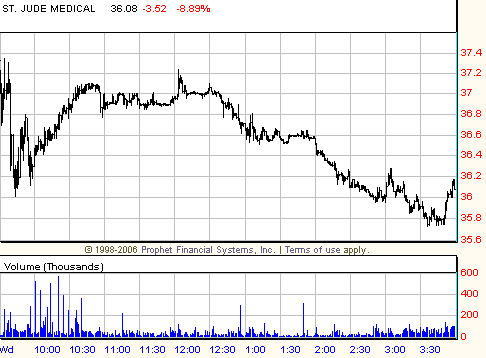

One of my absolute favorite plays is a stock that breaks down, comes back up to a great short price where a battle ensues and then breaks to the lows again. Today, STJ presented that opportunity. It had caught my eye in the morning because I generally like the way it trades on earnings, but when I typed it up before our morning meeting, there was no volume, so I wasn’t sure how good it was going to be.

However, right before the open, a seller came down about 75 cents to 37.25 and sold a couple of thousand shares. This immediately caught my eye, and I decided to trade it. The stock opened around that 37.25 level and then traded down quickly to the whole. Because of the gap down, I decided to short with the seller. A little bit of support was found around 37, but when he finally dropped the stock traded down to 36 in about 2 minutes.

Along the way down I was covering my short, and trying to figure out where to re-establish my short. The large gap down and the quick down move told me the stock was really weak, but on the way down I didn’t really see a level where there was a lot of volume done. Finally into the upmove, some volume occurred around the 60 level, and I decided this was my re-entry point. But then an interesting thing happened.

36.50 started buying. And buying. And buying. Hundreds of thousands of shares. Then 60 started buying. Humongous prints going off. Hundreds of thousands of shares at a time. So once I saw the big prints step up, I got long. Then he stepped up to 70. Then to 80, then to 90. Talk about defending a position. There was a battle going on here. The buyer was actually printing huge blocks a few cents ABOVE the offer. At the moment, the buyer was winning. So I rode the long on the way up. At around 37, I thought the seller would try to make a play, but if the stock got above 37.25 I was going to begin playing aggressively long.

But the plan was also to get short if the seller made a stand. The only thing driving the stock up was this one institutional buyer. Then, STJ couldn’t trade above 37.10, and when it got below the fig, it traded down to 36.75 really quickly before popping back up. Now I had a short bias. My plan was to be as aggressive as possible near the fig. And then the buyer came back and defended 90 cents, dropping a few times, but never printing below 85. I got out on the squeeze above the whole number, and set my alert for 88 cents.

When I got back from lunch, STJ was right at that 85 level and dropped for the first time since the morning session. I got short and focused on holding a core. Below 36.50 the plan was to be very short, as the next stop was the low of the day, and then the recent lows of 35.80. I was also aware that below 36.50, this fund that bought millions of shares would be completely and totally wrong. I wussed out a little and didn’t hold as much size as I wanted, but I was able to hold a reasonable position for most of the down move.

I definitely could have traded the setup better, but I was not only able to capitalize on my tape reading ability, but also I now have great levels for tomorrow. As a trader, you need to figure out what your best setups are, but also to capitalize on them when they present itself. I could have done a better job, but was pretty happy with the way I traded it, which is the second part of the battle.

Levels I’ll be using in the stock tomorrow: 35.40, 35.75, 36.50, 37.25

8 Comments on “STJ Earnings Play: Great Shorting Opportunity”

G – Thanks for getting me involved in the short as well, though a bit late into the party I chopped it up. Keep it up!

G – Thanks for getting me involved in the short as well, though a bit late into the party I chopped it up. Keep it up!

I have a flashback with STJ. Usually when this stock is reporting it develops the following move: down/short in the first 15-20 min off the open and then an uptrend. All these happening with big sizes and spread. STJ is a player! 🙂

I have a flashback with STJ. Usually when this stock is reporting it develops the following move: down/short in the first 15-20 min off the open and then an uptrend. All these happening with big sizes and spread. STJ is a player! 🙂

Extraordinary good call. Long when it broke over 36.5 for 40 cents.

Extraordinary good call. Long when it broke over 36.5 for 40 cents.

please define “fig”

thanks

please define “fig”

thanks