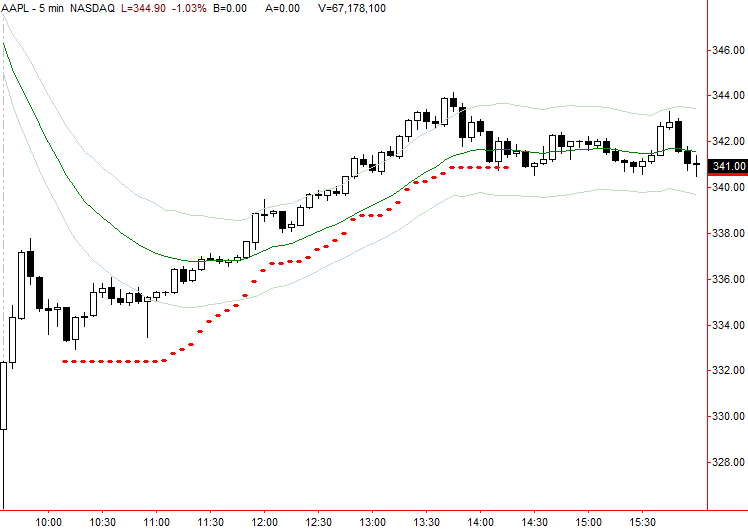

So I have been home sick for about a week now with a nasty sinus infection (and I think that has shown in the generally declining quality of my morning update emails and tweets). I had in mind a peaceful trading day from my couch with nice tame stocks, but when AAPL drove 10 points off the open, pulled back about a third of the day’s range in a two-legged pullback, and had a little flush below VWAP, I had an opportunity I couldn’t afford to pass up. (That combination of factors, by the way, is a repeatable high-probability pattern: strong opening drive on good volume (even better if there’s a gap opening), pullback less than half the day’s range (ideally in two legs), and then a flush to stop out people buying into the pullback with tight stops. We see this pattern several times a week, which is yet another use of the morning in-play list I tweet every day. Another lesson here is that even with incredible moves and volatility, simple technical patterns work.)

After that kind of opening drive, I was thinking gap closure could be on the menu for the day, and, in my wildest fantasies, I was thinking if we could hold above Friday’s low then there was a pretty good chance we’d rip through Friday’s high. I traded the stock a little bit, catching some moves on the tape, basically waiting for stops to be hit and buying after or into the flushes, had built up a little profit cushion and basically wanted to give the trade a chance without paying too much attention to it… that is, as the drugs for my sinus infection finally caught up with me. (Funny thing, Steve emailed me later in the afternoon noting that I had traded AAPL really well up until about 12:30, at which point it kind of looked like I wasn’t paying attention or something. I didn’t tell him that that was the point that the combination of antibiotics, corticosteriod nasal spray, multiple overdoses of cough syrup (bad idea, fyi), chamomile tea (far worse idea, btw) started to win and I had to take a nap. Oh well, now he knows. 🙂 I thought the best chance I could give this trade was to pull out a tool I haven’t used in quite a while: a mechanical trailing stop I built many years ago.

There are many forms and variations of trailing stops. The question they all seek to answer is simple, but important: what is the right balance between locking in profits and being willing to give back to let the trade flex on pullbacks? If your stop is too tight, you will be stopped out of moves early, leaving a lot of money on the table. If your stop is too deep, then you will give back more profits than you need to. Make either of these mistakes and you will not be profitable over a large sample size. There is no perfect answer, and what answers there are have to be examined over a large set of trades before you know that you have something that works. This is something I have literally spent years working on, and, in my experience, the “sweet spot” is fairly small. (Also worth noting that a good discretionary trader can outperform these types of stops, but that’s another topic for another blog post.)

Frankly, I never understood the fascination with having the kind of stop that many brokerage platforms offer that will simply trail a stop X cents from the current price. How do you know that X cents is correct? Where did you come up with the value for X anyway? Far better trailing stops can be done manually under previous swing or pivot points, and if this is combined with a read on market structure you can end up with something pretty powerful. (I usually trail two pivots back for starters.) Trend lines, in my experience, are not a great answer because you often want to be buying flushes through uptrend lines, contrary to what is usually taught in most technical analysis books. This is a common place for people to put their stops, so, of course, the market goes there and does what it does.

The best mechanical trailing stops are those that automatically adjust to the volatility of the market. A wider stop is needed in a more volatile market, and the stop also needs to adjust if volatility conditions change while the trade is in progress. There are many ways to do this, and if you’re interested I would Google the following (in this order) and do a little reading: Chuck Lebeau Chandelier Stop, Welles Wilder Parabolic, Cynthia Kase DevStop. For an out-of-the-box solution, most software packages do offer some version of Wilder’s Parabolic system; this might be a good place to start though, with some work, most traders will be able to improve upon the original system. I have a trailing stop in my toolkit that I developed quite a few years ago and have used in many contexts. I have friends running a mid-sized CTA who use this on a daily/weekly time frame. I used it in a discretionary swing-trading context and I also traded it on a very active system that mechanically faded opening gaps and used this stop. (The system wasn’t very good but it made money because of this stop.) In fact, this trailing stop will scratch out decent profits on an entry such as a moving average crossover that is little better than random, so there is an actual, verifiable edge in this tool. Of course, a stop like this never gets you out at the exact high of the move. That is not the point, but the point is to say that when the stop point is reached, the probabilities and momentum have shifted enough to compromise the integrity of the trend. It may still go up, but the easy part of the trade is probably over (read: more often than not, over a large sample). Take a look at what happened with AAPL today:

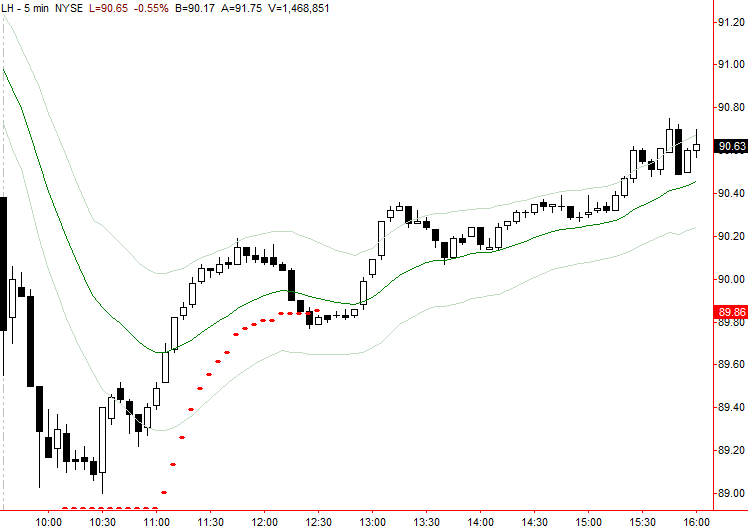

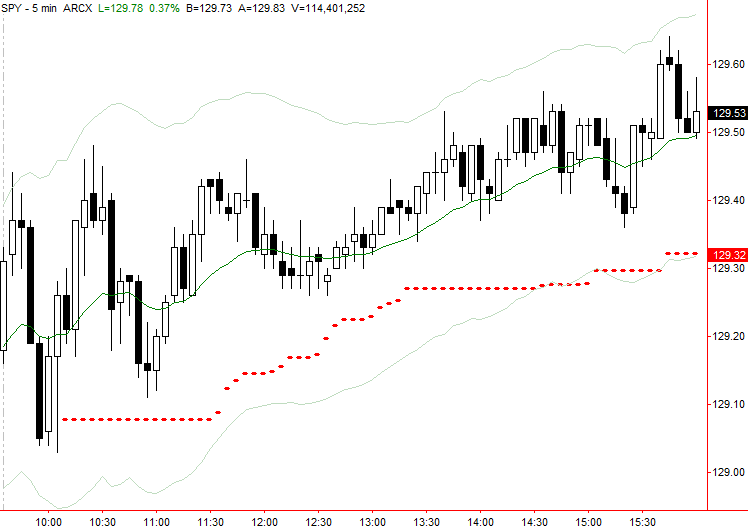

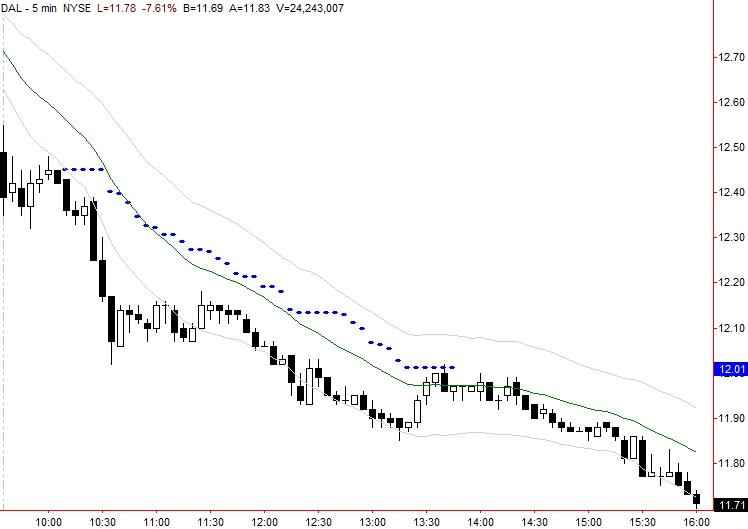

In the chart above, you can see the stop level as a series of red dots under the price bars. This stop is slightly more complicated than most of the ones out there, but it is most similar to LeBeau’s Chandelier stop. All it needs is your approximate entry time to make its volatility calculations, and then it basically trails a stop based on this volatility measure from the highest point reached since trade entry. Note that the stop actually moves closer to the bars through the day because volatility is contracting. My final exit from the trade was the bar that cut the trailing level just after 2:00, which, in retrospect, was not a bad place to pull the plug unless you planned to hold overnight and through earnings.

If you don’t already have a tool like this, you might (or might not) find it a useful addition to your toolkit. A stop like this is not a panacea, but it can provide some structure and discipline to your exits from trending plays. Just for further reference, here is the stop applied to a few more charts from today. As you see, a mixed bag… but, over a large sample size, you will make money if you apply a well-built tool like this with consistency and discipline.

18 Comments on “AAPL: A Case for Mechanical Trailing Stops”

Adam again a useful article thanks. Hope you get better soon and when you do i for one would be very interested in the ‘discretionary traders beat mechanical stops’ post / article.

Very useful post, pretty well done with a sinus infection (which I just got through, I know the pathetic feeling). At some point in time, a deeper explanation of these different mechanical stops would be great, especially from an experienced trader’s view. Will do the recommended reading in the meantime. get better soon!

I hope you will get better soon! Very good post. What a proof of altruism: with a sinus infection and still tacking the effort to post on the blog and trade. I remember an image with a soldier wounded in a battle but with his sword up and willing to fight.

Perhaps flushing the sinus with Calvados will kill the bugs…lol. Get better!

i’ll see what i can do… to write it legitimately i’ll have to get some actual trades where human vs the machine… maybe that will be fun for some of my trainees. also worth noting that 1 example doesnt prove the point… will have to think about how to write that article. thx

i’ll see what i can do… to write it legitimately i’ll have to get some actual trades where human vs the machine… maybe that will be fun for some of my trainees. also worth noting that 1 example doesnt prove the point… will have to think about how to write that article. thx

i think the reading and the books you will find through those references probably do a better job than i can of explaining the differences. thx

i think the reading and the books you will find through those references probably do a better job than i can of explaining the differences. thx

the pessimist in me has to point out that things might not end so well for that soldier! 🙂

thanks for your kind words. glad the post was useful

the pessimist in me has to point out that things might not end so well for that soldier! 🙂

thanks for your kind words. glad the post was useful

it is some measure of what my life has become that i actually considered your idea for a full 15 seconds before deciding it was a bad idea. thanks though! lol

it is some measure of what my life has become that i actually considered your idea for a full 15 seconds before deciding it was a bad idea. thanks though! lol

When it comes to the administration of Calvados, systemic rather than topical application is preferable. Can we assume your good discretionary trader is placing his stops purely on price action?

When it comes to the administration of Calvados, systemic rather than topical application is preferable. Can we assume your good discretionary trader is placing his stops purely on price action?

Hey Adam. Nasal spray is great but if things are still really bad try getting a bowl of really hot water, add vapour rub (put this on your chest also) and hover your head over the bowl (not in the water) with a towel over your head breathing in deeply. Best of luck 🙂

Hey Adam. Nasal spray is great but if things are still really bad try getting a bowl of really hot water, add vapour rub (put this on your chest also) and hover your head over the bowl (not in the water) with a towel over your head breathing in deeply. Best of luck 🙂

Hey, was just wondering what bands u r using in the charts shown above…

Similar to Keltner channels, but around a 20 period XMA rather than SMA