In the past few years SMB has built some remarkable trading tools. We led the pack in moving to HTML5 years before others (can use on smartphones and tablets). But beyond the cool technology in Scanner, Radar, and Real Time it is the actual idea flow that comes from very experienced traders. Traders who have spent years learning how to identify the best risk/reward setups.

If we look at the past few days in the market there has been a lot of anxiety and a lot of volatility. During this sort of environment to have access to an AM Meeting where I explain short setups in ACE, CNC and TSLA with key levels can be invaluable. I also discuss key market levels that make sense to get short or long.

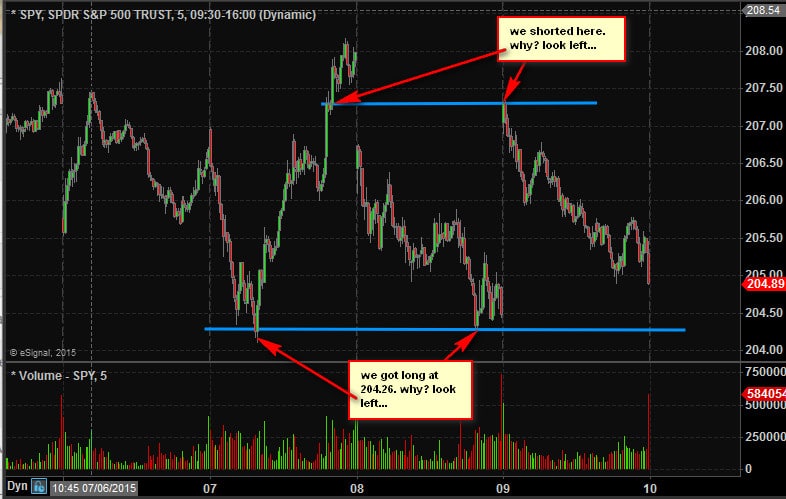

In the above SPY chart you see support hold at the overnight futures low from July 5th. After the weak close on July 8th we had a perfect opportunity to short at prior afternoon inflection around 207.30. This level was discussed in our AM Meeting and I executed a short there. Then during the day as members of SMB Real Time see me managing the position I explain to them why I am adding or covering.

In this TSLA chart you can see after gapping lower on a downgrade the first move was to the downside breaking a clear support area from the prior days. This “opening drive” serves as confirmation of a short thesis and when the stock moves back up to this area we would initiate a short. As you can see TSLA failed at this prior support then trended lower for over $10.

ACE, CNC, TSLA, AET. these were the top ideas discussed at the beginning of our AM Meetings in the past week. Each idea had better than 1:5 risk/reward. in fact the risk/reward averaged better than 1:10 on these ideas. Look, rarely do I toot my own horn on the value of the idea we are generating on a daily basis but the fact of the matter is they are pretty awesome. So much so that we are getting comments in the chat and emails that one good idea is covering the cost of members for an entire year!

CNC announced that they were buying Health Net in a cash and stock deal. Risk arb hedge funds automatically short the acquiror in this sort of deal causing strong downward pressure when the market opens. We began shorting in the pre-market above 83 and when our thesis was confirmed with the down move on the Open we added to our shorts.

ACE announced that they were acquiring in CB in a cash and stock deal. It gapped 10% higher in the pre-market. The problem with this gap higher is risk/arb funds would all start to short as soon as the market opened. And since it was gapping 10% higher all large institutional buy orders that were sitting at price levels at 102 and below would not be able to absorb the selling pressure from risk arb funds.

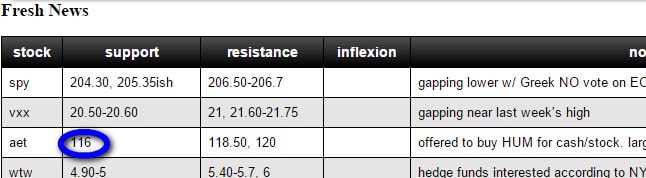

AET announced they would be purchasing HUM in a cash and stock deal. This setup was different than ACE and CNC in that AET was already gapping lower from the announcement. It was very close to the area where it broke out from when the Supreme Court ruled in favor of Obamacare. So our idea was to get long around 116. As you can see AET supported 116 on the Open and traded up to 120.

We know as experienced traders that it isn’t simply about “great ideas”. It is about developing a consistent process that we follow each day that allows us to succeed in markets. SMB Tools and mentoring give you the framework to develop that process and be one of the few who become successful as a pro trader.

Steven Spencer is the co-founder of SMB Capital and SMB University which provides trading education in stocks, and options. He has traded professionally for 19 years. His email address is: [email protected].

Steven Spencer is currently long KING, LEN, OHRP, TWTR, WMT and shor NQ, SPY