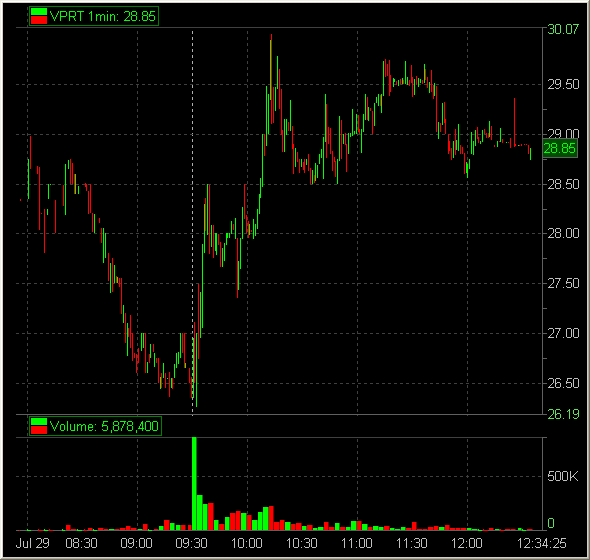

I made one bad trade today in VPRT. After the trade I shook my head and remarked to Steve how amateur my trade was. I was not pleased with myself as a trader. The result of the trade? A complete chop. A two point winner. I couldn’t agree more with Steve as he summarized my bad decision-making: “That could have been a huge rip.”

VPRT was on my watchlist. Before the open I make an attempt to tweet (StockTwits, Twitter, Facebook) the stocks I am watching. It was not my primary idea. Shorting SPY was as we were below support levels from a significant period of time. Stopped out of a couple lots at 129.06 on excellent trades. I had a series of about a dozen charts across my screens. I peaked in from minute to minute on VPRT’s progress. I wanted it to move away from 27 and start to intraday trend.

After moving away from ACI, RCL, OI and SPY VPRT caught my eye. The old bullish flag pattern had entered. It was a little after 10am. I started to conclude that VPRT had settled a bit. I was a bit negative on the day which annoyed me as there was opportunity on the open. Also I dislike being negative on Friday. That is just a bad start to the weekend.

I noticed a buyer on the bid repeating at 28. I liked the chart. I bought one lot. Stop 27.89. I noticed a seller on the tape at 28.07. 28 held the bid again. 28.07 sold again. The bids at 28 were not retested. A seller was not seemingly ready to hit the 28 bids at that moment. I bought another lot. Stop 27.94.

VPRT was not really moving. Was I in this position because I wanted to make back some money I thought to myself. If VPRT dropped the bid at 28 where would I be able to exit? Looking at the chart I noticed two very quick and steep 80c downmoves out of nowhere. I could not be confident that I would be able to exit at responsible prices if VPRT traded against me. I admitted this to my trading self. Should I lighten up I asked? I decided I would in front of that 07c seller. If that seller lifted I might re-add to my position. As I had this conversation with my trading self that 07c seller lifted.

Well as long as I am in this one bad trade I might as well now do nothing. It is starting to work. VPRT found 28.50 where I took off half. VPRT approached 29 where I considered selling but it blew through this level. There was nothing really to do from the long side. VPRT kept ticking higher. As VPRT approached 30 it didn’t feel right to me anymore and I got flat.

I announced my exit to Steve. He asked why I didn’t wait until the bids dropped before existing. I started to say because that is not how the stock trades when it was within a few ticks 90c lower. I was asked in our morning trade review after the open why I sold here at 30 and I didn’t really have a good answer. It didn’t look right to me. I suppose that was one response. Maybe my intuition told me to sell. I am not sure.

So I made 2.5 points on this trade. Boy was this a terrible trade. But Bella you made a chop how so? I asked this to our newest class. On the first attempt at the answer Young DB targeted the reason. He offered, “because you couldn’t control your risk.” I couldn’t. Yes this trade worked. But our first responsibility as traders is to control our risk. In this trade I failed to do so.

Bella

One Good Trade

2 Comments on “One Bad Trade”

Would you say this is One Bad Trade based on a poor reason to buy (wanting to get money back) or a mistake based on improperly taking in market information (not reducing your risk enough to get an edge in the trade)?

both