Traders,

I look forward to sharing my thoughts and top ideas with you for the upcoming week.

Right before I do so, here’s a quick note. As I have outlined in great detail in my previous couple of Inside Access meetings, the only place I review my trades each week, I wanted to see the market and critical sectors consolidate for a swing environment to become favorable again. Such price action would improve the risk-reward and, together with a higher low and base being developed, reset specific charts and setups, enabling consolidation directional swing opportunities. That’s now the focus this week.

Starting with my large-cap swing ideas, all of which share a similar setup.

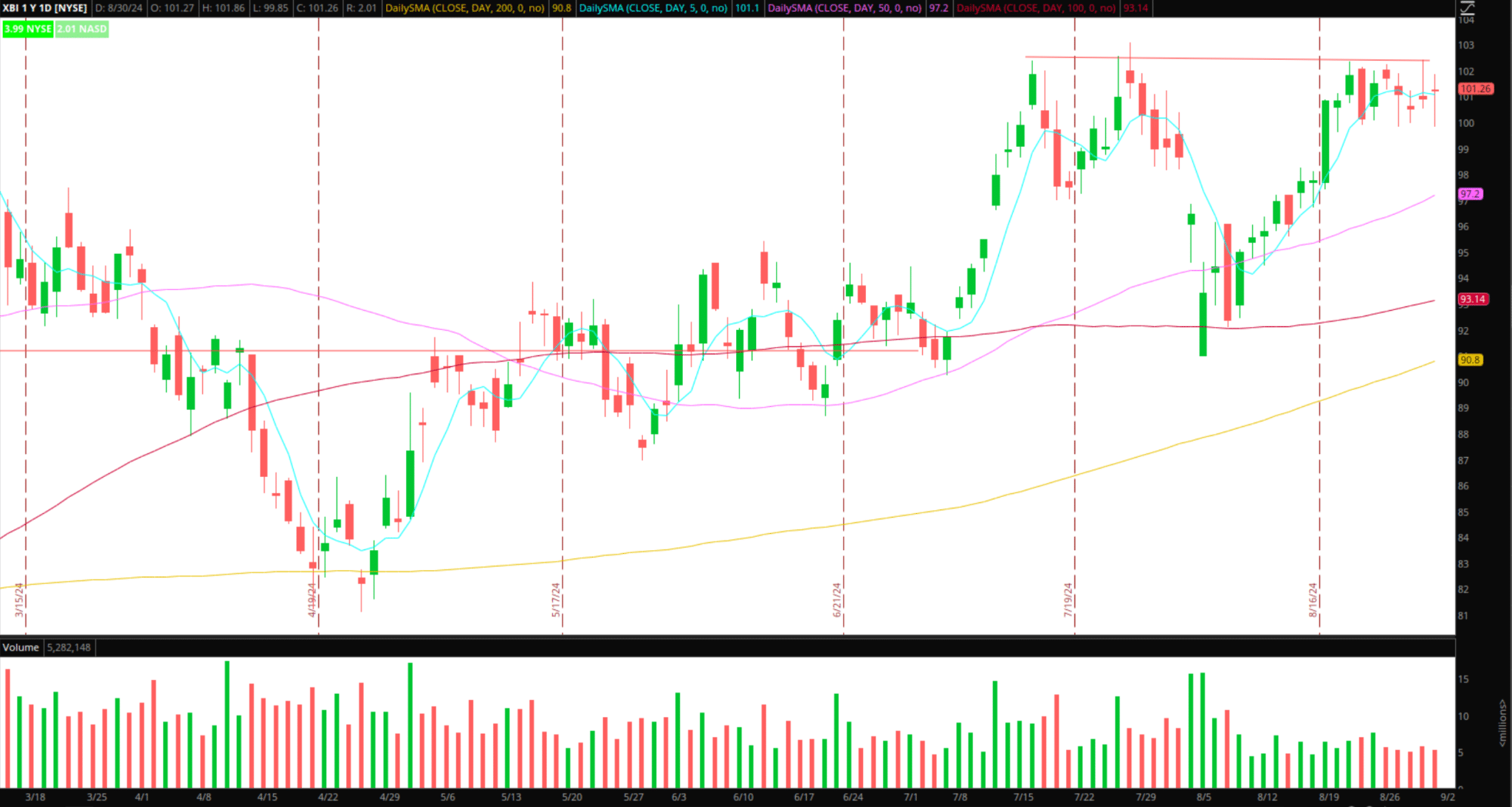

Consolidation Breakout in Biotechs (XBI) / (IBB)

The Idea: After V-bottoming and displaying relative strength, the sector has now spent time going sideways, setting up a more favorable risk: reward pattern. The sector continues to consolidate near 52-week highs and resistance near $102. Specifically, this setup shines through across multiple timeframes.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

The Plan: I am looking for a breakout in both volume and price above $102 across multiple timeframes. If the stock breaks above $102 and spends time above, I will look to initiate a long position with a stop at the day’s low. After that, I am looking to piece out of the position at 1 ATR / the 52-week high. After that, I will trail my stop using 5-minute higher lows, targeting a multi-day momentum continuation trade, piecing out of the position as it makes significant higher highs intraday.

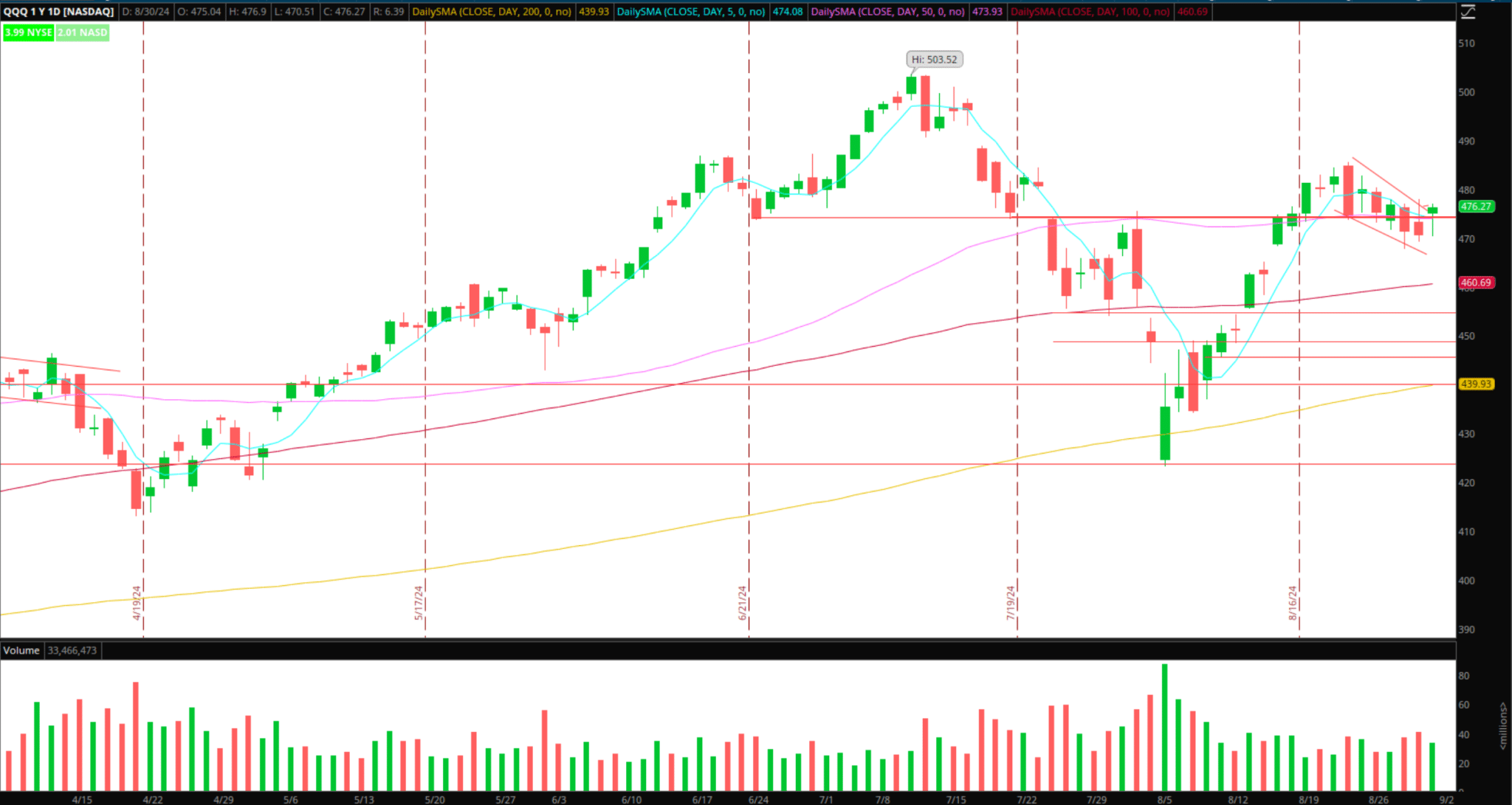

Consolidation Breakout in Tech (QQQ) / (SMH)

The Idea: Some relative weakness in tech and semis. However, we could see rotation flow back into this area. A good risk-reward pattern now exists, with a clear breakout area in both QQQ and semis (SMH and SOXL).

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

The Plan: For QQQ, similar to semis, I am looking for a break above Friday’s high and hold intraday, confirming buyers are firmly in control. After that, I might look to get long if market internals remain favorable, with a stop at the low of the day and a similar exit strategy to XBI in terms of ATR and a 5-minute timeframe trail.

Additional sectors/areas of interest with a similar setup after consolidating = XHB (homebuilders) and small-caps (IWM / TNA).

Pops to Short in Small-Caps

BNRG: Fantastic momentum mover on Friday, on exceptional volume. After the retracement off the high and week close, the focus will now be on shorting a push into a potential zone of resistance. If the stock pops toward its 2-day VWAP / $2 and fails, I will look for an intraday short targeting $1.5 – low $1s.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

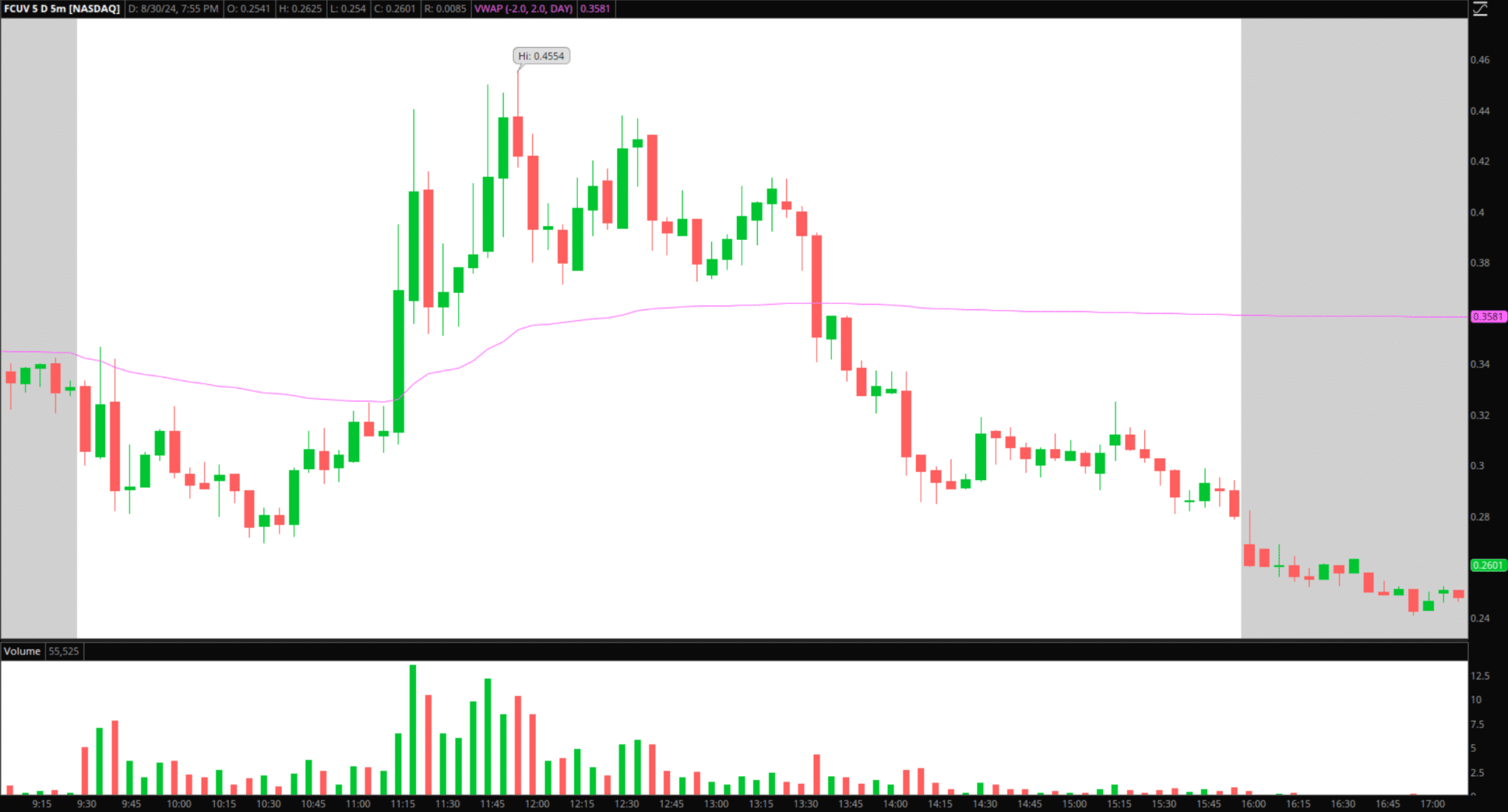

FCUV: Similar to BNRG, significant retracement off the high and weak close. Therefore, I will set alerts for a pop-back toward its 2-day VWAP. If the stock fails to reclaim this zone, I will look to get short versus the day’s high, targeting a retracement toward the lows from the AHs on Friday.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.