Traders, It’s a unique and exciting trading environment, and as always, I look forward to sharing my thoughts and trading plans with you.

Given the action last week, let’s review plans for both large-cap and small-cap stocks for the upcoming week.

Starting with plans for large-cap names.

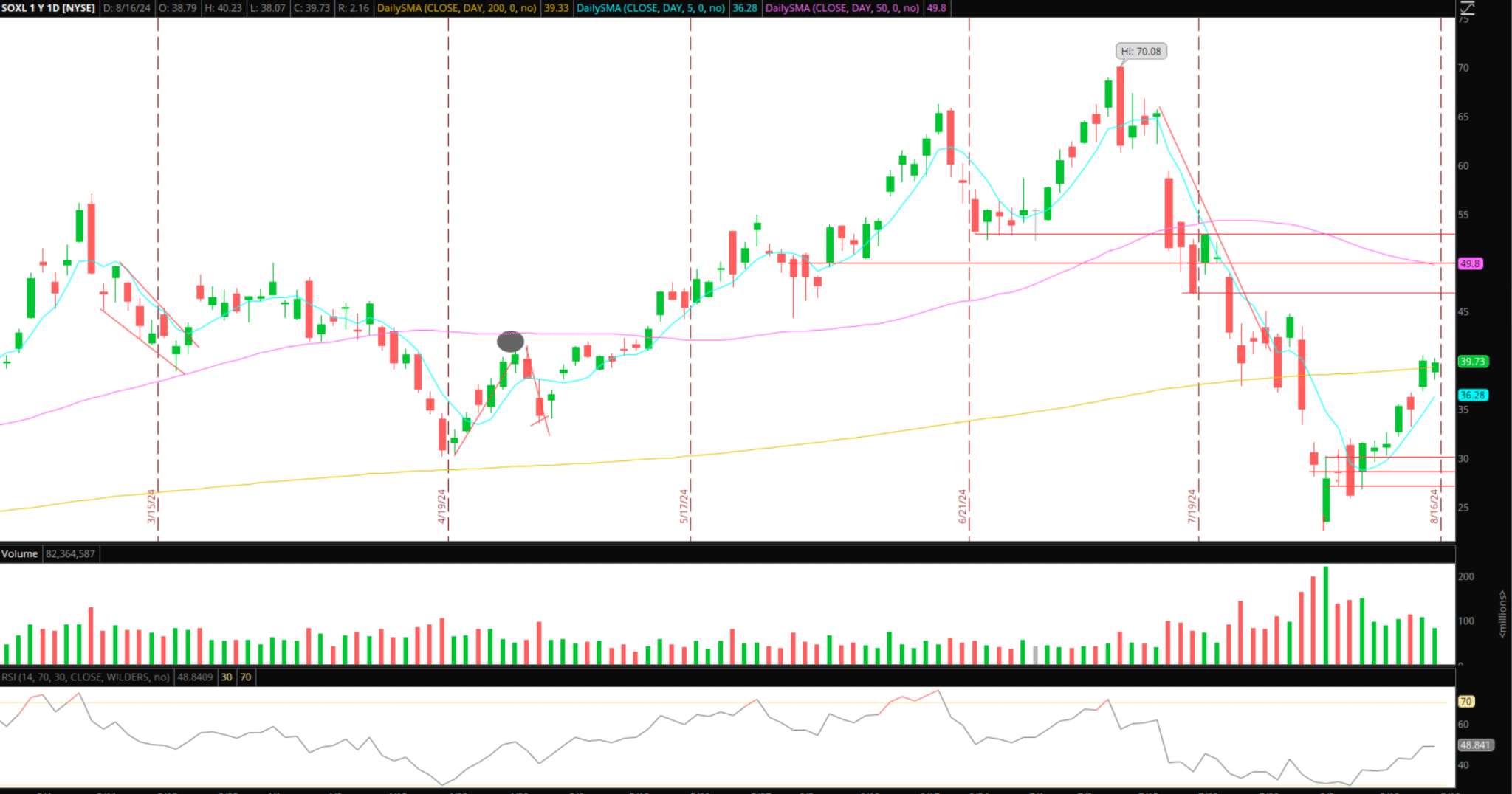

A Pullback in SOXL

This idea can be expressed in many different ways, with several stocks and ETFs to choose from. However, it has yet to be confirmed.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

The market has not taken out the previous day’s low for two weeks since the bounce began. Going forward, if SOXL, or whatever best sets up on the day of a pullback, can break the trend and take out the previous day’s low, along with weak market internals, I will look for the pullback. I am not looking for a crash or retest of lows by any means; I am just looking for a measured pullback in the market, as this move has gotten stretched to the upside. As volatility has subsided, and the VIX is remarkably back near lows, I would look for a multiday position here versus just intraday.

That is the key takeaway: adjusting the timeframe and plan as volatility has eroded and the risk of a significant directional overnight gap in either direction has also diminished.

Now, I like SOXL due to its liquidity and range and also because it led the way on the way down, unsurprisingly due to the instrument’s mechanics. However, some other names on my list for this pullback idea are PLTR, NVDA, TQQQ, and AMD.

ASTS: Failed Follow-Through to Short

It was an incredible momentum mover on Thursday and Friday, following its earnings Wednesday. Momentum trading, move2move, will continue to be my focus in this tape until we see a shift in the overall market.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

With ASTS, I would look for a push over 32 toward 33 – 34 for a failed follow-through set to get short. If the stock fails to hold above Friday’s lower high or Thursday’s peak, I will look for a short risking against the high of the day for continued momentum to the downside, targeting Friday’s low primarily. Depending on the action, I might look to trail my stop after that using lower highs.

Now, onto Small-Cap Stocks

Last week, a notable shift in small caps occurred, with the cycle shifting to favor longs in the near term. As a result, shorts need to be more careful, especially when looking for an all-day hold, shorting above VWAP, or holding a short midday on declining volume and a VWAP reclaim. The potential for a squeeze is elevated as the percentage of gappers closing green has increased.

CING Backside Short: Small dump AHs on Friday. It now all depends on where this opens on Monday, barring any dilution. On the short side, this will potentially be an A+ for the reality check, but it all depends on how it sets up. The general idea here is that I am stalking for backside confirmation, which could come in many ways. After that, I am looking to short the immediate lower high versus either the HOD or VWAP / Key level reclaim, targeting significant unwind.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

GOVX Open-MInded Momentum Mover: Monkeypox mover. Once the tide turns in this small-cap cycle, we know how all these moves will end and their agenda. However, this is firmly on the front side, with a theme playing out. So, I hope for higher and several other names to pop up in sympathy. So, until a significant character change or exhaustion, I will be open-minded and trade the range.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.