Hey Traders,

Get ready for an exciting week ahead with some fresh trading ideas. In this update, I’ll break down my thought process and share my entry and exit strategies for my top ideas, which are set for significant directional moves.

In my latest Inside Access meeting, I detailed my exact trades and executions, and last week’s watchlist was spot on. Several names made impressive moves and offered great opportunities.

Now, here are a few of my top ideas for the upcoming week:

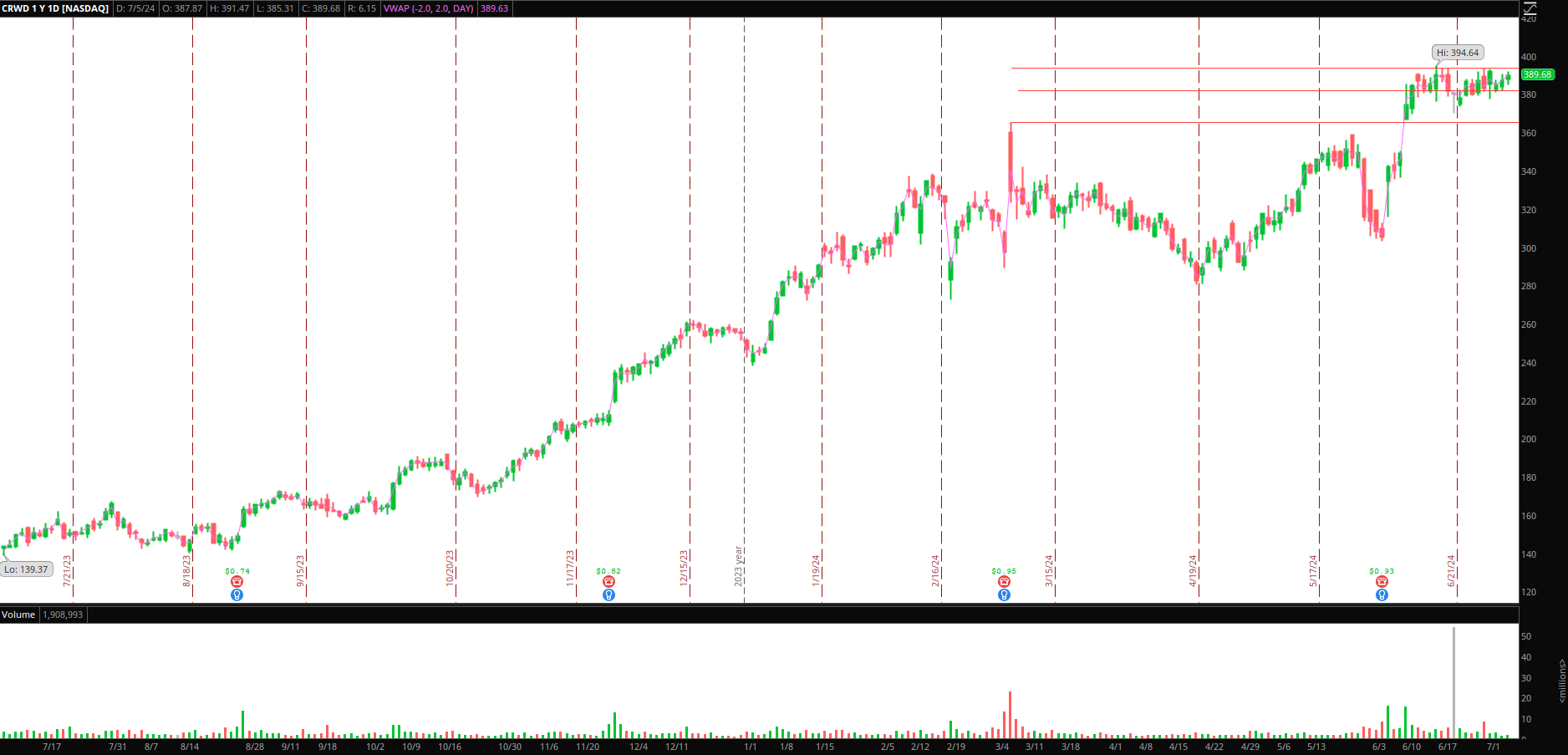

Consolidation Breakout in CRWD

The cyber industry has shaped up favorably in recent weeks, with the Cyber ETF having two beautiful legs up in recent months, along with many names within the sector that are well set for upside.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

CRWD is my top idea out of all of them. From a technical point of view, it ticks the boxes I look for in a swing setup. The stock is holding above previous resistance, well above rising moving averages, offering a skewed risk reward with a clear breakout and inflection point and a higher timeframe uptrend to support the overall momentum, price, and volume contraction before a breakout, alignment across multiple timeframes, and various other checks.

Here’s my plan:

I have a small starter in the name, but I am only looking to put risk on once the stock breaks above resistance. Once it clears $394, I’ll get the size I want, with a stop either at the day’s low or the previous higher low, depending on the setup. I’m looking to capture multiple ATRs, and therefore, I’ll be trailing my stop on the 15-minute timeframe, higher lows, and scaling into 1 – 2 ATR moves over various days.

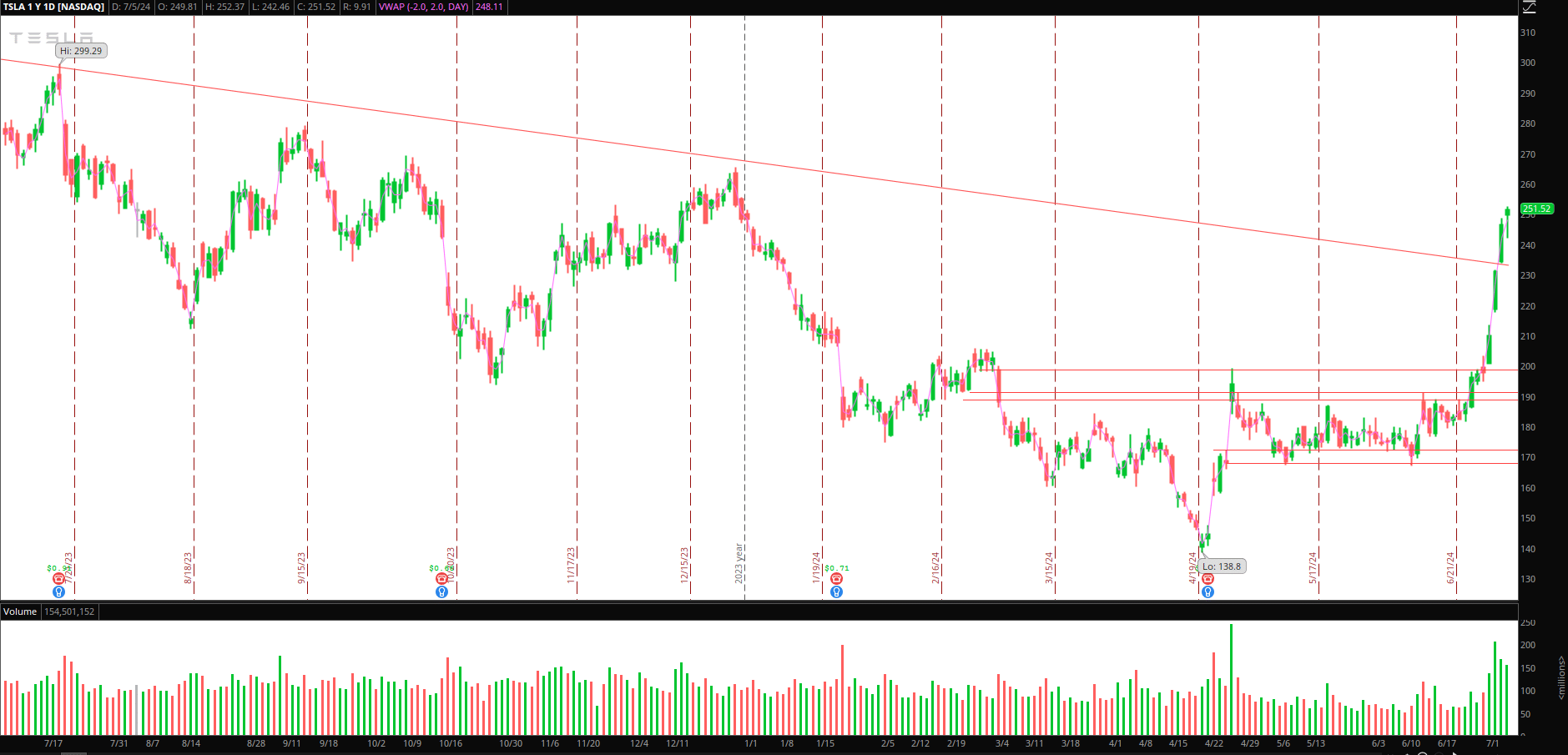

Extremes in TSLA

By extremes, I mean any outlier move that presents an exciting reversion opportunity. For example, if TSLA had another significant push toward $260+ without pulling back and consolidating, it would have me interested in a short-term mean reversion opportunity.

*Please note that the prices and other statistics on this page are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and commissions.

However, if the stock pulls back significantly, sub $240, I am looking for a short-term bottom to be confirmed, some sideways action, and a breakout for another leg higher after the significant breakout.

It is a two-sided tape, and I will watch this closely in the upcoming week(s). Ideally, $260+ this week is for an A+ mean reversion opportunity, followed by a bounce trade to the long side.

Additional Ideas For the Upcoming Week:

Lower High / Backside in SIRI: Nice pump job and squeeze in SIRI these past few weeks. It finally extended and broke its trading character on Thursday / Friday. If this fails to reclaim $4 on a push, I will short versus the day’s high and hold for up to two days, targeting a move back toward $3.

OPTT and QLGN Pops to Short: Both names have alerts set for a pop back toward multi-day VWAP and potential supply/failure areas for a full-day + short position versus the high.

Continuation in AMZN: Dips continue to get bought as AMZN trades at new highs. I am sticking with the trend on this.

Stalking SMH Lower-High: We’re coming back into a major potential supply zone. I’m watching SMH / the sector closely for a potential bull-trap confirmation and lower high. If that confirms, I’ll position short versus the day’s high for a multi-day swing short.