Traders,

Get ready for a thrilling week with some fresh trading ideas. In this update, I’ll break down my thought process and share my entry and exit plans for my top ideas.

During my latest Inside Access meeting, I reviewed my trades and executions from last week, including my top trades and thought process from Monday to Thursday. For those curious, that’s the only place I thoroughly review my trades and executions.

Last week brought some A+ opportunities, especially with Tesla on Thursday and Friday, and the selloff in the semiconductor sector, particularly NVDA on Thursday, along with other top swing opportunities such as IWM and XBI on Thursday—a great week to review thoroughly.

For the week ahead, here are my top ideas as of right now. Of course, as the week progresses, new ideas and plans will also come into focus.

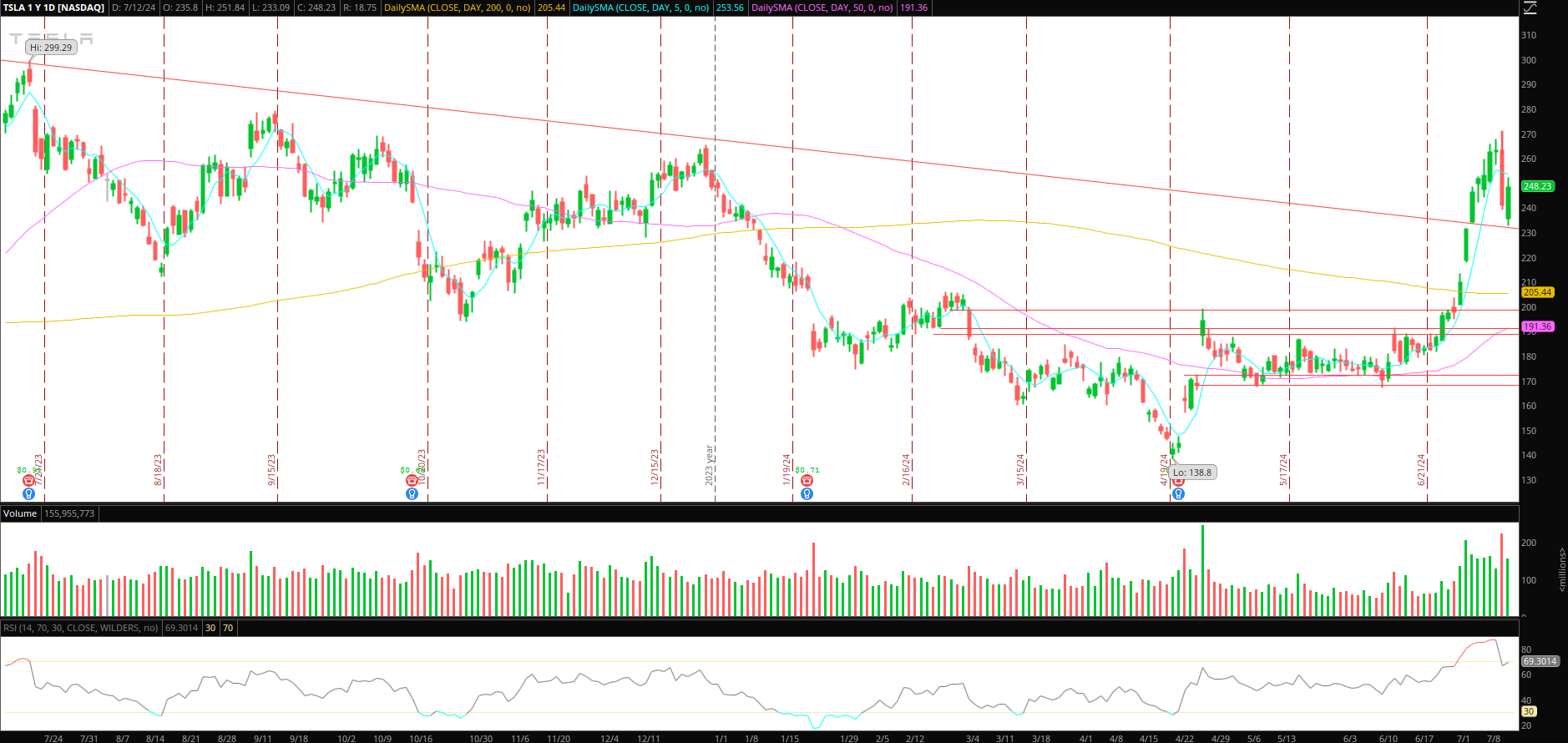

Tesla Higher Low Continuation and Extremes

In my opinion, Tesla provided the top opportunities last week and warrants a thorough review. If you haven’t already, I urge you to dissect the opportunities in detail. If you need an idea of how to go about reviewing a setup in detail, check out Lance’s Twitter, as he has spoken on this topic in detail.

Now, it’s important to remember that we’re just over a week out from Tesla’s earnings. But what I like about last week’s action, coming into this week is how Tesla found support right at its higher timeframes previous resistance on Friday, clearly showing buyers firmly in control despite Thursday’s rapid selloff.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

So, here’s my plan:

While I am open to short scalps in Tesla, especially if we go ‘straight’ toward $255 – $260, my primary focus will be for a higher low on a pullback, near $240 – $235. I’d love to see the stock experience a morning wash into this zone of demand and confirm a higher low in the low $240s versus Friday’s low for entry and intraday VWAP reclaim as a potential add spot. After that, I will be looking for $250 as a first target to take profits and trail my stop using higher lows on the 5 to 15-minute timeframe, depending on the price action. Ultimately, I would be looking for a multi-day swing targeting an exit above Friday’s high, near mid $250s.

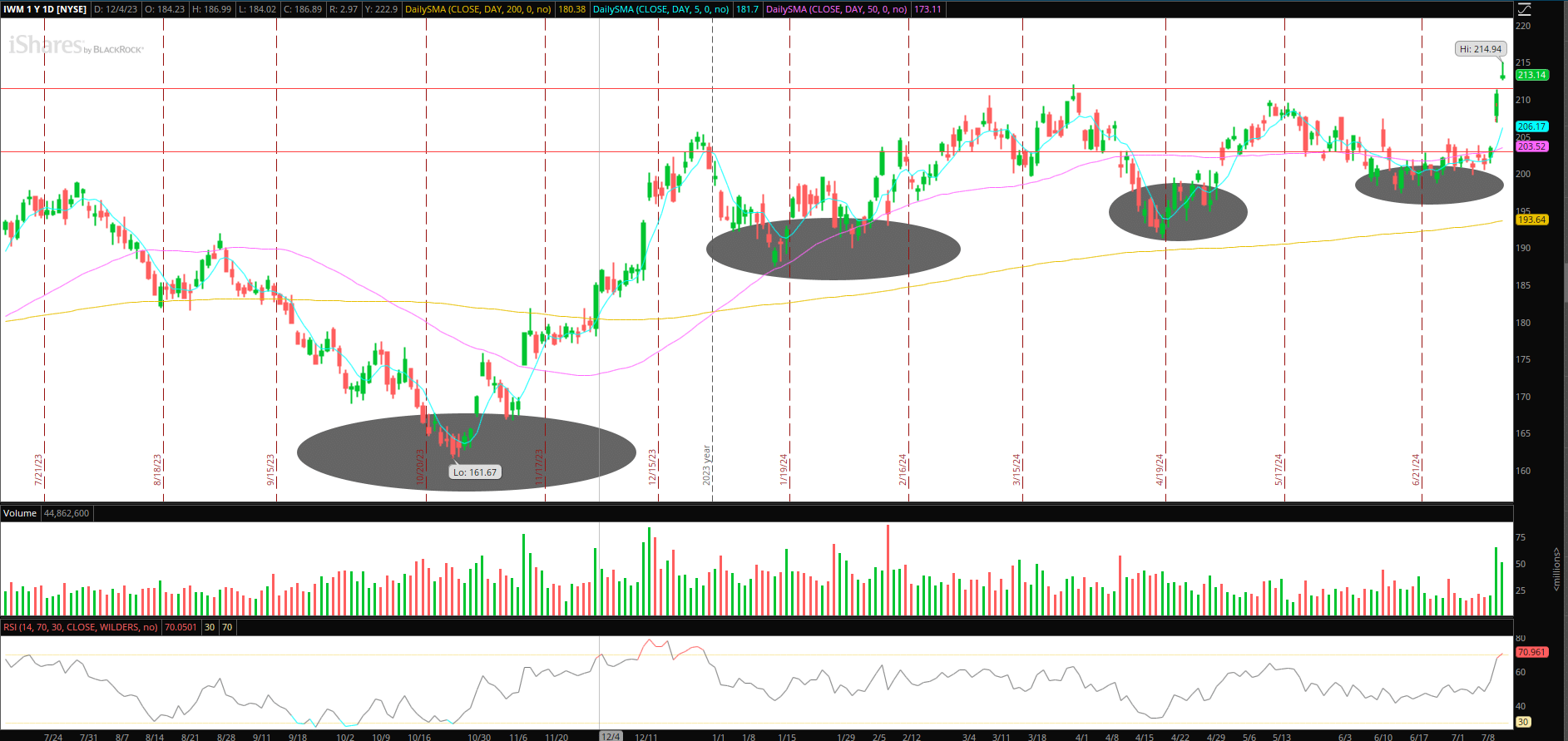

Small Caps (IWM) and Biotech (IBB) Continuation

Small caps and biotechs experienced a notable character shift and in-flow following the inflation data on Thursday.

IWM took out a significant area of resistance, one that has held firm for several years, and likewise in IBB / biotechs.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

So, going forward, in IWM and IBB, I will not look to chase strength or highs but rather monitor both for a pullback into prior resistance. I’d like to see buyers step up and turn prior resistance into support, indicating and further confirming the major momentum shift. Ideally, the pullback is followed by a day or two of rest and consolidation, setting up an entry on a multi-day breakout for a leg higher and continuation.

Key levels I am watching in the IWM for support: $212, 211

Key levels I am watching in the IBB for support: $144, $143

Additional Ideas:

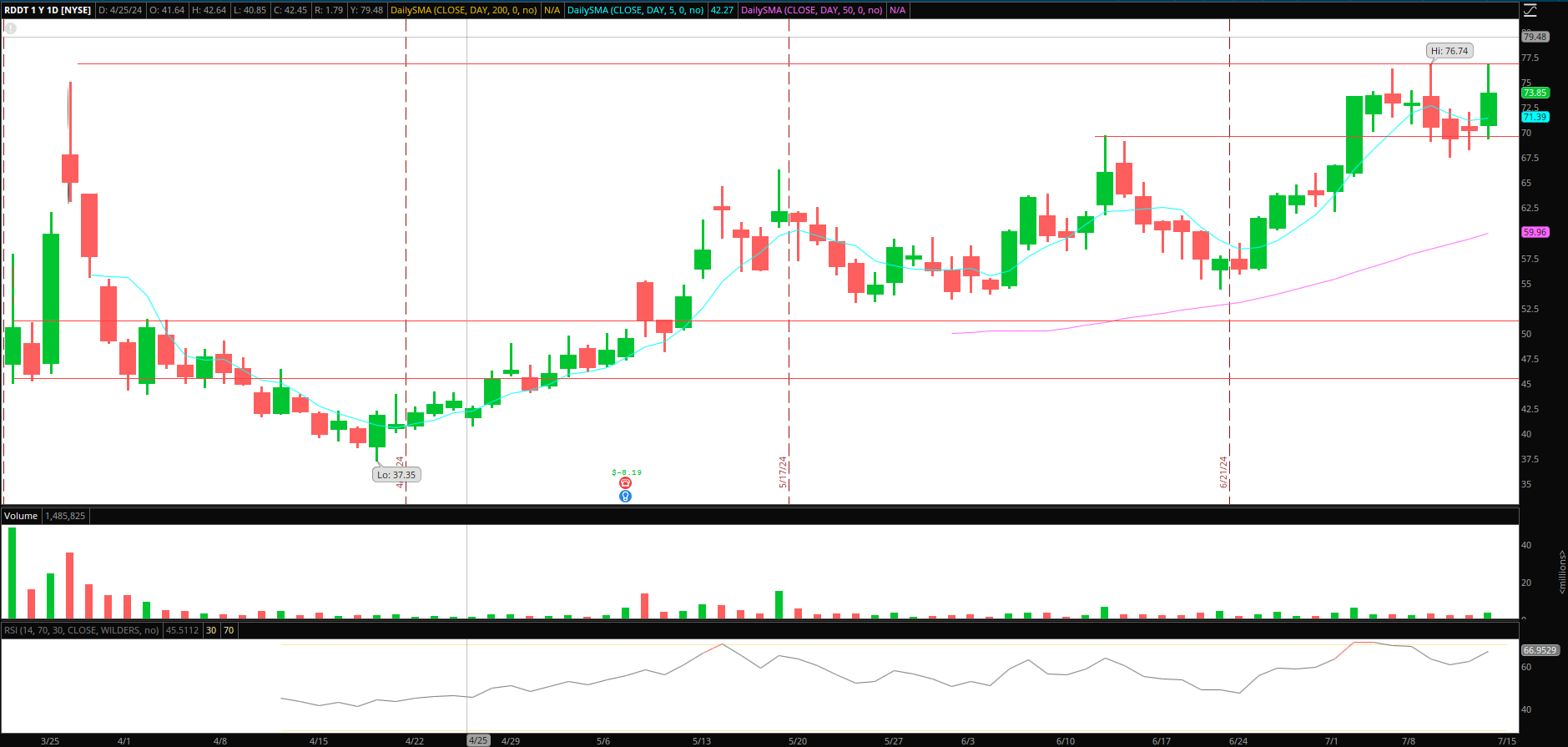

Reddit: The daily chart shows a great setup for a continuation higher. Given the stock’s range and liquidity, it’s important to note how it trades, so I adjusted my size and risk. Friday’s 2-day range break provided a great long entry; however, I did not act on it.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

I will watch for a higher low to confirm early next week for possible entry, with a wide stop on reduced size. Alternatively, I am also watching for further compression in price and a breakout over its highs for a momentum trade, as long as volume is present.

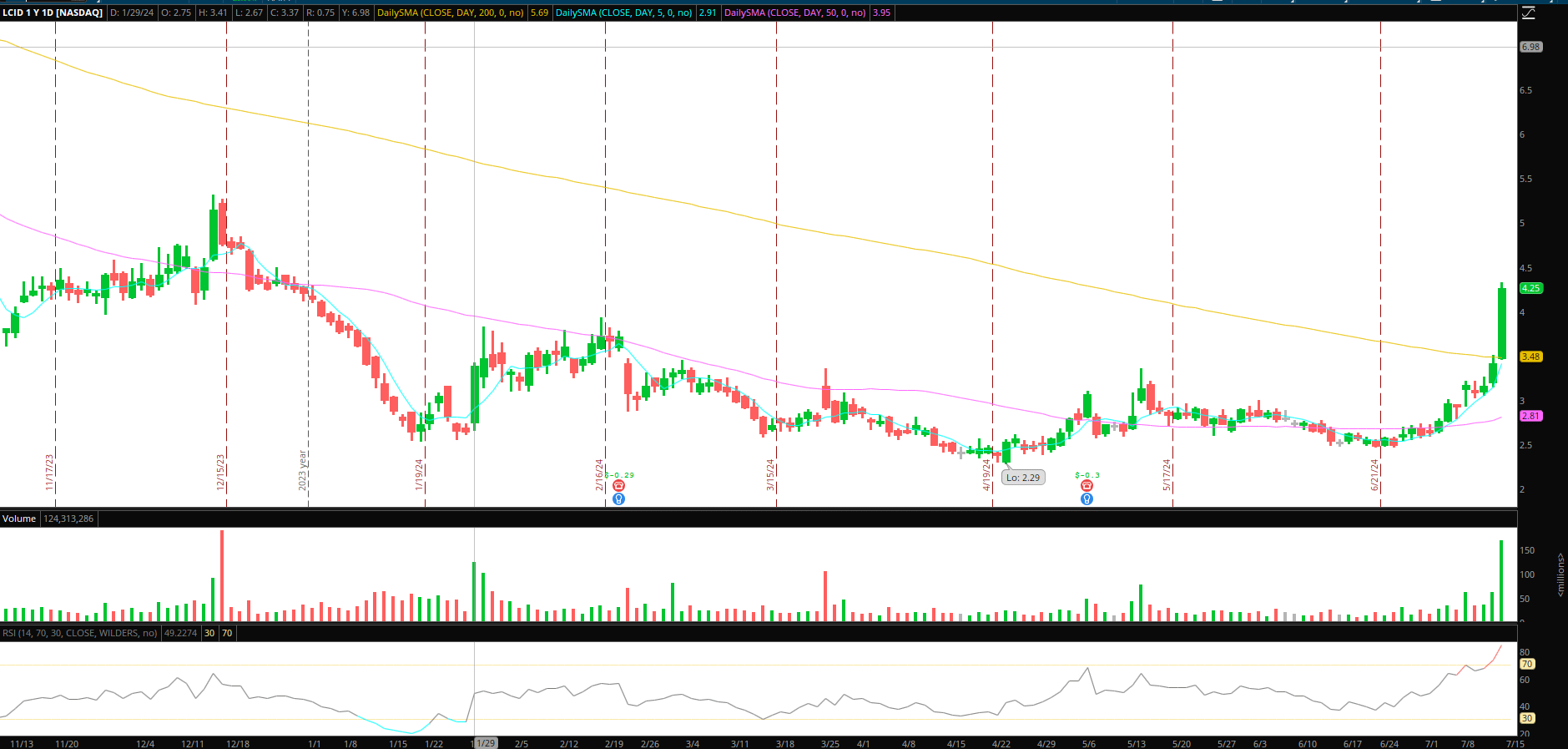

Lucid: It was a great mover on Friday, and it was nice to see its range and volume finally expand and squeeze out some shorts. This will be on close watch going forward for a short swing. Ideally, this can trap and push closer to $5, but I’ll be on the lookout for exhaustion and a failed move above Friday’s high / uptrend break / VWAP snap for a short entry if it fails to have legs higher. I have a similar plan in RIVN.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.