This week I’ve written a series of posts on ways to exit your winning trades. We have discussed exiting because of a Time Stop, if an important intraday level is established, and when a stock hits your target. Today we will highlight another example of a Reason2Sell: if a stock breaks the uptrend.

If a stock breaks the uptrend this can be a Reason2Sell. It is up to you to determine which time frame to watch for your trading. There is no right answer to which time frame you should use to trade, whether it’s one minute or 15 minutes. The issue here is to be consistent with your time frame, gain experience and skill with that measure of time, and keep working on getting better reading charts during this duration.

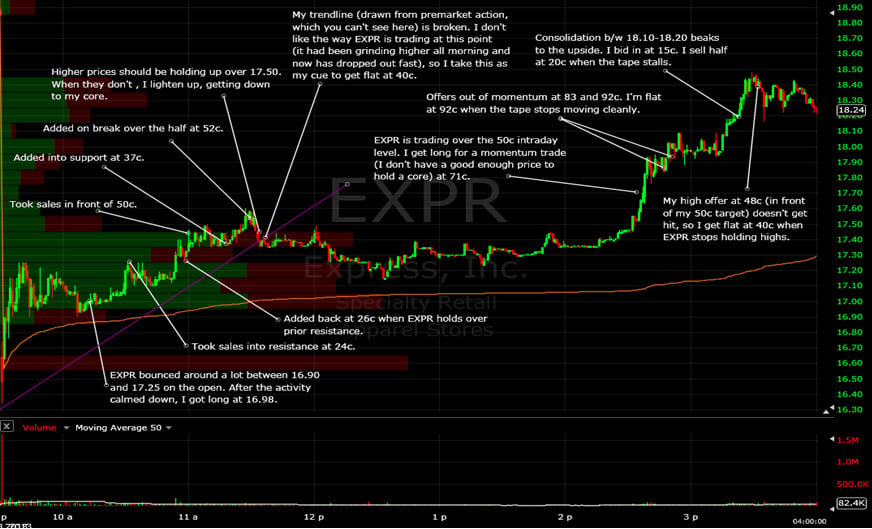

Today the Stock of the Day was EXPR (see Figure 1.1), which Spencer teed up for our traders in the SMB AM meeting. With the chart below Trader VC decided when EXPR broke his trend line then he would exit. He would not necessarily leave the stock. He would exit, reevaluate, and perhaps wait for another excellent risk/reward setup. But because EXPR had not broken his trend line all morning and then it did, he judged as a Reason2Sell.

Figure 1.1

Consider adding Reasons2Sell as a way to exit your winning trades.

Tomorrow we can be better than today.

Mike Bellafiore

no relevant positions

4 Comments on “A Reason2Sell in $EPXR: Identifying Breaks in Stock Uptrends”

At 12.07 EXPR quickly dropped from 17.35 to 17.28.

How do you avoid getting into such little squeezes or overall squeezes when there is a holding level with a buyer or a seller? Is there something specific you look for on the chart or tape (like a look of whiteprints etc.)?

I am asking because I do hesistate a lot of times going into a trade when I see a clearly holding level because I don’t want to get squeezed.

Thanks!

Fox,

Either I do not understand your question, or I need to clean up and clarify your use of language. Not sure which. That is not a squeeze. A squeeze is when the stock goes higher. 7c to the upside would not be a squeeze as well. That is not a big enough move for us to exit most consolidation pattern trades like above.

Thxs for reading.

Bella

Dear Mike,

thanks for your blog it is really helpful for me.

I think the trader could add to his position at 17.10 – support (around 11.00 am). It would be better price than 17.26.

What do you think?

Thanks in advance,

Maks

Maks,

The trader had it right from a technical perspective and from the tape. There was clearly a tap at 17.25 and it failed there twice. The risk was to below 16.90 so entering at 17.10 would present more than 20 cents of risk at a level 15 cents away from a proven seller and the morning high. better to buy close to support or after the seller lifts.

Steve