Traders,

It continues to be a unique and exciting trading environment, and as always, I look forward to sharing my thoughts and trading plans with you.

Like last week’s watchlist, I’ll share my plans and general thoughts for both small—and large-cap stocks, given the opportunity set and where I am seeing success. Regarding my trade and opportunity reviews, I only do that thoroughly during my weekly Inside Access meeting.

So, let’s start with my plans for individual small-cap stocks, which are uncorrelated to the overall market’s direction.

The cycle continues to be hot for small caps, with many day 1 gappers closing in the green after experiencing significant flows. Once Day 1 moves fail more sharply off the open and VWAP reclaims fail on subdued volume, I’ll know that the cycle is shifting.

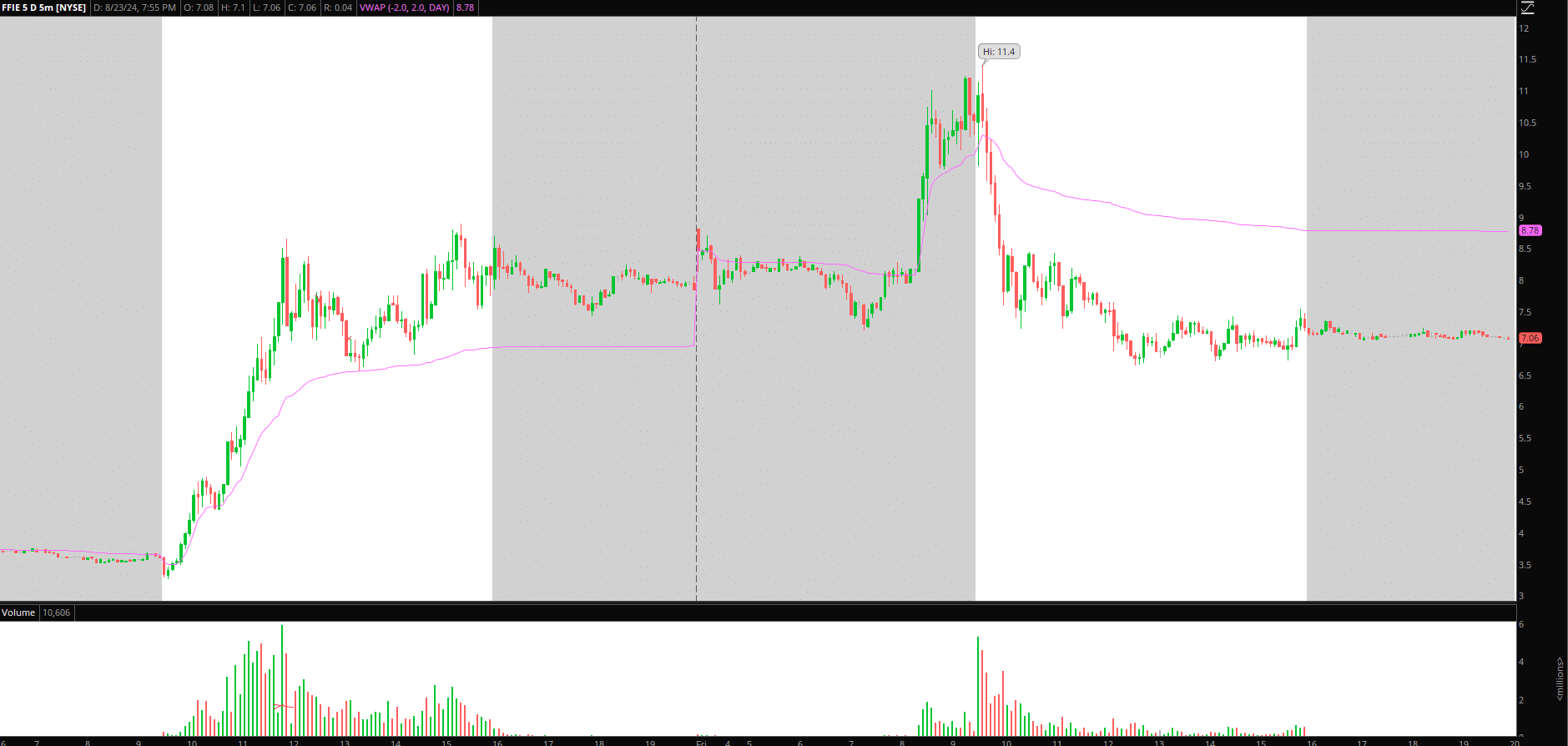

Lower High, Pops to Short in FFIE

FFIE was a tremendous momentum mover on Thursday and Friday. Of course, from a fundamental perspective, this company is well-known, having run recently during the meme-mania in May.

After Friday morning’s blowout and exhaustive move in the pre-market, the backside was confirmed off the open with the pre-market high rejection and sharp failure on sustained volume.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

As long as the multi-day VWAP does not reclaim, followed by a price action chop, I will be focused on shorting a lower high. Ideally, this has a short-lived SSR push early in the week toward $8.5 – multi-day VWAP and fail. After that, I would initiate a short swing position versus the day’s high. I would plan to hold versus the day’s high while trimming the position to $7. I will aim to hold this for multiple days and target a move back near $5s.

On the backburner, several other small-cap stocks I am looking to short:

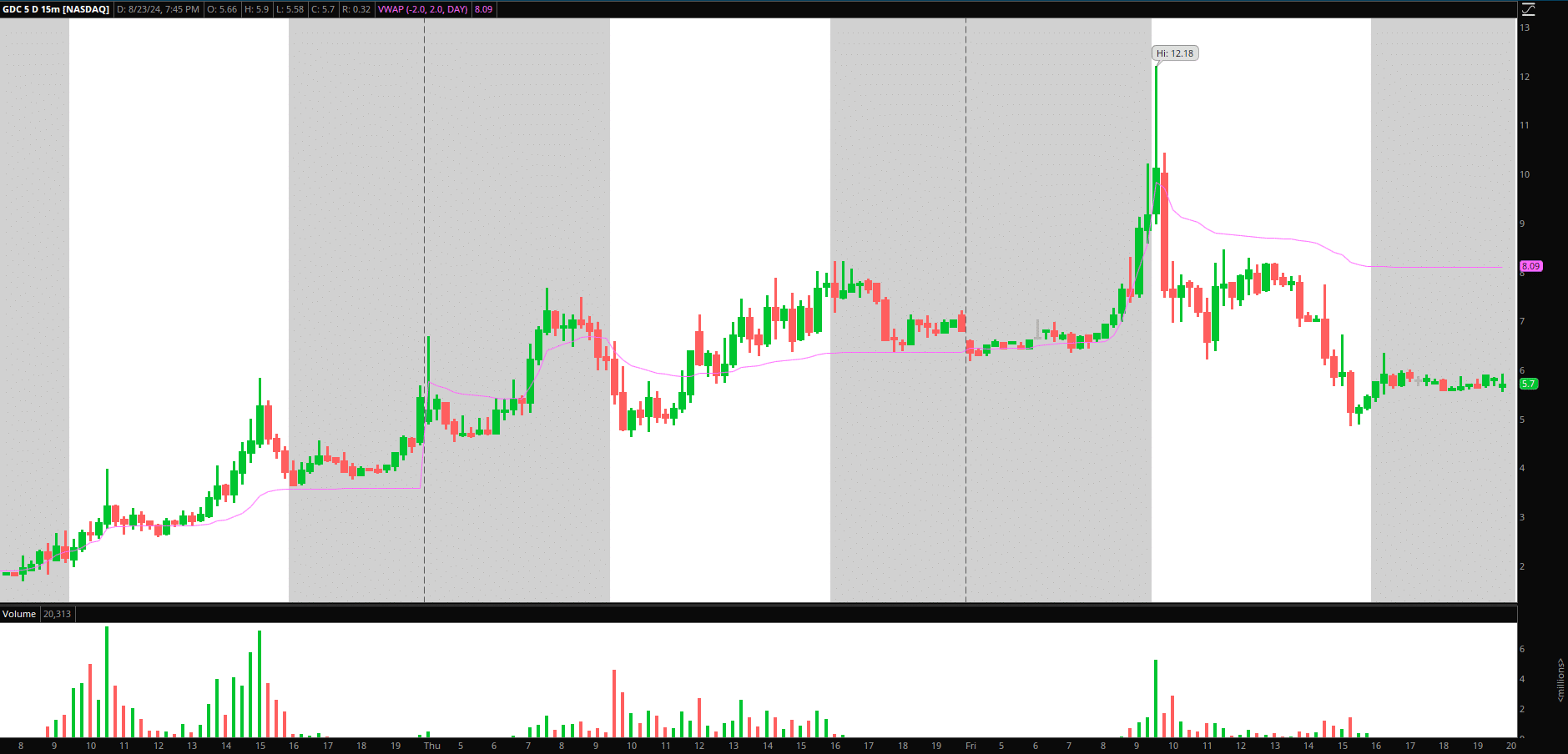

GDC – Similar blowout Friday to FFIE. Like FFIE, I am looking for failed follow-through pops toward its multi-day VWAP. However, while I see this giving back most of the up move in the coming weeks, its pops could go further than one thinks due to the trickery that took place in the stock.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

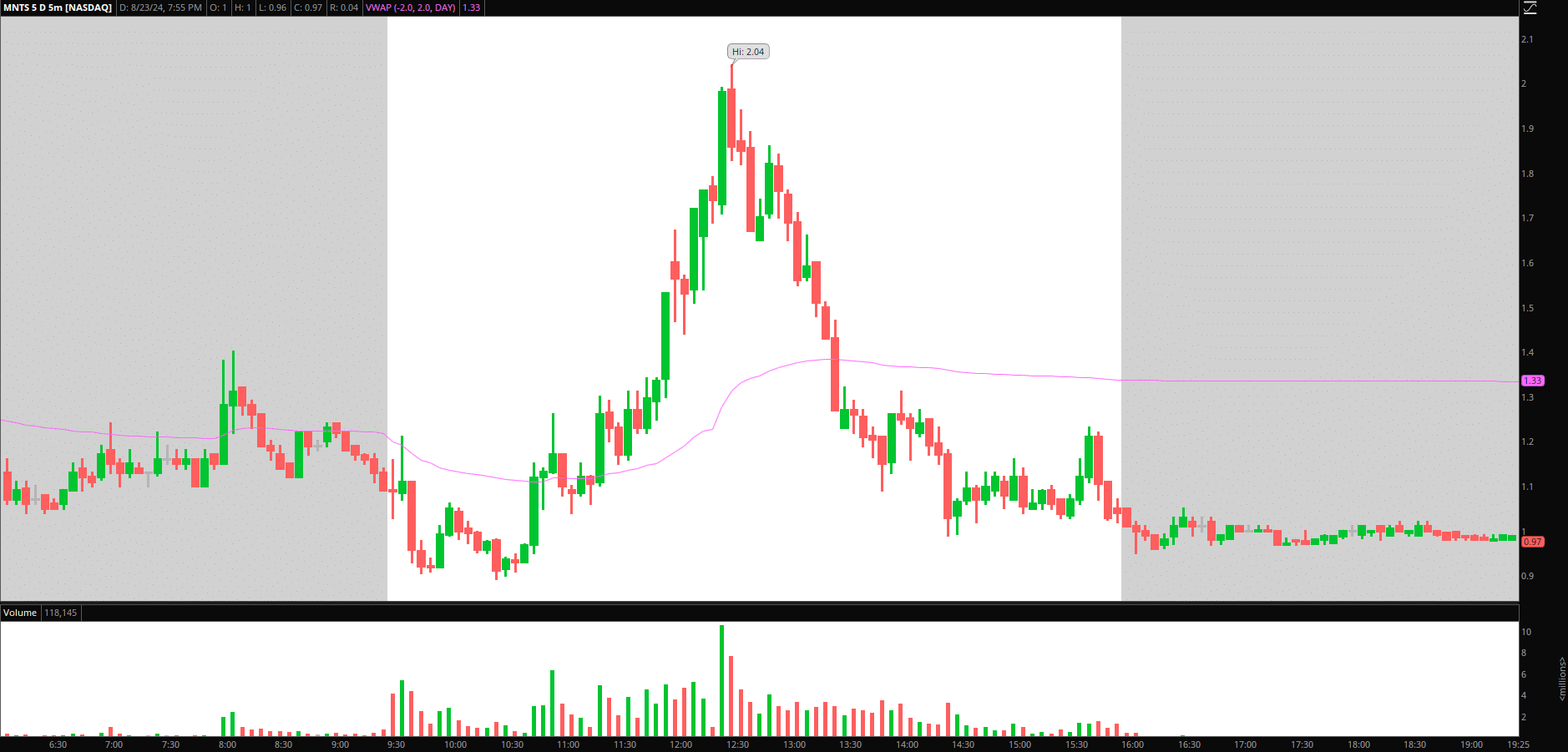

MNTS – I’ll set alerts for pops toward $1.3 + for intraday short and unwind sub $1.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

Focus Shifts to Favor Swing Longs

As I have been going over in my inside access meetings, I am looking for the market to consolidate and digest this move, having offered multiple pullback opportunities last week. I need to see previous resistance hold firm as newfound support and bases to build to have greater confidence in directional swing longs in large caps.

So, with the SPY now showing early signs of consolidation above the $555 band of support, I am looking for further sideways action and energy to build. As long as the market can maintain its footing above this critical zone, I’ll shift my focus to include directional swing long setups. On the flip side, if the market breaks below its rising 5-day and then $555, I’ll be hands off and looking for support and a higher low near $550 and its rising 50-day.

So, within that, from a long perspective, I am seeking out relative strength and attractive technicals for my watchlist.

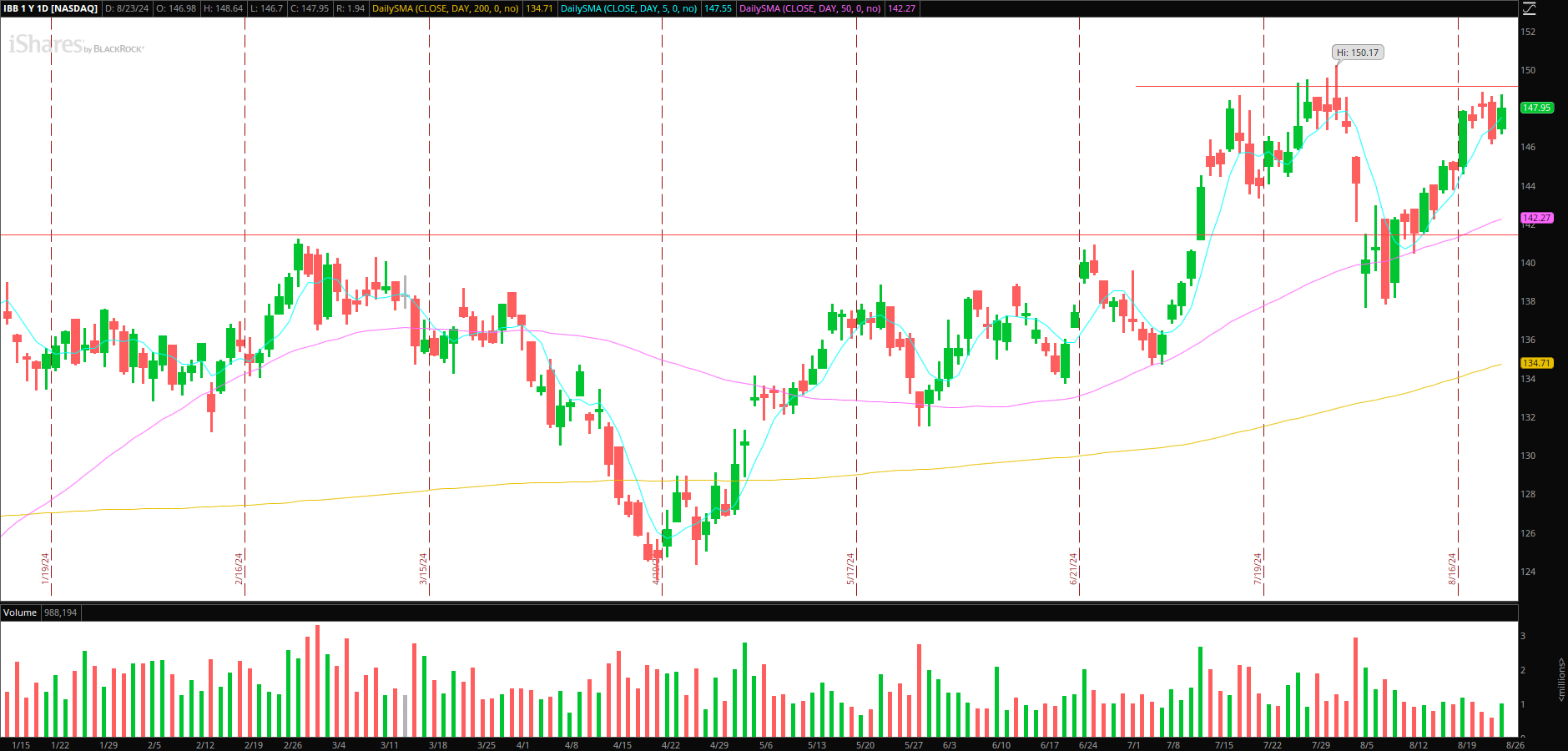

For example, the biotech sector was one of the strongest last week. The IBB and XBI closed shy of their 52-week highs and near a major breakout and inflection point.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

So, from now on, a focus will be on identifying the most well-positioned stocks within that sector for a potential breakout. Alternatively, I will also be eyeing the IBB for a consolidation breakout in the coming days and weeks. Given its almost 10% move off the lows, however, I’d prefer for a few more days – a week of sideways action before a consolidation breakout occurs.