Just a quick thought here… An hour or so ago (around 1PM EDT 11/1/10) the market was making new lows and lots of stocks seemed to be in danger of dropping support. However, one of the ways we look at the market is to look at the sectors and industries that are A) up or down the most (on a volatility-adjusted basis) on the day and B) making new highs or new lows with the market.

As the market was making new lows around 1pm this afternoon, I noticed that the only major sector indexes making new lows were consumer staples and utilities… traditionally ultra-defensive sectors. This is certainly a different kind of weakness than if, say Energy or Materials (which have been recent leaders) were driving to new lows with the market… My understanding of this is that this was weakness not to be trusted… at least in the very short term.

One of the big questions we face intraday is when to press and when to take small profits… know when to hold ’em know when to fold ’em in other words. This certainly got me out of my shorts at the low of the day today. One last thought… remember nothing works all the time. All you’re looking for is a small edge… something that happens more often than it doesnt.

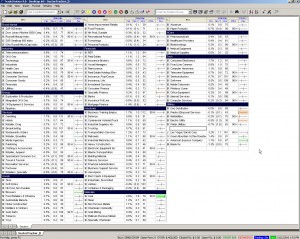

I am including a screenshot of my sector tracker that I monitor intraday. Maybe you can set something like this up for yourself… I find it to be very helpful in reading the overall market. (I didn’t think I was going to write this blog at the time… I know a screenshot actually taken at 1Pm would have been a bit more compelling!)

4 Comments on “You Should Know Which Sectors Are Driving”

Excellent points Adam. I’m thinking I could tighten up my watch on Sectors and have a better understanding of how the overall market is behaving..and in relation to the stock(s) I am involved with..or considering. Thank You.

Would you be willing to share the easy language code for the sector ranges in radar screen?

Which part? the –|——: thing?

Which code? You mean the —:—|- thing?