YRCW reported disappointing earnings on Wednesday and gapped lower. It moved very well off of the previous S/R levels 22 & 25 (see chart below). On Friday it traded below 22 as selling began to pick up again and it closed at 18 which corresponds with its pivot low from May & June. The large surge in volume as it approached 18 caught my attention and I opened a long position (chart to right). When it bounced to 18.75 I sold 25% of my position to cover some risk. I would be more committed to this position if it can hold above 19.

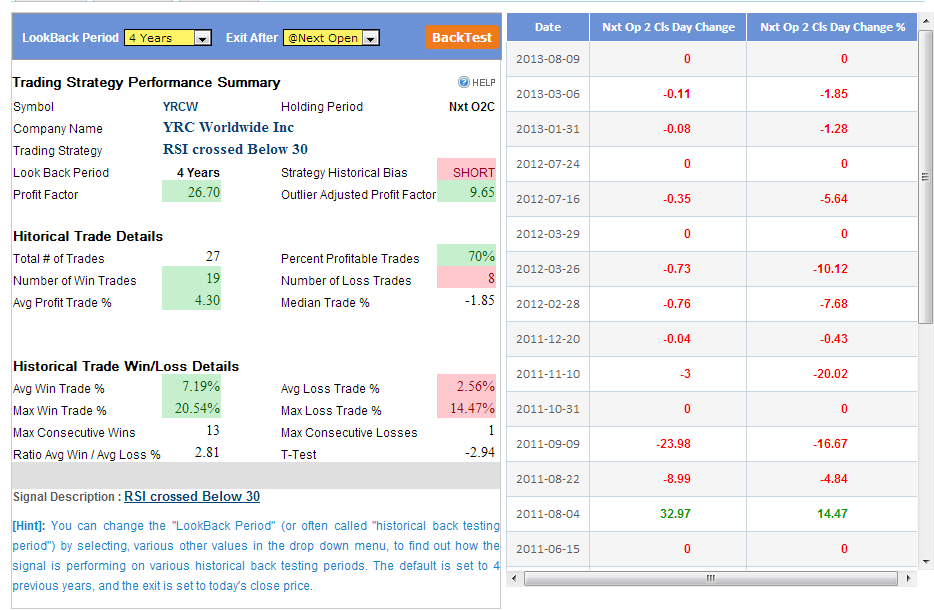

I asked my friend Kora Reddy from @paststat to run a statistical analysis on the likely direction of YRCW for Monday. The results are below. It is indicating that YRCW most likely will close lower on Monday than where it opens. I will use this information to help me manage risk on my position. The next major support in YRCW is around 16.50 so perhaps it will flush closer to that level before trading back up to 17.50-18. If the opening print on Monday is 18.30 and it closes at 17.80 this would be in line with the below statistics.

Here are some of the things that are factoring into my thought process for this trade

- There was a surge in volume as YRCW approached 18 which indicates to me some larger players believe this level offers great value

- YRCW had an enormous move from 8 to 36 in three months on the view that they would be able to more efficiently run their business through consolidation. If investors were mistaken and they can’t complete their turn around it could trade back down to 12 or lower. I view this as a less likely scenario but I consider it…

- On Day 1 following its earnings release it did huge volume and the 22 level was defended so many investors still believe the “turn around” story is intact. If that is the case the stock trading 20% lower two days later is probably viewed as a buying opportunity for many. This view was supported by the price action as volume surged closer to 18 and it stopped going down.

- I expect many of the funds that hold positions to do further evaluation this weekend and place orders Monday, which should give me an indication in the first hour as to direction for the day.

- This is not a stock that I am very familiar with so I will be more cautious than I would with something like GMCR NFLX AMZN BIDU where I have a long history of trading and observing their patterns as well as a clear understanding of their businesses and how the larger players view them as well.

Steven Spencer is the co-founder of SMB Capital and SMB University and has traded professionally for 17 years. His email is [email protected].

Mr. Spencer is currently long YRCW

One Comment on “Looking For An Oversold Bounce– $YRCW”

I’m feeling good when I’m in the same trade as SMB!