market-related post, wondering if the most recent down move would lead to a higher level of market volatility or simply retrace and be back to business as usual. Well, it appears that we have our answer as it is back to the #NewNormal. In the past four trading days the SPY … Read More

A Trade Idea: $CLF

I look at the weekly and monthly charts in CLF and it looks like death! Maybe another 40% of downside. But as a lower time frame trader I see a long set up. I tweeted earlier today that CLF looked to be bottoming as it was being supported at 24.50. That was a good spot to initiate a small position. … Read More

A Simple Tape Trade: $SPLS

I made this very simple tape trade on the Open today. SPLS was gapping lower on earnings. The sector has been decimated recently and my initial instinct was to look to short on the Open. As the market opened I got short but a buyer stepped in at and I covered. On the chart below I have highlighted where the … Read More

Trade Review: PAY by Shark

In this video, Shark reviews a trade he made in PAY on February 22nd. He discusses the big picture, his thought process throughout the trade, and the trade management skills he brought to the trade. This webinar is no longer available *No Relevant Positions

The Market Sells Off. Now What?

I was off the desk today travelling and visiting with family, but checked in several times to see how our traders were doing. It was an exciting day in the market. It is the type of day you typically see only a handful of times each year and as a short term trader you dream about being able to “crush it” … Read More

Did The SEC Overreach in Freezing HNZ Account?

I read an interesting piece on the CNBC website by John Carney regarding the SEC freezing the assets of a Goldman trading account that made a very suspicious trade in HNZ options right before the takeover was announced. John raised the idea that the SEC is overreaching by freezing the assets of the account without any evidence beyond the suspicious … Read More

Should Short Term Traders Consider News–Part III

On Friday I was chatting with a non-SMB prop trader that I trained several years ago. He was long DLTR when the WMT “news” broke around 2:00PM. From the chat messages you can see that we were in agreement that there was a short term “fading” opportunity in the retail names that had been quickly hammered based on a leaked … Read More

What is a Counter-trend Trade?

The counter-trend trade has been the trade of the year thus far in the market. The trade is expressed via a long position in the SPY after a down move to recent support. The idea behind this trade is the market has a strong underlying bid and when it pulls back to a prior support level buyers will step into … Read More