I wasn’t planning on trading AIG. I thought SEED would consume most of my attention. Actually I thought I could establish a decent size position in SEED, sit back, and enjoy the ride. I would let the MoMo hedge fund traders do their thing. Who am I to get in the way of a low volume market pattern?

SEED above 12 was an excellent trading opportunity. But while SEED was not moving AIG called for me.

“Bella get in there.”

“Mike you don’t want to miss a break down in me today.”

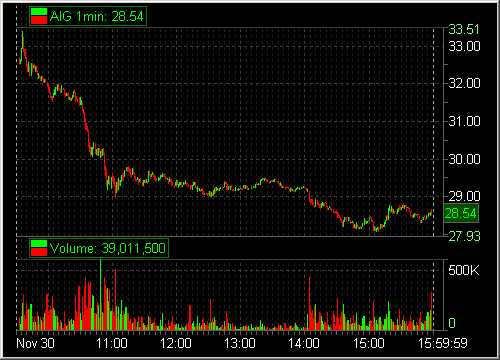

And so I nibbled. When I just start trading a stock I like to feel its strength and weakness by trading in and out of it with small size. I can tell by how easy it is to get hit on the bid and possibly how difficult it is to get taken on the offer just how weak an AIG is. AIG was weak on the tape. And it was easy to get hit on the bid and hard to get shorts on the offer. The next significant long term support level after I started trading it was 30.

31.50 became an important intraday level. 31.51 kinda held the bid and AIG spiked to 32. But then AIG found 31.50 again and all the fun began. The first momentum trade below this level did not work. No worries. I have nothing else to do. Maybe the second time? Nope. Again no big deal. My SEED was not really moving much so AIG had my attention.

Finally I noticed something different on the tape. 31.50 offers were not getting cleared as they were before. And then 31.45 was not lifting the offer after 31.43 did some unusual volume for such a punk level. I got short. This was a Trade2Hold. This trade really worked. What is that saying? “If at first you don’t succeed…..” Anyway, Chop!

So I am back in the AIG game. Didn’t necessarily want to be but these things are not always up to me. Mother Market decides and my job is take what she is offering. On this light volume, hang over holiday trading session, it was all AIG, all the time.

Best of luck with your trading! Don’t forget to follow us on Twitter!

5 Comments on “AIG Pulls Me Back In”

what do you do when you are trading AIG and you become 10-15 cents out of the money because of the computers? i have a headache trading it. order flow is very hard to read in this thing.

what do you do when you are trading AIG and you become 10-15 cents out of the money because of the computers? i have a headache trading it. order flow is very hard to read in this thing.

It is. I have a core position which I hold and trade around my core. This helps. With AIG you have to pick your spots. If you are having trouble reading the tape in a stock then only short at the best of entry prices. We call this adding more Checks in your favor.

quite a few times today i traded in and out of it when i saw held bids/offers. when i get long it seems like a big seller or (more likely) computer pushes it down 15 cents below the original held price only for it to reverse course much higher then before without giving you a chance to get in.

feels like order flow like this is becoming increasingly common.

really like the advice on the core position! i’ll make sure to get good prices!! thx.

quite a few times today i traded in and out of it when i saw held bids/offers. when i get long it seems like a big seller or (more likely) computer pushes it down 15 cents below the original held price only for it to reverse course much higher then before without giving you a chance to get in.

feels like order flow like this is becoming increasingly common.

really like the advice on the core position! i’ll make sure to get good prices!! thx.