On Twitter I received this tweet:

@rodlivar asked @mikebellafiore is neccesary to stop in the shakeout today in BBY at 13.25 at 09:40 or you could wait for the real level 13.10 or 13

I noticed SMB Trader, The King of Men, did a nice job choosing BBY to trade and traded it well on the open. I asked him to prepare a blog post explaining his Opening Drive Play. Below is that play.

Stock Selection:

This morning BBY was doing good volume (>10% of average daily trading volume in the premarket), which makes it In Play. The company guided down its free cash flow estimate, but posted same store sales for the holiday season that were better than expected. My bias was to look for the opening drive on the long side with an eye on establishing a position at 13.00 where there was good volume done and the buyers stuck the bids a couple times. BBY was my primary focus because of the strength shown in the setup premarket, and also because it has a manageable liquidity profile (typically 1c spread and a thick bids and offers). I’ve also managed to make a couple good trades in the stock in the past and the rest of the In Play setups didn’t allow me to construct a trade plan I could have conviction in.

Trade Plan:

Above 12.50 focus is on the long side. Looking to establish a long position at the 13.00 level in the premarket, get in small with a real stop and look to accumulate size with buyers. Some risk should be taken off in front of the 13.50 level on the daily, and holding above there is the spot to take a shot. Because the stock has an ATR of 0.5 a drive up a point is a large move for the stock, so my price target for the drive is 14.00.

Trade Management:

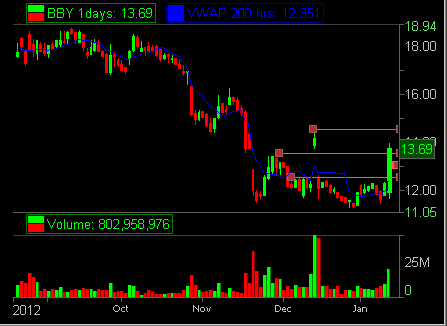

Here is a chart with my executions: green circles indicate buys and red circles indicate sells.

Here is a tick chart of the drive:

Entry was for a feeler at 13.00 in the premarket. Stop for that was under 12.80, because under there the clean setup pattern of higher lows is broken and the drive is less likely. Moreover, even if the drive then does occur after dropping 80c those aren’t the kind of setups that are going to lead to big production. I should have been comfortable giving the setup a bit more risk, so I didn’t have enough size going into the open.

The 13.25 buyer stuck the bid and I got to tier2 bidding 26c and selling the 10c pops while the 13.35 seller was still there. My stops for my adds were 13.24 and 13.19. When the 13.25 drops you are not wrong yet, the out for the core is under 13.00 once 13.25 holds the bid. The dropout went to the top of the premarket range, and it shouldn’t be sufficient to shake you out of everything. It is worth noting that the stopout decision becomes much trickier if you don’t get the entry at 13.00 and you establish your position at 13.25, but the long isn’t wrong until offers hold under 13.00.

On the dropout I got stopped out of all my adds, but I kept my core. I added back above 13.30 when 13.25 stuck the bid again and the sellers lifted. According to my plan, I got back down to my core in front of the 13.50 resistance level on the daily. At that point I moved my stop for the core to under 13.25 with an eye toward holding through the noise that I anticipated.

However, the stock was strong and very well behaved. I added the first time through 13.50 for momentum and hit out right away when it dropped. Then 13.45 stuck the bid and it broke through 13.50 again. I added back with a stop at 13.44, but I didn’t add enough size. I needed to get up to at least tier3 at that point to try to turn the trade into a home run, but I simply wasn’t as aggressive as I needed to be. Even if the setup fails from there I’ve managed my risk so that it would still a winning trade barring catastrophic slippage.

The stock had a fantastic push up from that point. I lightened up when the momentum paused, and got flat in front of a strong 90c seller because of the volume spike and steep move close to my target. This is an A tier setup, and the only thing keeping it from being A+ for me is the shakeout at 13.25.

@mikebellafiore

What are your thoughts on the best way to trade BBY?

Thxs to The King of Men for his excellent analysis and sharing his BBY with us. Long live the King!

** no relevant positions

5 Comments on “Revealed: How SMB Trader, The King of Men, Navigated BBY Premarket”

How many shares on average did you play on something like this for each mini swing? Just curious.

King of men I would like to know which are the prices of your core position because you write about your adds

thanks a lot for your help

where you sell the core position?

BBY is a thick stock that can be overtraded, not saying this was. I believe the best trade was into the close when the seller at 13.80 lifted, then the add was after the unusual hold on the offer at 14.11 lifted, then the real momentum kicked in

Looks like he overtraded it a bit to me, the buy/sells were clustered together too much for a stock that doesn’t move that much. Granted he was risking .01 to make the .10c pops, I think a lot of mental energy is wasted making such small gains on a thick stock. I would rather be a little smaller, and not get shaken out by .01c drops. I think a setup like this, you get into a position, and you try to hold for the bigger move instead of trying to play move by move. Over the course of your career, if you are trying to make .10c pops on low beta stocks, your cost of doing business with be very high. Get into your position around 13, be small enough that you can let it wiggle around, once it breaks above 13.35 seller you add for momentum and you try to hold your core from 13 and sell you momo add when the tape slows, and find more setups. In this market, I’ve made a lot more money playing higher beta stocks, with smaller size and bigger ideas, then reading the ticks. Someday the tape could be back in play, but I believe that edge is dwelling quickly.