One of the questions I receive most often is regarding trades based strictly on the tape. These occur far less frequently than in years past because of the masking of buyers/sellers by the HFTs but they still do occur from time to time. This morning I was trading AMLN on the Open as it was In Play due to an FDA approval.

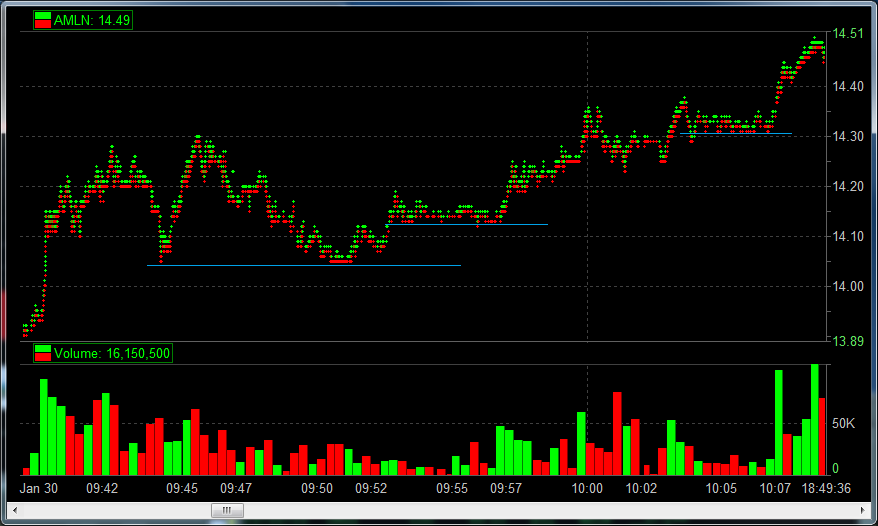

It was gapping higher but had begun a pre-market downtrend so I was leaning short . I identified a seller at 14 and got short in the 13.90s. It then proceeded to move up and down in a 20 cent range for a few minutes. With each passing minute I felt the likelihood of a profitable short trade diminished. As the 14 seller lifted I got long and was prepared for a move to 14.50-15.

For the next 10 minutes it continued to gyrate higher and lower. Finally at 9:50 I saw something that caught my attention. The bid was getting pounded at 14.05 and would not drop. I called this out to the desk and added to my long position. I placed a stop below 14.05 and waited. I was rewarded with about 50 cents of upside during the next 20 minutes. Not bad for a trade where I was risking a few cents 🙂

Steven Spencer is the co-founder of SMB Capital and SMB Training and has traded professionally for over 15 years. His email is [email protected]. For more information on SMB’s comprehensive tape reading program click HERE.

No relevant positions

*live trades discussed in this post took place in T3 Trading Group, LLC a CBSX broker dealer

One Comment on “A Tape Trade”

There was a similar set up at the end of the day in LNKD. There was a nsdq buyer at 74.70 that never dropped. Hopefully earnings season will bring more of these trades.