I received another great question from The PlayBook Webinar Series of last week on our 2nd Day Trade in $EDU. Here it is:

Just my opinion, but since the stock is coming from $20 or $22 is it the previous day, I think a lot of people would have tried to catch the bounce at 13.50 to 13.70 at 11 am. That play would have been good for almost a point. Then back at 13.50 at 12 oclock perhaps more people might have been inclined to think this as a double bottom and then got long again? The stock is coming from 22 dollars the day before and we are at 13.

How do you differentiate between this play at 11 o’clock whether this is a long play or a short play? There was money to be made both long and short but is there a percentage decline you are looking for that indicates this has more to fall, etc? I would think 22 to 13 many are thinking long. I did notice on the third day it opened up at 11 and then went up to almost 14.

My old trading mentors would just tell me to stay out of stocks like this because well, you are exposing yourself to a steamroller one way or the other. After a stock is down 41% (from 22 to 13), wouldn’t it be common sense to think that shorting it could expose one to a great squeeze or a major bounce?

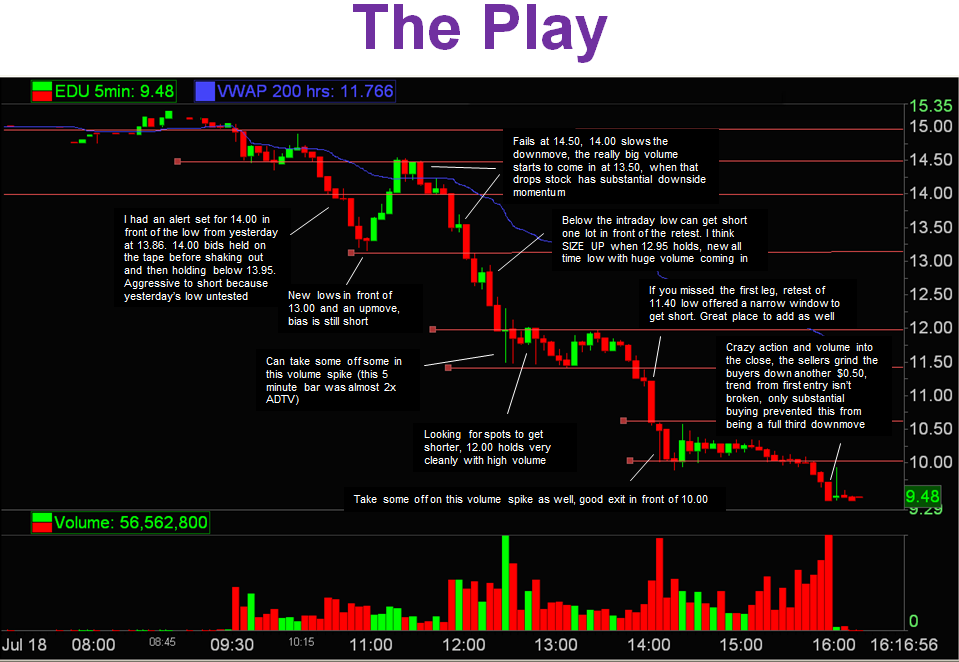

Let’s repost the intraday chart of EDU to give a point of reference.

@mikebellafiore

1. The bounce from 13.50 to 14.50?

That is not a bounce. That is an intraday scalp trade. That is a play that should only be attempted by those committed to very active trading, possess superb Reading the Tape skills, and are experienced pro day traders. I see that play. Spencer might make that play. I would not recommend that play for anyone who was not a Y3 (year 3) trader. Having worked with hundreds of traders, it’s just too hard for a new and developing trader. In this case since I know you have traded for almost as long as me. I can see you offering this as a potential pattern to trade. I would caution that you label the trade correctly however and trade it as such. It’s a scalp not a bounce trade.

So what would a bounce trade look like? We need to see EDU clearly hold above an important technical level CLEARLY indicating the change in psychology for the stock. In this case we would need to see EDU hold above 14.50. The key for a bounce trade is to see the stock hold, then hold higher, and then load up and hold for the real move. This is how you make real money in a bounce. This principle applies to a market bounce as well. Again a scalp from 13.50 04 13.70 to near 14.50 is not a bounce trade.

2. This is not a set up worth trading because of the potential spikes?

When a stock is very weak the day before, has horrible fresh news, and shows clear weakness the next day, it has the potential to trend cleanly in the same direction as the day before. The government investigation probably has to be explained away or there needs to be a puking, steep additional downmove, for the stock to turn. If you do not like trading these stocks, then don’t. Trade the set ups that make the most sense to you.

Great questions. Thxs for your contribution to our trading community.

Please join us at the next The PlayBook Series where we discuss a Trend Trend Trade.

Mike Bellafiore

no relevant positions

One Comment on “Bounce or Scalp? Knowing the Difference for Successful Trading”

Thanks for the clarification.

Other than the chance to get short around 10:20 at right below 14.50, I really saw the trade as a bounce/scalp at around 13.50 at 11, and then another short right under 14 at around 11:50. I would have covered there and looked for a double bottom at 12.

I mean this is all with a cool head. I doubt I would actually make these trades I am talking about at the moment when the stock is doing this with all the volume and fast action.

I guess the greater question/point I want to make is that the stock is down 40% to 45% and I think it takes a lot of risk to get short a trade at that point. So what is the key intuition a trader gets in his/her head to know that a stock is still a huge short after being down over 40%.

I think today’s markets have changed and selloffs tend to get lot more one-sided. Maybe it’s due to HFTs.

A trader could have said the same thing about ISRG and that stock recently had very strong bounces on the second and third day after being attacked by shortsellers (granted there was no SEC investigation).

I guess the thesis remains in place until it doesn’t. I agree with you, right now stocks that have bad news for the most part really don’t bounce so huge bias short works very well. I think AH did something similar as well in April/May. Just don’t want to get caught short in a stock when that bias doesn’t work and have a large position. Trading just a few thousand shares at most could help to eliminate part of the risk. Or just leave behind the chance to make or lose a lot by being in stocks that aren’t as much in play.

Great trade nonetheless!