I received the following email last night while watching Netflix:

Dear Steve,

my name is Guglielmo and I’m glad to be part of the Trader90 community. I trade from Singapore. Yesterday in the AM meeting you were discussing GLD as a long being a very strong stock. At the same time, we saw the strong NFP numbers, suggesting a risk-on day and a sell of safe assets including gold. Evidently, the latter thesis was wrong, so would you mind elaborating a little bit more why you had confidence in buying GLD?Thank you. Your AM meetings are so valuable.Regards,Guglielmo

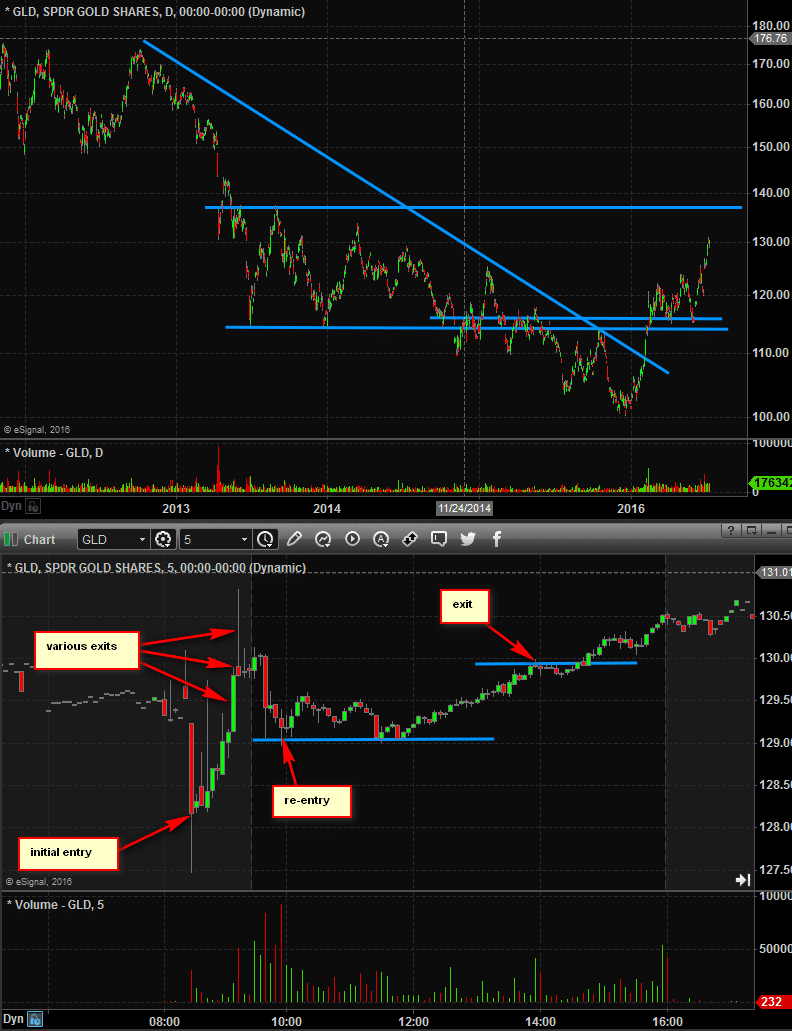

This is an excellent question. When the June non-farm payroll reported we saw an immediate move higher in stocks while bonds and gold moved lower. Traders were reacting to a very strong jobs number buying “risk” assets and selling “safe” assets. But that wasn’t the end of the story. There are many many different cohorts of investors and traders. And not all of them are basing decisions simply as “risk on” or “risk off”. In the case of gold it has had a strong bid for months as it broke out of a multi-year downtrend. So whenever it has a sharp move lower I look for a low entry point.

Friday morning GLD dropped several dollars very quickly towards 128 and stabilized. The risk/reward made sense to me there for a potential pop back to 130. I wasn’t looking for GLD to have a strong up trend day similar to stocks but rather was looking for a quick “pop back” as dip buyers would step in following the weakness.

It just so happened that the rebound happened fairly quickly and I exited as I was broadcasting our morning meeting (more info below).

Steven Spencer is the co-founder of SMB Capital and SMB University which provides trading education in stocks, and options. He has traded professionally for 20 years. His email address is: [email protected].

No relevant positions