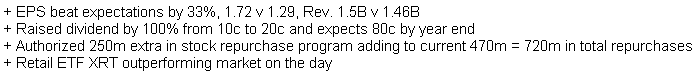

We had excellent news from RL this AM:

Here are some trades you might consider making your own:

1) Opening Drive. If RL doesn’t tick down on the open and their is protection on the bid, then pay the offer and play the momentum.

2) The Pullback. So you missed the opening drive and still want in with this RL. Buy the pullback from 124 into the 123.60 area. The result would have been a loss with a stop out as RL found 123. This is still an excellent trading set up.

3) Breakout. Buy RL as it breaks above 124 and play the momentum. As RL holds above 124 hold and add a Trade2Hold lot. This would have been a chop!

After the open I asked our Trainees to consider if there was anything from just the news that made RL so strong today. As we look at our charts and consider the tape is there something from the news we should highlight and remember for a similar set up?

Mike Bellafiore

Author, One Good Trade

2 Comments on “An Opening Dive, a Pullback and a Breakout (RL)”

I was in from 124 to 127. Using strategy #3. The news was good, but I’ve seen news just as good that didn’t have this kind of price action. I think we need to look at the daily chart to see why this happened. The stock topped out at 115 in December and started under performing retail and the SPY. This got a lot of shorts involved, with a stop around 115. This earnings gap caused a lot of popped stops, momo players, and institutional accumulation. Thus you get a really awesome morning move.

I think Rob L’s focus on higher TF is smart. Price had actually broken it’s Dec 21 high the day before and closed 10 cents off the high. That sign of strength set up the breakaway gap the following day.