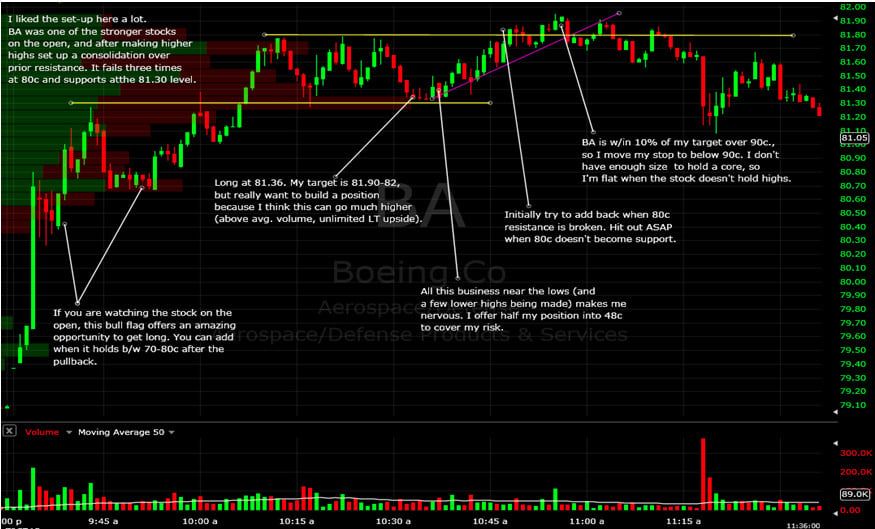

Traders often struggle with when to sell a winning position. They sell too early and they regret as the stock trades three points higher or they don’t sell and the stock gives back all of the trader’s gains. The poor sale can send them into a distraction of regret, frustration, and even anger. In my next book The PlayBook, I write extensively on how to improve your exits. One technique is to develop Reasons2Sell for your winning Trades2Hold. One Reason2Sell, out of many others that the trader predetermines, can be if a stock hits your target. SMBU provides an example of selling when a stock hits your target in the chart below.

KMay, a graduate of our college training program, was trading BA this week on our desk. She set a target for near 82. One mistake that traders make is they do not have enough nuance to their sale for if a stock hits your target. Too many just wait for the stock to reach the target and then decide whether to sell. This is not nuanced enough. This does not make sense.

As a stock approaches your target the risk/reward for your position, in this case your long position, diminishes. As the stock gets closer to your target your risk/reward becomes less favorable. As the stock approaches your target you must have two hands on the wheel with your trading looking for weakness on the tape. If you spot weakness on the tape and the stock is near your target then this may be a Reason2Sell. First, you must learn how to Read the Tape. Second, you must develop your list of Reasons2Sell. Lastly, you must practice executing your exit strategy before it becomes internalized. In our example in BA below, KMay sold when BA failed to show strength on the tape near 81.90, near her target, so she got flat.

Sell when you spot weakness on the tape near your target is a Reason2Sell. Consider adding this as an exit strategy to your trading.

Mike Bellafiore

no relevant positions