This week I wrote a post Study Trading not Markets ($TSLA) where I shared the power of studying trading patterns over stock fundamentals. After all I play the game of trading pro not economics professor or Uber-Confident Financial Media Entertainment Complex Guest. My job is to make excellent risk/reward decisions with my firm’s money to which for some trades longer term … Read More

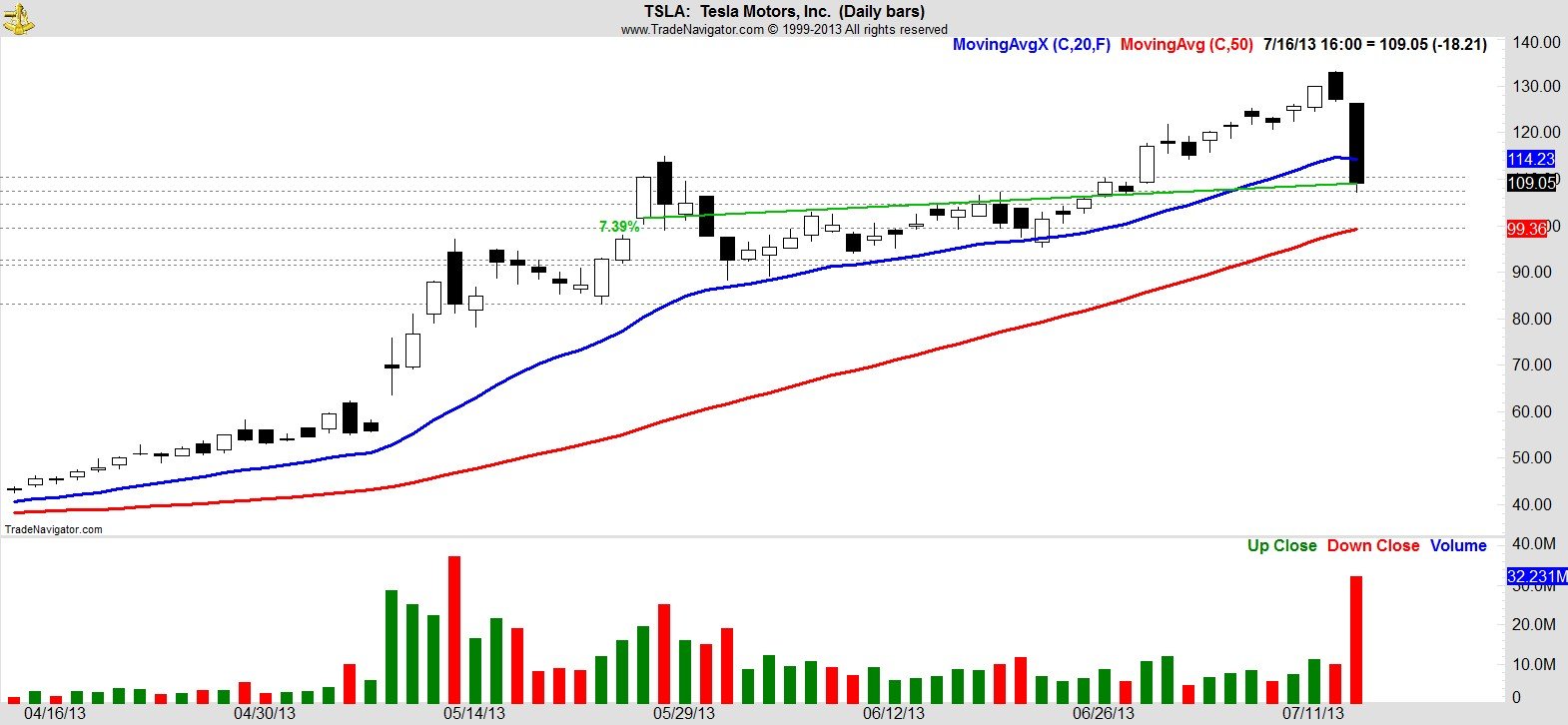

Study Trading Not Markets ($TSLA)

Some traders/investors make the mistake of studying markets instead of trading. This can negatively affect your trading performance. More specifically, this certainly was the case with the recent down move in battleground stock TSLA, the growth stock. For those of us who have traded professionally for 15plus years it is hard to watch and read the nonsense about TSLA’s valuation. … Read More

Do Not Fear the Bots

Computer trading has become the largest part of our market’s volume threatening the profitability of many discretionary traders. Many traders/investors fear the bots. We shouldn’t. We should embrace their underlying technology and use it to help us find more of our favorite trading patterns. And even turn quant. Adding support to my thesis above was a recent blog post at … Read More

New Fatherhood and Trading

They say that fatherhood changes everything and I can confirm that it does. At 42 my life changed completely when Luke entered the world. How you ask? My downtime is gone. After work I used to enjoy some downtime with Hardball, PTI and the Yankees. Now as soon as I walk in the door, I get the immediate hand-off from … Read More

Bad Luck Boeing?

On Friday the news hit of a fire on a Boeing 787. Yes, that same plane that BA was forced to take out of service because of lithium battery fires during flight. I don’t know about you but I prefer my flights without fires on board. BA tweaked and fixed the battery issue and the 787s were back in flight. … Read More

The 3PM Bull Basket

I was sitting on our trading desk looking at SPY this Friday. I felt a very strange sense of déjà vu that it was 1998, the year I was relative strength trading semi-conductor stocks, and MSFT, INTL, DELL. This was before the Internet Boom but when these sectors were red hot. At 3PM we would add to our strongest-acting stocks … Read More

Real Companies Get Bought When They Gap Down… Except for UPS

If you sit near me on our trading desk you have heard me say, “In a strong market real companies get bought.” What I mean is when a real company gaps down, in a strong market, it is likely to find a big buyer and find a way to trade higher. But then there was UPS on Friday. This was … Read More

A Quant Test on a Trading Thesis

Hi Mike, I was halfway through typing my question when I remembered a blog post similar to my original question: http://www.smbtraining.com/blog/how-do-you-determine-how-far-stock-can-move I was wondering if you’ve found any statistical information by back-testing the above since then. For me personally, I first find important support/resistance levels on a stock & after that do I then consider the likelihood of those support/resistance … Read More